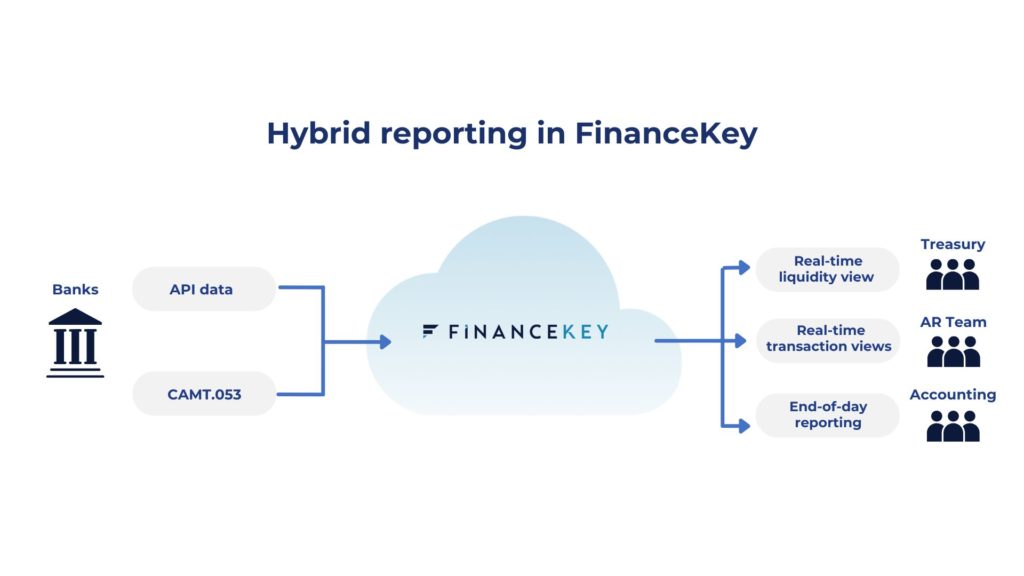

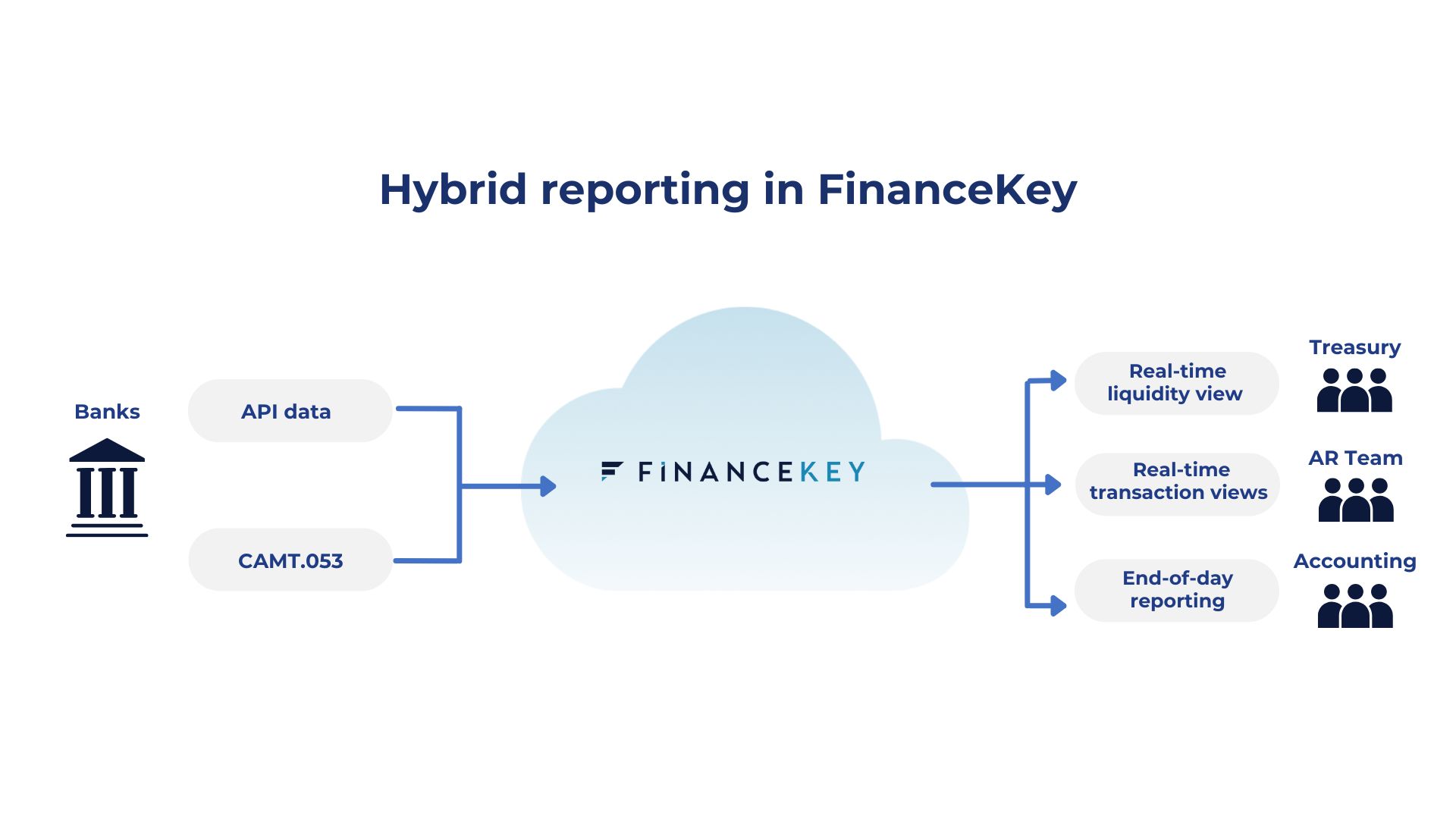

Find out how FinanceKey’s hybrid reporting model turns intraday bank data into real-time cash visibility and automates reconciliation – without disrupting the processes your ERP currently relies on.

|

|

What’s shaping treasury technology as we head into 2026? What should treasury teams prioritise, and how can they build a credible business case for change? Our panel of treasury experts shares practical insights from real-world transformation projects.

|

|

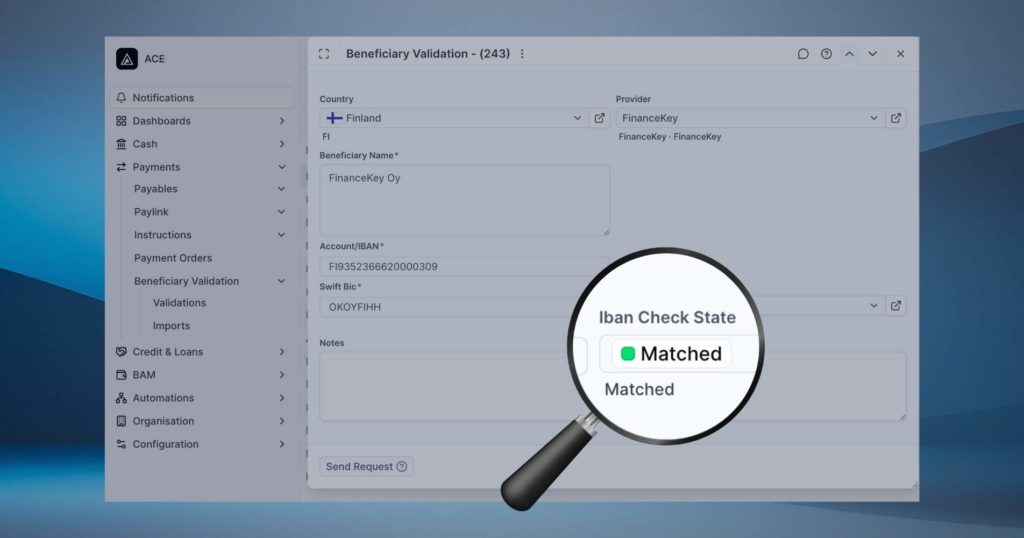

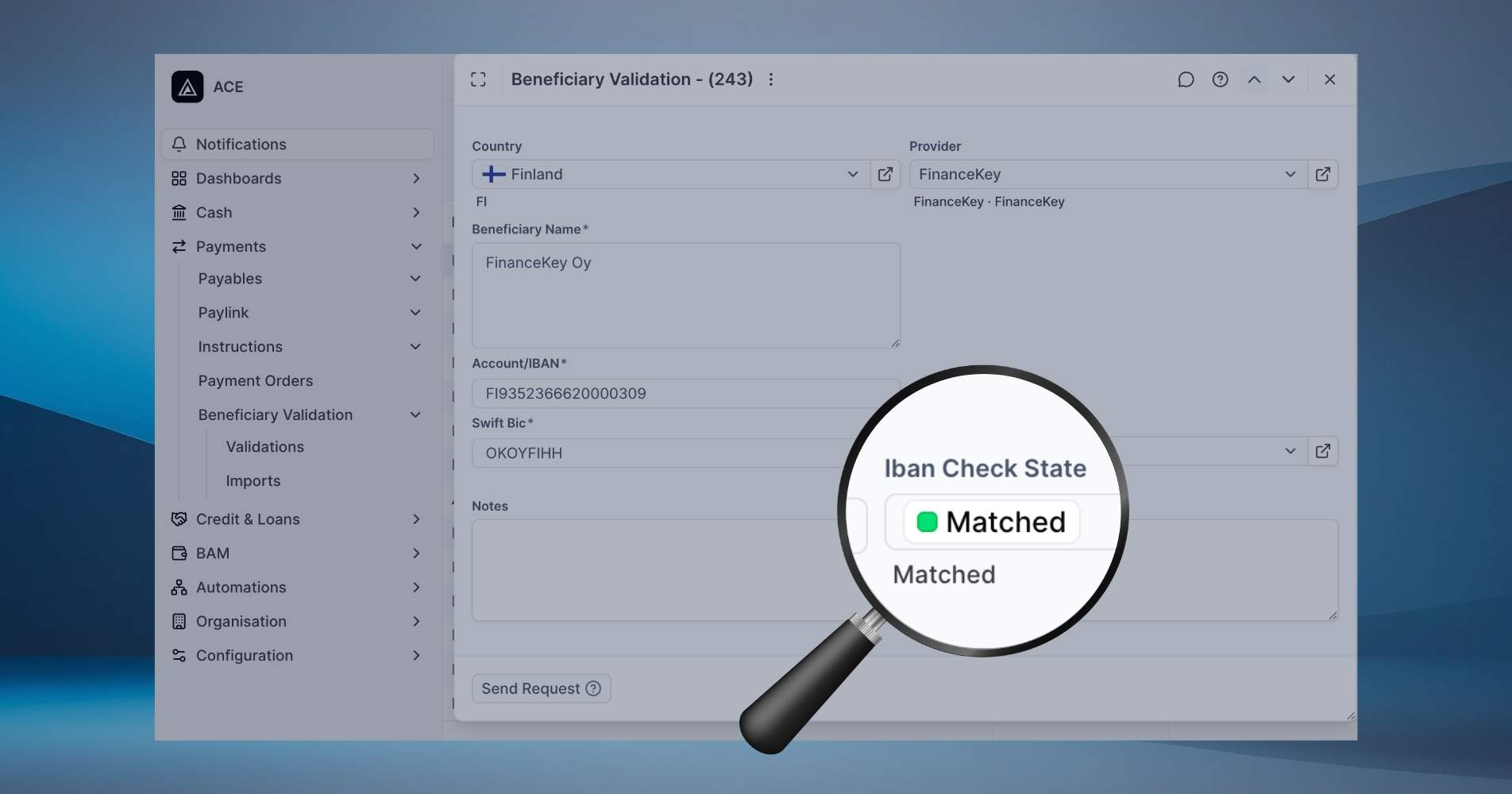

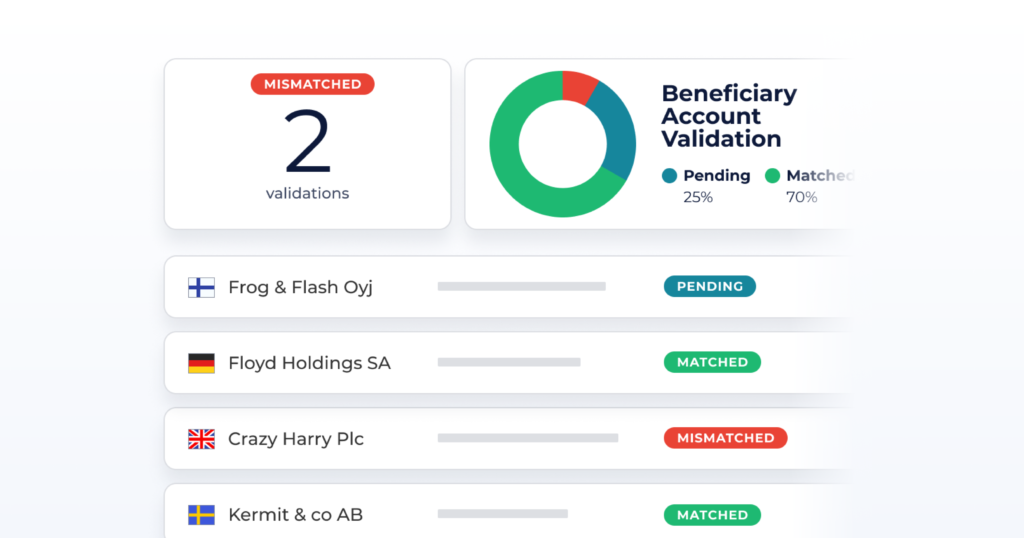

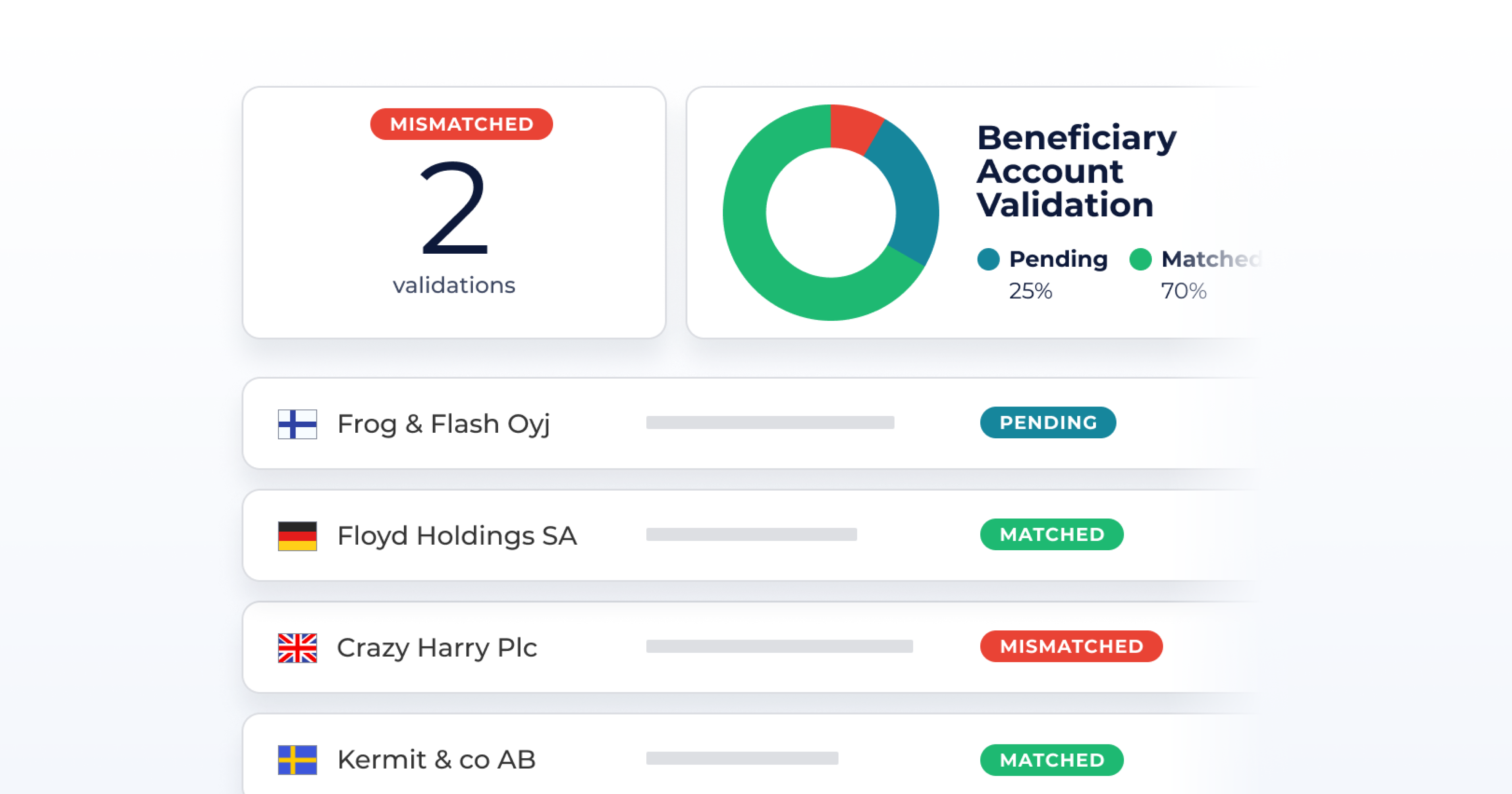

Learn how Verification of Payee works in FinanceKey and how teams can use it for accurate, scalable bank account validation.

|

|

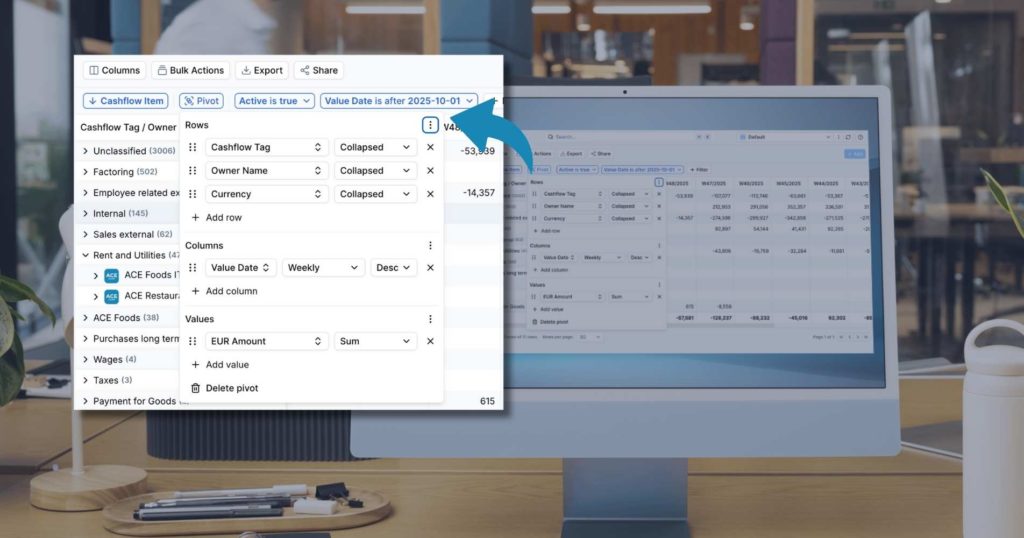

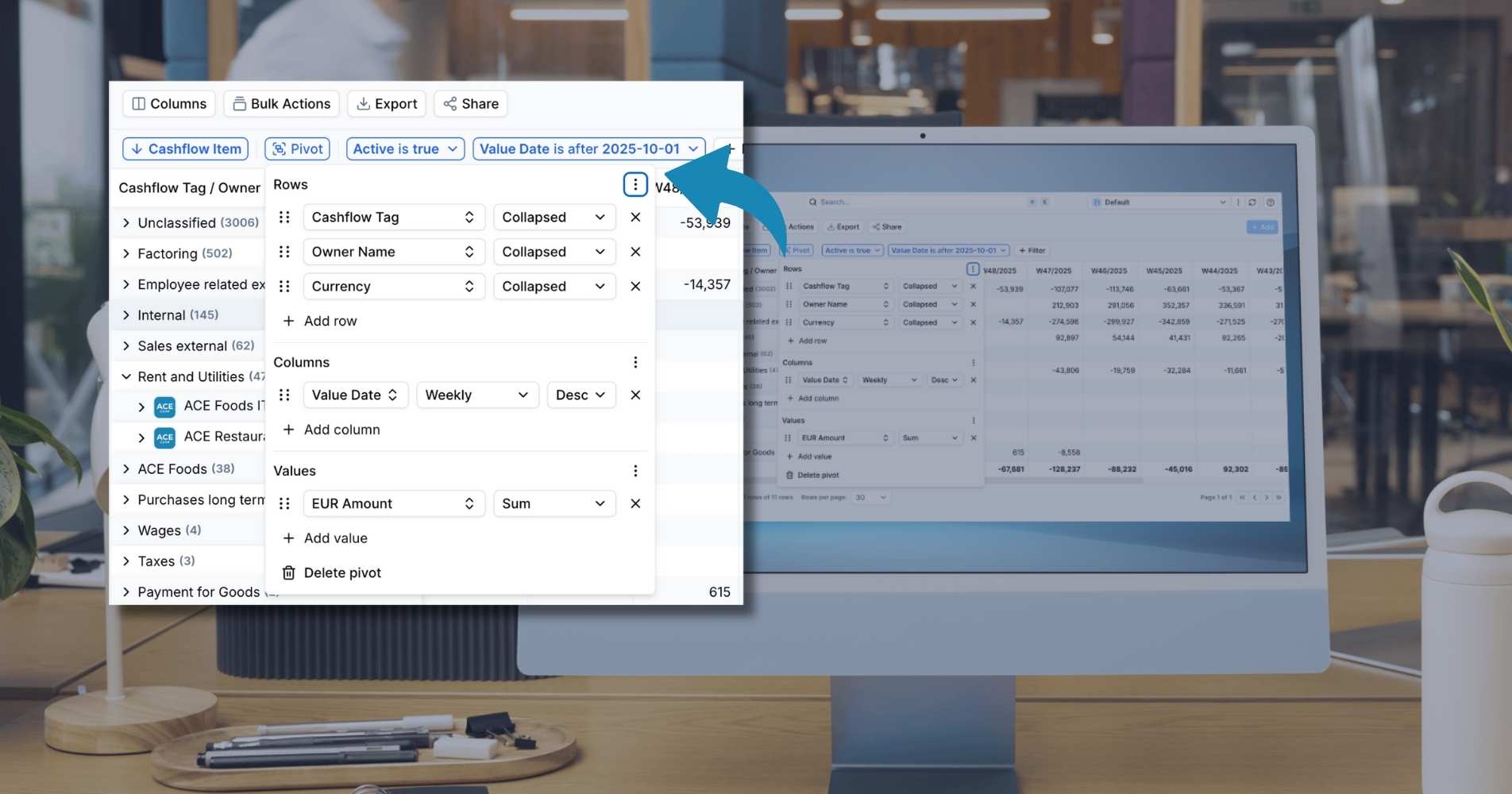

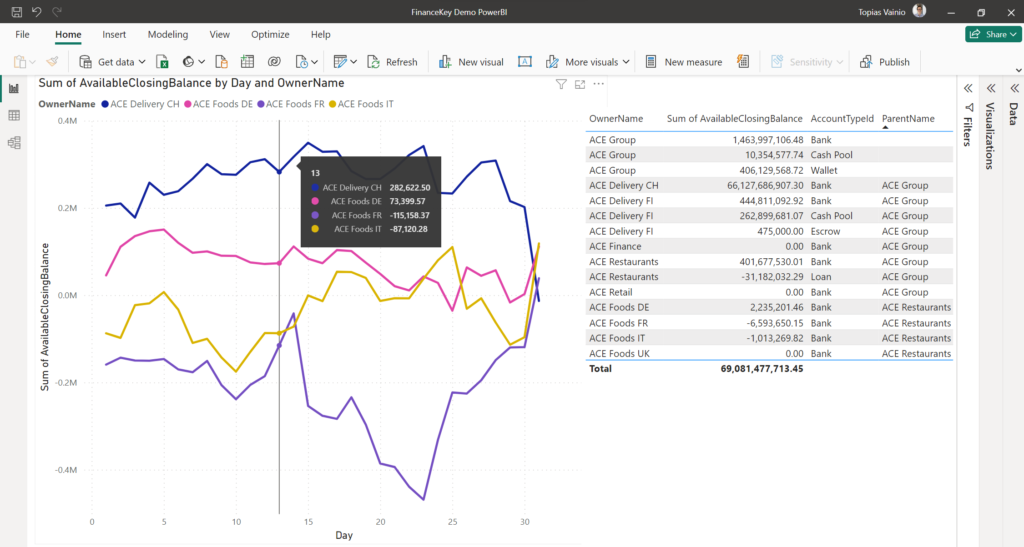

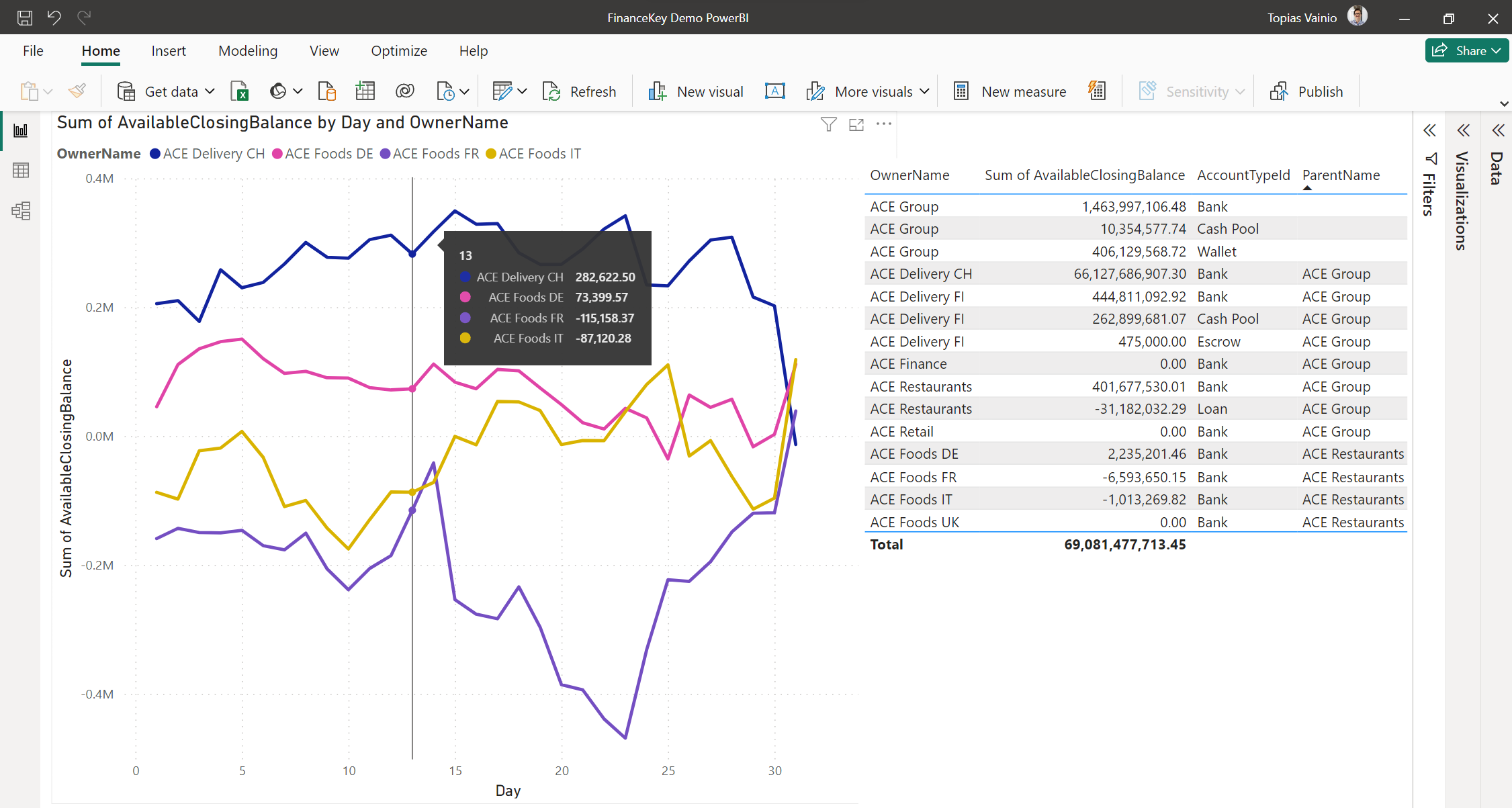

See how FinanceKey’s pivoting feature lets treasurers transform bank and cash flow data into clear, real-time liquidity and forecasting reports

|

|

FinanceKey’s CEO breaks down five real-time treasury myths and shows how finance teams are getting results without replacing existing tools.

|

|

Inside Danske Bank and FinanceKey’s collaboration on piloting a real-time account and balance API.

|

|

Understand how treasurers connect with banks – from H2H and Swift to APIs – and how each approach fits into modern treasury operations.

|

|

Learn how to choose between PSD2 and premium banking APIs for your treasury setup. Understand the differences, real-world use cases, and how to integrate APIs into your existing systems.

|

|

How to build a compelling treasury technology business case with five key strategies that go beyond cost savings – including team capacity, cross-functional value, and stakeholder buy-in.

|

|

Discover how to assess your current systems, identify tech gaps, engage vendors early, and build a scalable foundation.

|

|

FinanceKey’s CTO explains how standardised data, proactive monitoring, and ecosystem-wide optimisation set teams up for success.

|

|

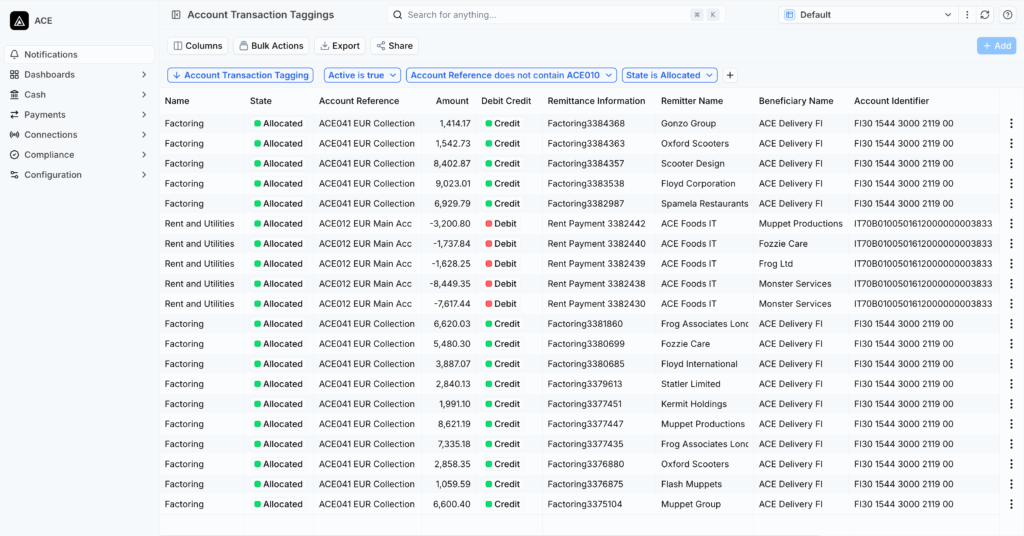

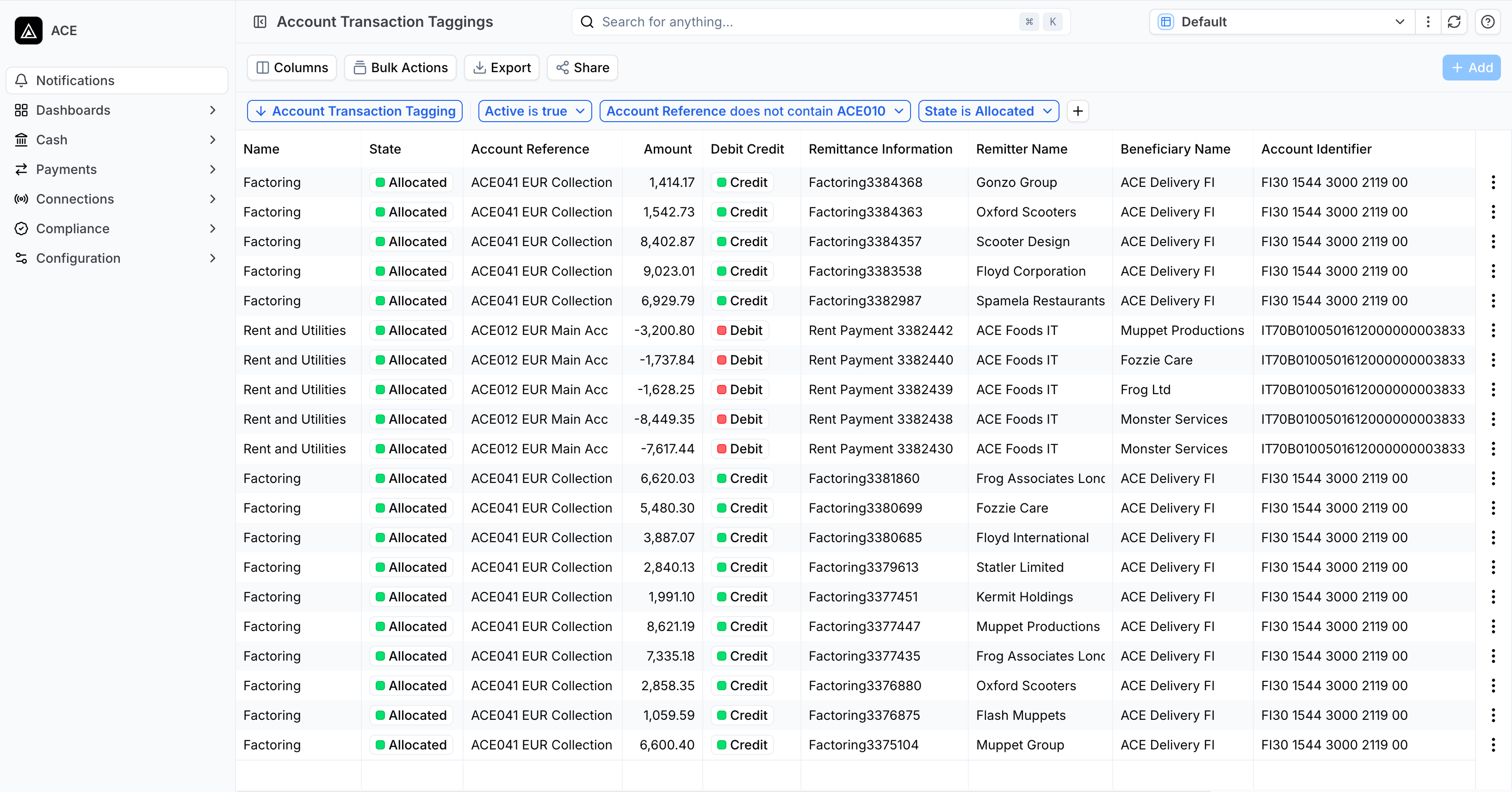

Learn how cash flow tagging helps treasury teams turn transactional data into strategic insights, enabling better decision-making and improved financial planning.

|

|

FinanceKey’s CTO explains why a “customer-first, technology-flexible” approach is the key to getting real results.

|

|

How treasury teams use FinanceKey to streamline SAP workflows – automating bank data flows, easing S/4HANA transitions, and reducing manual work without system overhauls.

|

|

Discover how FinanceKey navigated a busy week at Slush, organizing a CFO Lunch and House Party, while also engaging in productive customer meetings and participating in key events at Slush.

|

|

Following our recent upgrade to Azure Elastic Pools, we are thrilled to announce the addition of SQL Azure Elastic Queries to the FinanceKey solution. This cutting-edge feature enables us to seamlessly access and combine common data across all client tenants, enhancing our data synchronization capabilities.

|

|

We are excited to release our joint whitepaper with Raiffeisen Bank International AG, exploring how innovative solutions and strategic partnerships are transforming treasury management in a digitized and AI-driven world.

|

|

FinanceKey’s self-service onboarding not only allows quick access to cash visibility but unlocks instant, actionable insights. By enabling quick and informed decision-making, FinanceKey transforms how businesses can manage their cash. Through the user-friendly interface and real-time capabilities, FinanceKey sets the stage for data-driven treasury, positioning enterprises for a competitive advantage.

|

|

At FinanceKey, we offer a new collaborative way to manage treasury – moving data across systems & applications needs to be easy and straightforward. With FinanceKey, you can seamlessly integrate real-time data into Power BI – discover the 6 simple steps!

|

|

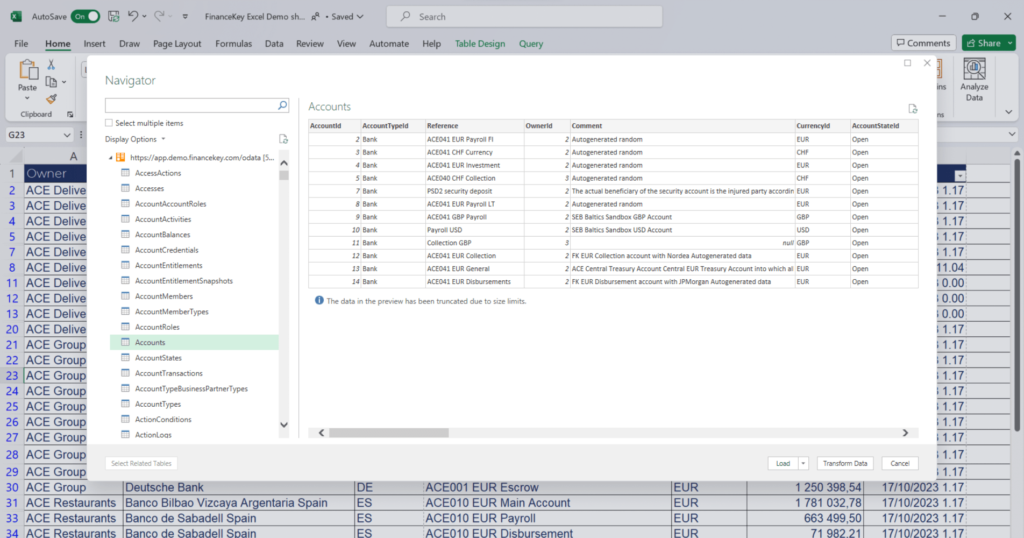

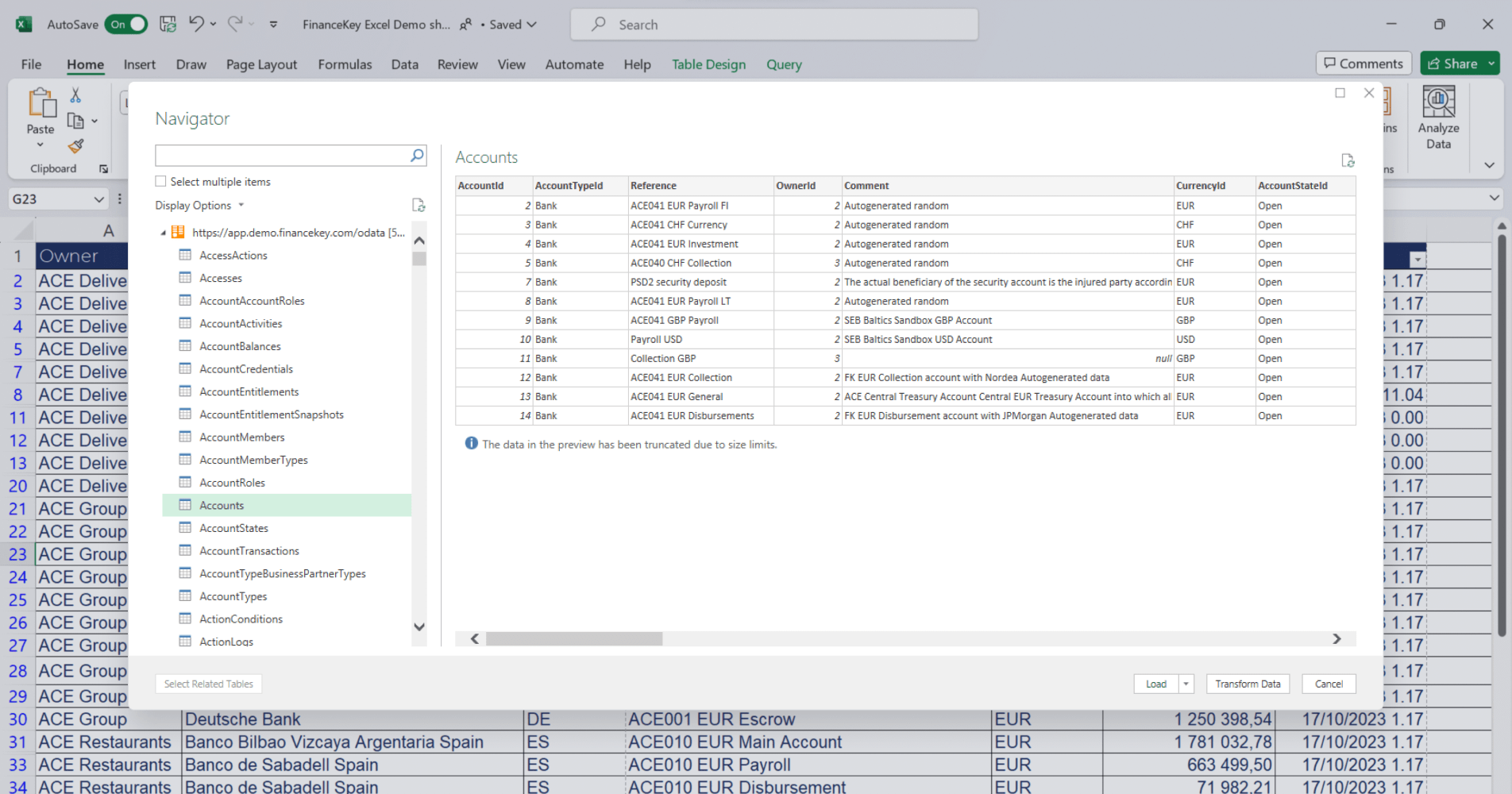

At FinanceKey, we offer a new collaborative way to manage treasury – moving data across systems & applications needs to be easy and straightforward. While we encourage moving beyond Excel’s over-reliance, it still plays an important role in many companies. With FinanceKey, you can seamlessly inject real-time data into your Excel worksheets – discover the 5 straightforward steps!

|

|

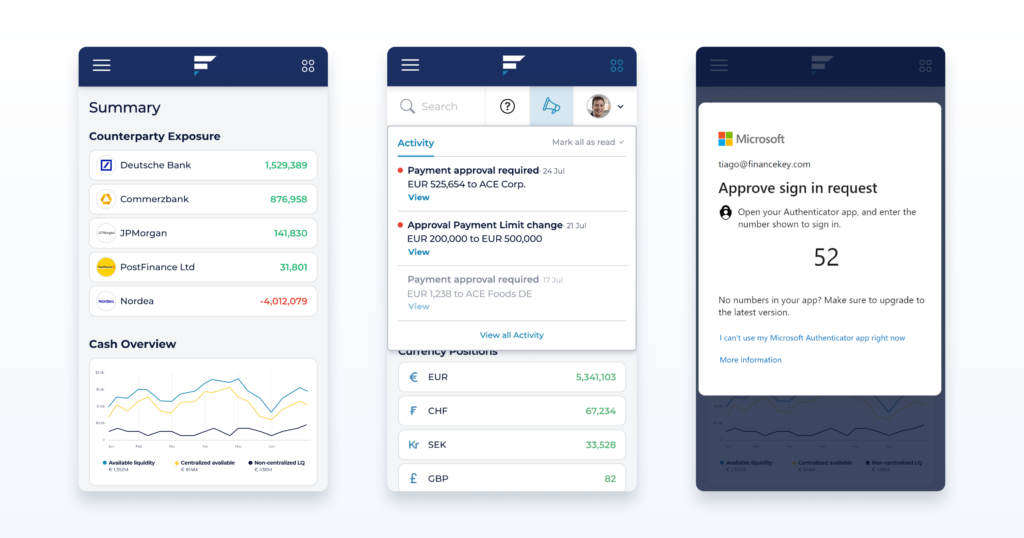

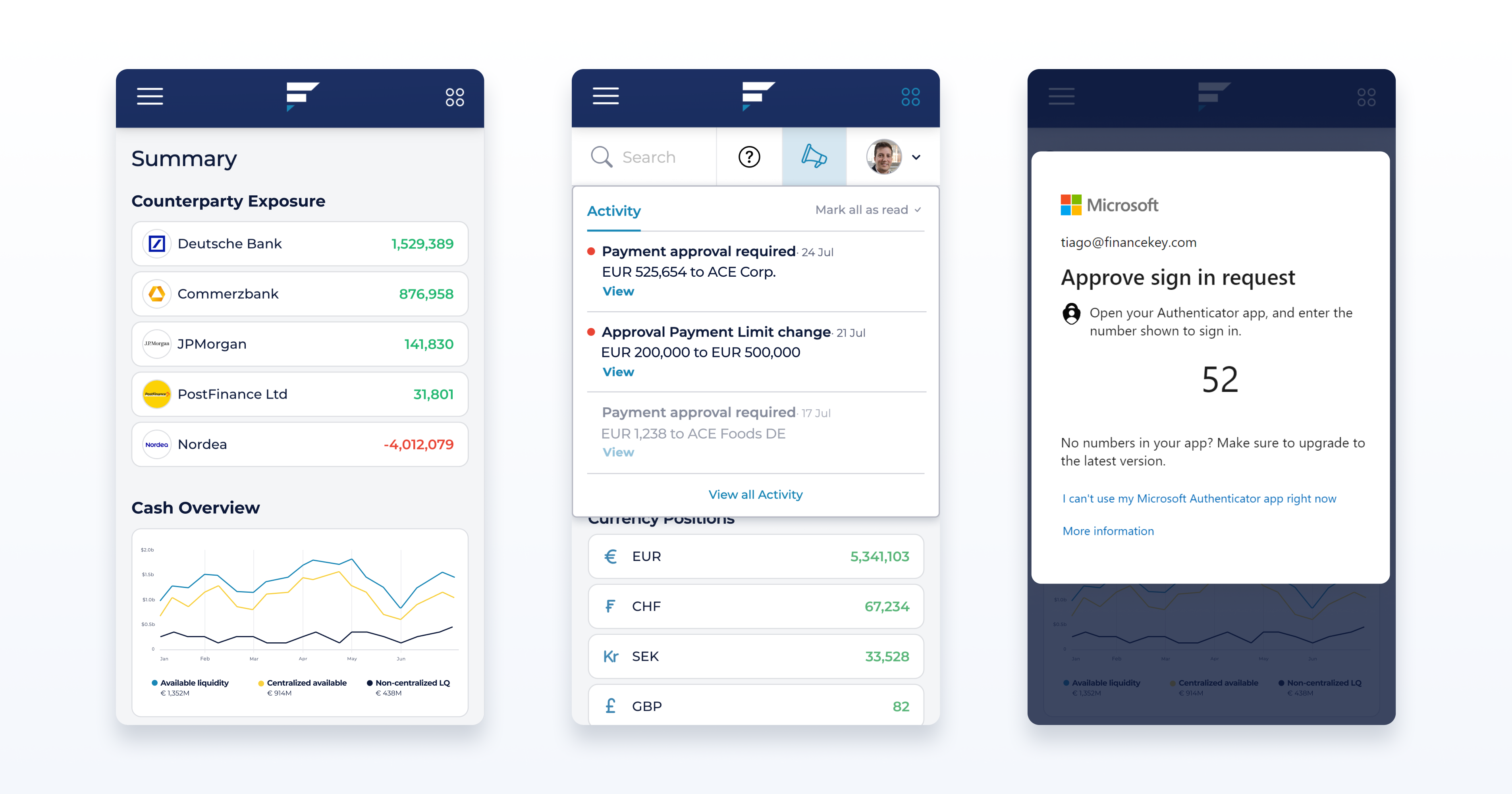

FinanceKey unveiled its Mobile Version during the EuroFinance International Treasury Management conference in Barcelona. It was fantastic to see so much excitement about our Mobile Version – many treasurers and CFOs are eager to manage their treasury while on the go!

|

|

FinanceKey took part in the 32nd annual EuroFinance International Treasury Management conference in Barcelona, from the 27th to 29th of September. As one of the Innovation Hub exhibitors, we had the opportunity to showcase FinanceKey’s solution to hundreds of conference visitors and deliver a presentation for an enthusiastic audience eager to hear about new innovative solutions.

|

|

FinanceKey is a Next Gen platform allowing seamless integrations via modern APIs, real-time cash management and a centralised payment hub. As a modern solution, FinanceKey is AI-powered, offering intelligence for forecasting and fraud protection. The core of FinanceKey is an open, modular and scalable technology that offers flexibility to meet the customer demands of today and the future, and developing quickly new functionalities.

|

|

FinanceKey becomes an official third-party provider for Raiffeisen Bank International (RBI) Cash Management Open APIs and is live with RBI’s Account Statement API providing access to real-time balances and transactions.

|

|

Finnish fintech companies deliver instant cash visibility across multiple banks, empowering businesses to navigate economic uncertainty and streamlining finance processes, powered by a seamless Open Banking experience.

|

|

The requirements for finance and treasury solutions are changing as the complexity of system landscapes, payment operations and data are growing. Dealing with multiple systems, banks and other external providers is a challenge that keeps IT consultants busy.

|

|

FinanceKey is pleased to announce being a member of the Common Global Implementation – Market Practice (CGI-MP) initiative. FinanceKey CTO Macer Skeels joins CGI-MP working groups bringing a wealth of treasury & technology knowledge to the committees and valuable insights into multi-bank connectivity from corporate, bank and software vendor perspectives.

|

|

Payment frauds are getting more sophisticated and complex to spot as fraudsters attack day-to-day business processes. One common fraud is hacking into the supplier’s email, changing the bank details on the invoice and sending it for payment. Change requests coming from a credible source, including valid documentation, are hard to spot unless one has a prudent protection mechanism built for vendor frauds.

|

|

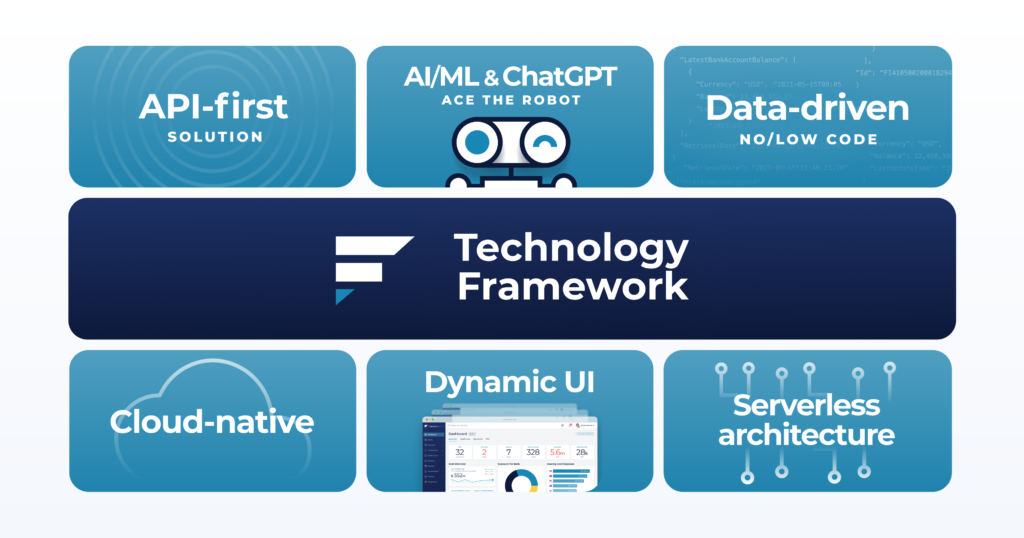

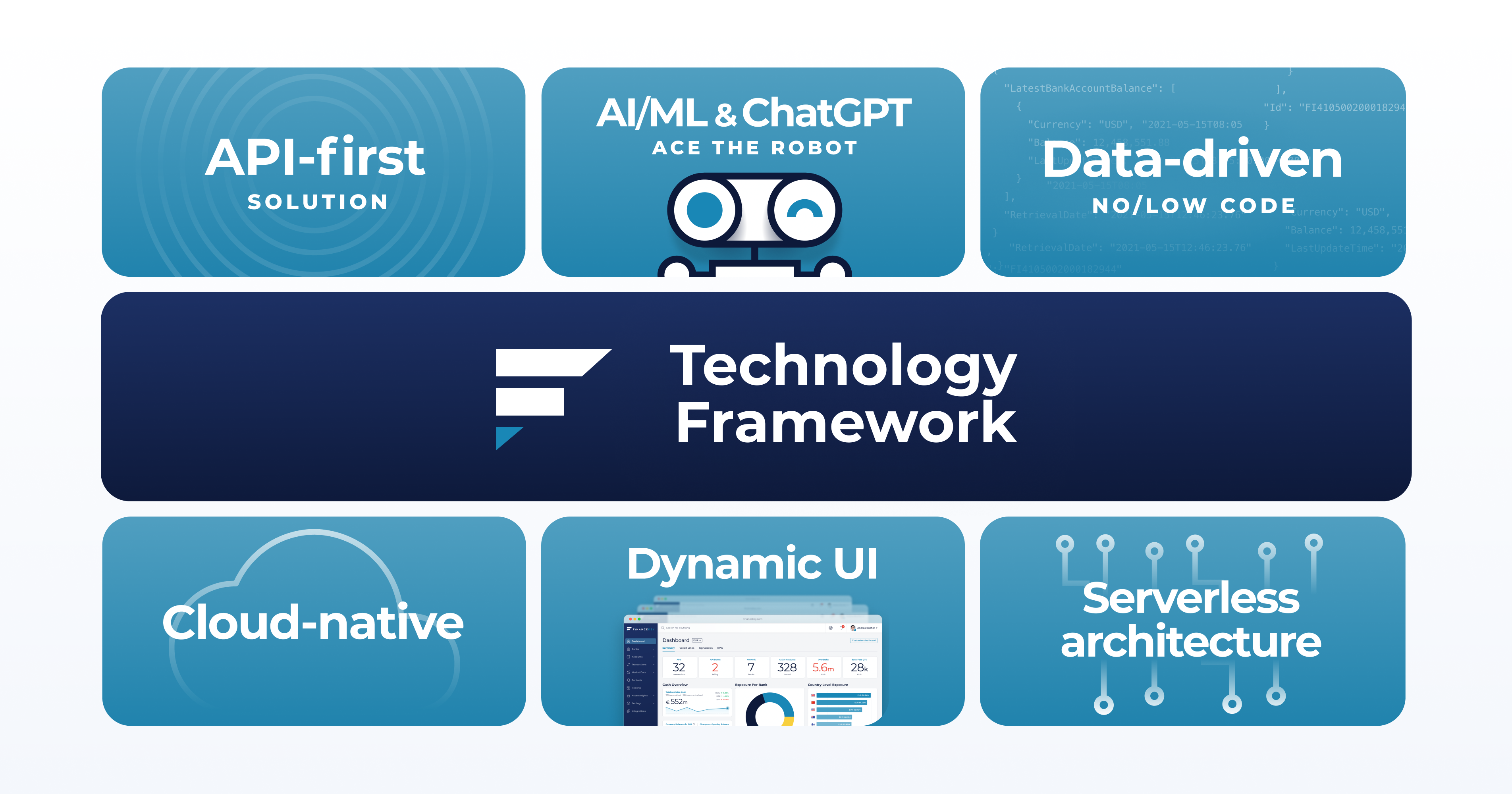

Treasury teams work in the intersection of multiple systems and external partners, creating a very fragmented landscape from tooling, data and workflow perspective. To solve the complexity treasuries are facing, FinanceKey has invested early on in building scalable technology, that can support any payment and treasury use case.

|

|

One of the key decisions FinanceKey has taken is to consciously put APIs first. Many people have been asking why we considered this decision so important. This post answers those questions about why we think APIs are so important, and in particular, what benefits they will bring to the banking and treasury domains.

|

|

FinanceKey has been selected as one of 15 fintech companies from the Nordics and Baltics to participate in Mastercard’s Lighthouse FINITIV program. Initiative focus on building partnerships with Mastercard, AWS and leading banks in the region.

|

|

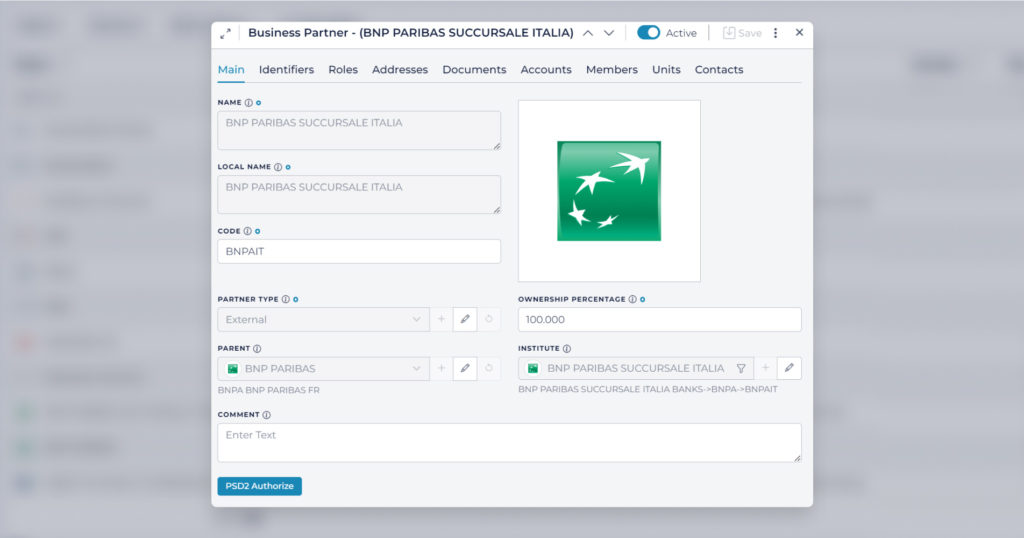

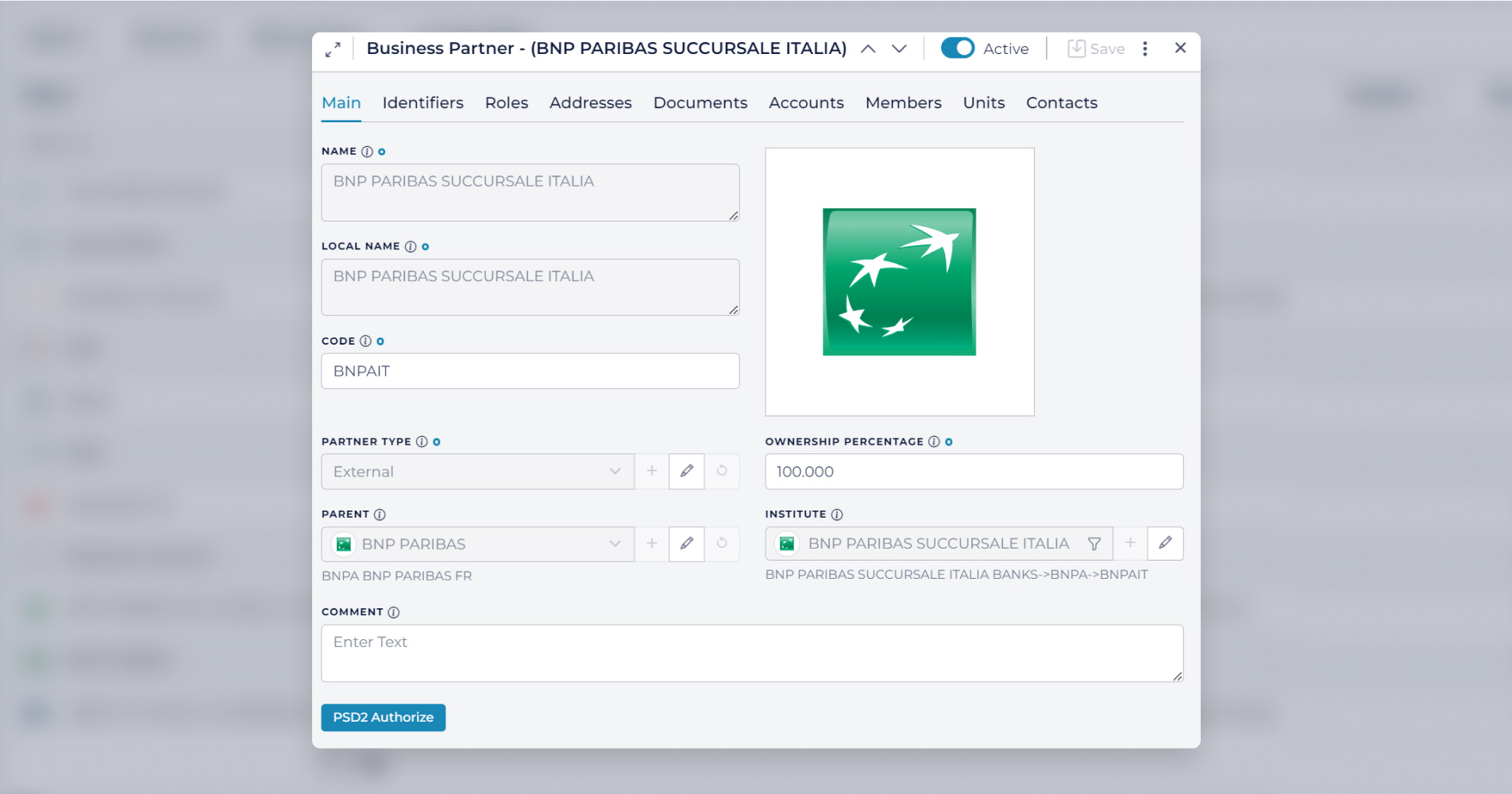

FinanceKey has been awarded Account Information Service Provider (AISP) status by the Finnish Financial Supervisory Authority (FSA). AISP registration provides us with the ability to help customers access their bank account data via the regulated Payment Services Directive 2 (PSD2) Application Programming Interfaces (APIs) within the European Union (EU).

|

|

Experienced finance leader, and currently advisor, coach and board professional, Kristian Pullola joins FinanceKey as Chair of the Board. Kristian brings a wealth of strategic and hands-on experience to the founding team having worked in several top finance and treasury roles during his career, including positions as Executive Vice President, CFO and Vice President, Head of Treasury and Investor Relations at Nokia Corporation.

|

|

We are thrilled to announce the FinanceKey founding team. Together, we aim to build intuitive tech for finance professionals eager to leverage API banking. We have ourselves faced the pain points many finance and IT professionals encounter every day — and are looking forward to help solve these for others while driving the use of real-time finance operations.

|

|

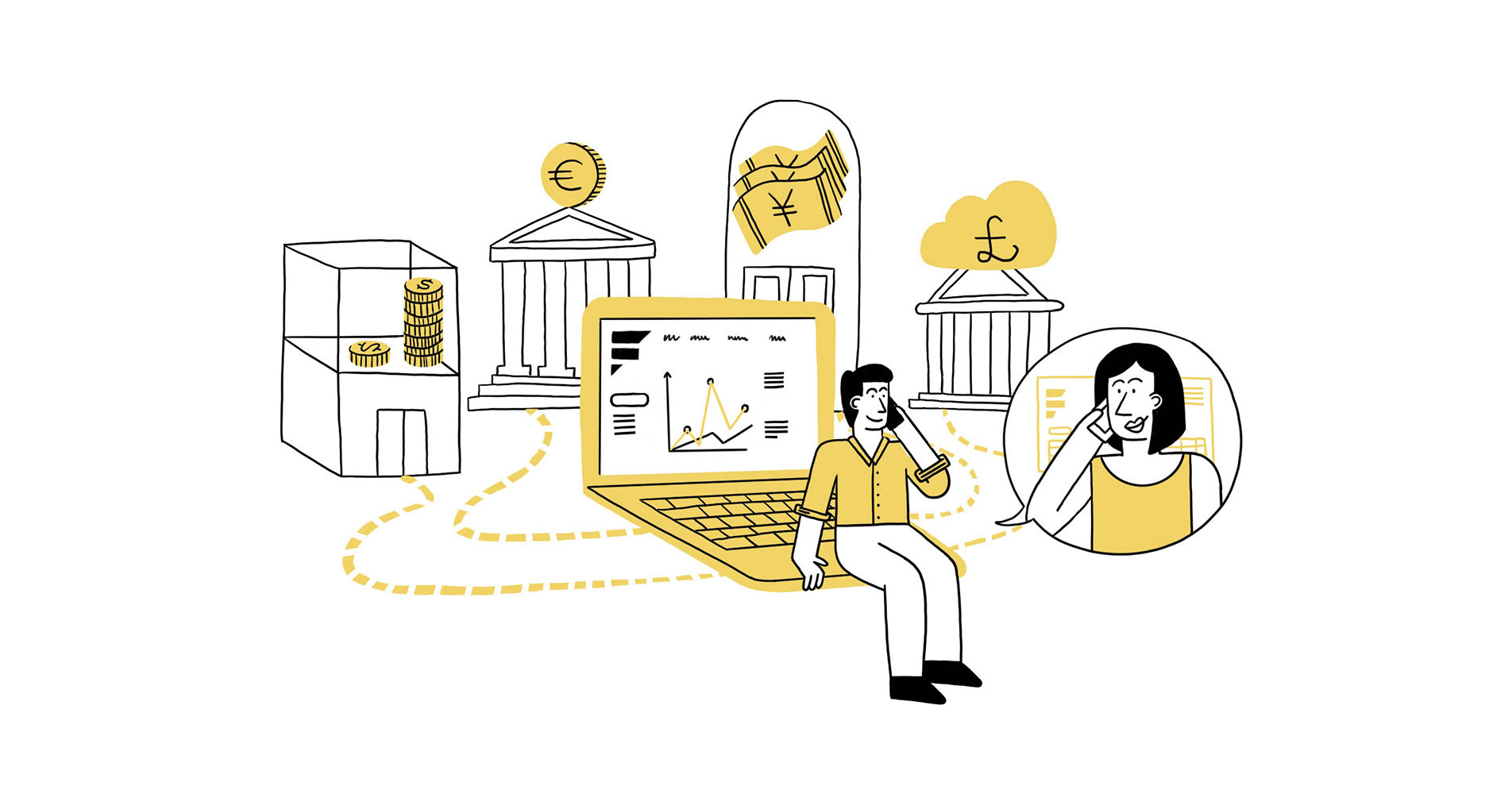

The waves of open banking innovation reach the corporate sector as banks look into providing better service for their biggest clients. Banks hold a lot of data that helps automate treasury operations. For banks, APIs offer the potential of monetizing the data and innovative ways of providing banking services. Businesses benefit from API banking with new and unprecedented opportunities to digitize finance operations end-to-end and become real-time.

|

|