Agile Technology Supporting Customers’ Payment and Treasury Needs Today and in the Future

FinanceKey is a Next Gen platform offering seamless integrations via modern APIs, real-time cash management and a centralised payment hub. As a modern solution, FinanceKey is AI-powered, providing AI and ML capabilities at the fingertips of treasurers helping to overcome the challenges of a disconnected system landscape and repetitive manual workflows. The core of FinanceKey is an open, modular and scalable technology that offers flexibility to meet the customer demands of today and the future, and developing quickly new functionalities.

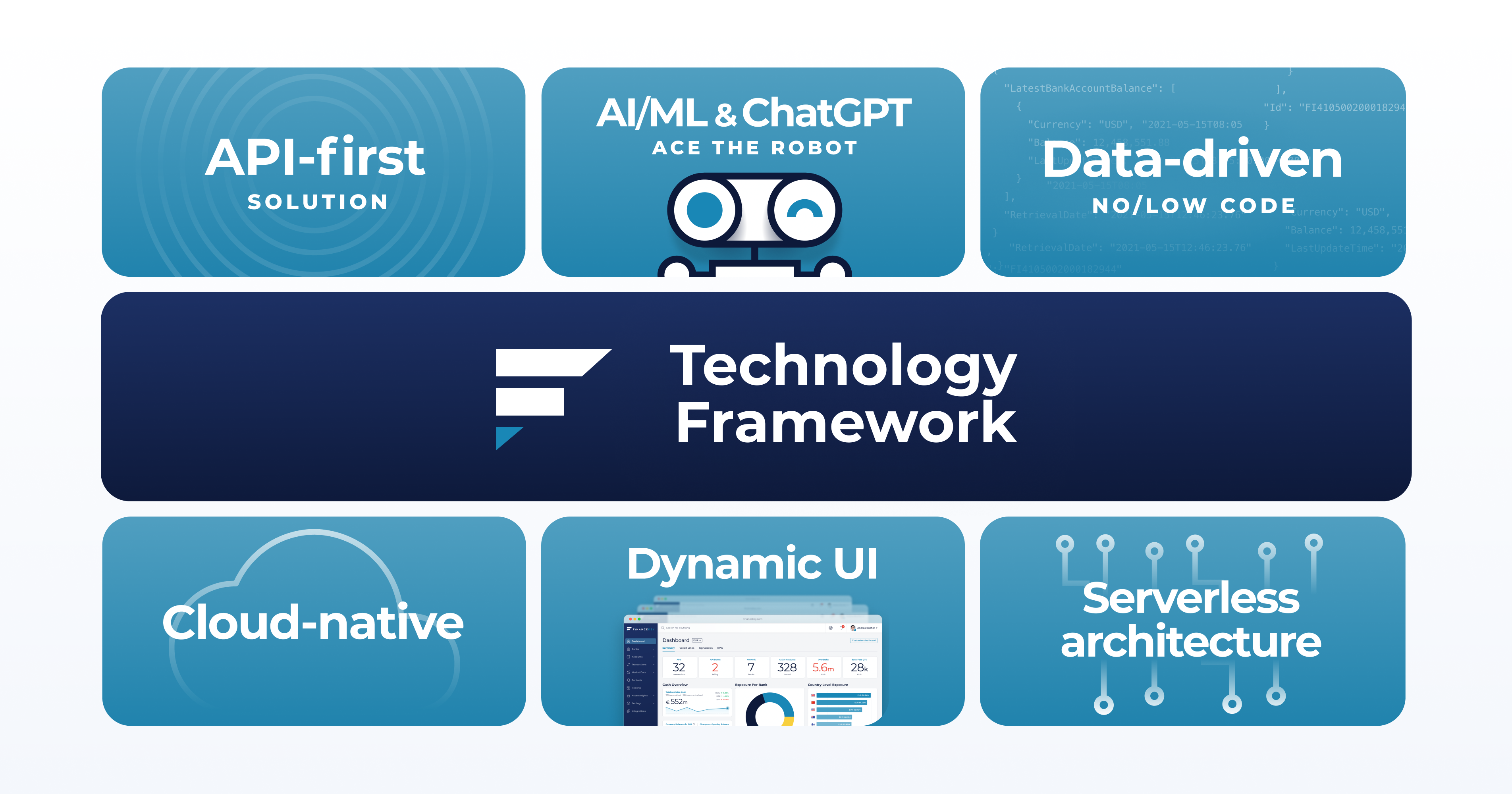

FinanceKey’s ambitious vision is supported by a proprietary technology framework. The framework allows customers to drive digital finance transformation with a new connected, data-driven and collaborative way to manage payments and treasury. The technology enables FinanceKey to be easy-to-use, easy-to-implement and scalable for the current and future needs of enterprise finance teams.

As a data-driven platform, FinanceKey is configurable as per customers’ needs, providing our customers with the flexibility to adapt to changing business needs and scalability to support their growth. With an API-first approach, everything in FinanceKey can be consumed via an API as a service – supporting seamless integrations to existing systems via one Finance API – such as PowerBI, Excel, ERPs and TMSs – and plugins to standard systems FinanceKey offers (e.g. Microsoft Dynamics, SAP S/4hana, Oracle Netsuite and Workday). As a connected platform, FinanceKey helps break silos between systems and internal teams, bringing a new level of collaboration capabilities to finance teams.

As an API-first platform, FinanceKey has taken a future-proofed approach. However, we support also traditional file-based exchanges where required (e.g. SFTP, EBICS and Swift). Where possible FinanceKey helps businesses to take modern API integrations into use and take advantage of real-time, while enabling a hybrid solution that supports both APIs and host-to-host connectivity. Importantly FinanceKey is designed for the API-era, instant payments and real-time intraday reporting.

FinanceKey’s no/low-code and data-driven approach supports dynamic user interface (UI) and dashboards, allowing businesses to take full ownership of e.g. finance integrations with minimal need for IT resources. Additionally, end-users can flexibly filter data, save views, select readily available dashboard elements or create their own based on their organisations’ needs. Similarly, the UI is helping FinanceKey developers accelerate the development work and enables fast onboarding of new integrations to banks and other parties. Our responsive UI is available on mobile, helping to manage treasury on the go!

Key functionalities of the platform include e.g. configurable global search (a search that works!) and workflows, analytics, dashboards, access rights (vertical e.g. data segregation & horizontal e.g. functionality), approvals, audit trail, bulk actions and subscriptions. The key functionalities to automate fragmented treasury operations and support end-users in CFO, treasury, accounting, and IT teams.

Having had the privilege to build software from scratch for the era of AI and APIs, enables us to take quickly new features into use. Currently, we are working on something cool allowing users not to only search anything, but ‘ask for anything’. More on this soon – and we are collecting user feedback on questions to ask to help people perform their jobs more efficiently. Ultimately to go home early on Fridays! Keep us posted with the ideas you have for our AI robot ACE!

API First

Building the solution on APIs with a user-friendly UI allows customers to

- visualise data and configure custom views

- consume the product as a service

- easy integration into existing customer systems

- workflow automation

- extend the application via 3rd party partnerships

Cloud Native, Serverless Architecture

- FinanceKey has been designed to run in the cloud

- without physical servers

- providing an efficient implementation for customers

- cost benefits

- a more secure and scalable architecture

Data-Driven

Wherever possible, system components are defined in data which

- promotes reuse

- allows the application to be easily tailored and configured

This data-driven approach also supports further automation which FinanceKey has capitalised on by creating a robot that ‘writes’ code based on the data in the database. The main tiers of the application are completely written by the robot

- raising quality,

- promoting standardisation and

- continuous improvement

Benefits for Treasurers, Cash Managers, FX Risk Managers, Treasury IT and Other Finance End-Users

A future-proof, AI-powered software framework, allows end-users to benefit from:

- Ease of use

- Quick onboarding without heavy implementation projects

- Responsiveness of the user interface

- Speed and agility

- Continuous improvements

- Ability to bridge the gap between legacy and digital

- Intelligent modern technologies, such as AI, ML and conversational UI