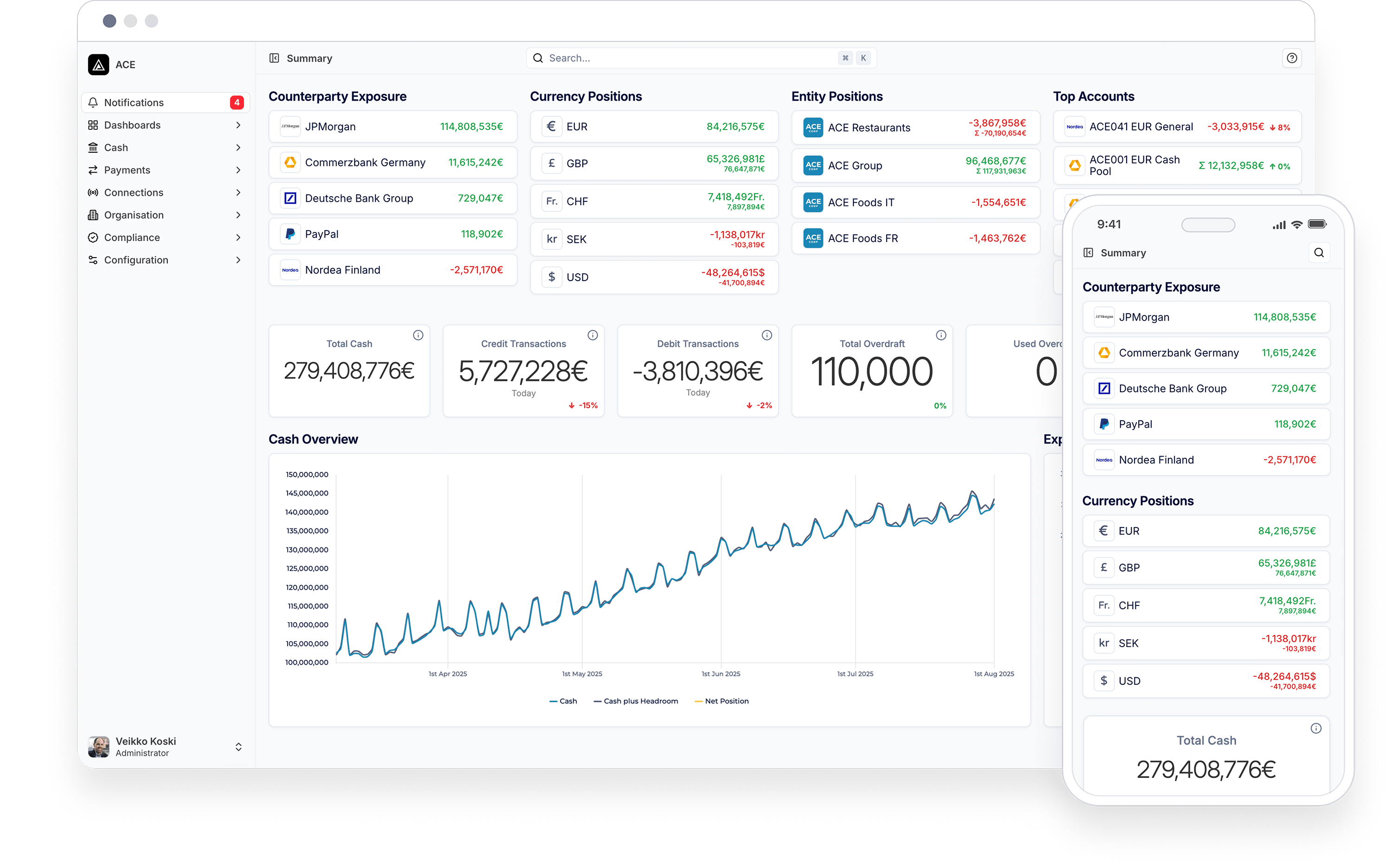

Real-time cash visibility

and payment automation

Connect your banks, ERPs and TMS to one single dashboard or use our treasury API that aggregates everything behind the scenes.

The orchestration layer for modern treasury

All your financial data,

finally connected

Stop logging into multiple banks, ERPs and TMS. Seamlessly integrate all your financial data into one centralized dashboard for complete control and real-time insights.

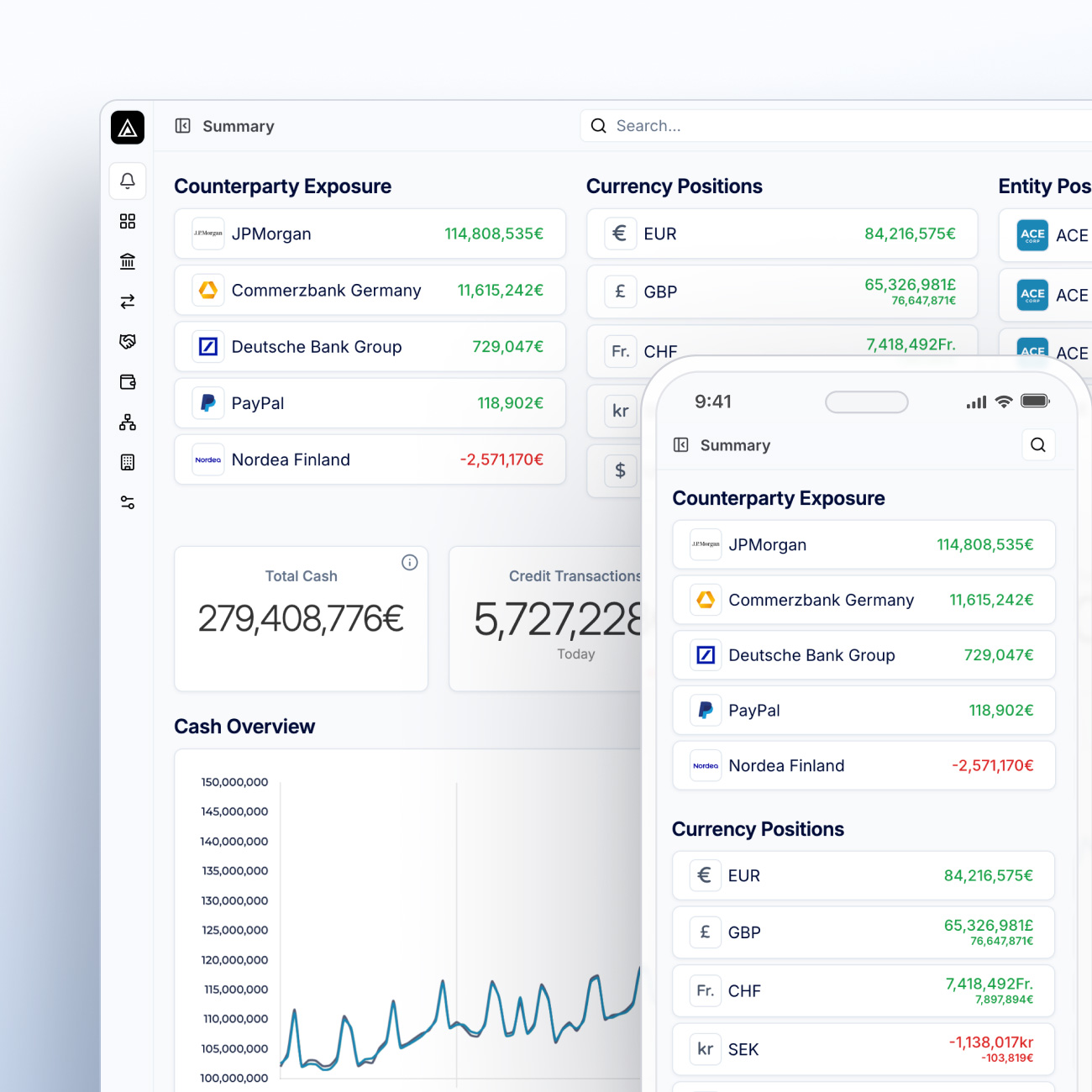

See your cash,

make smarter decisions

No more waiting for end-of-day reports. Get real-time cash visibility across all accounts, currencies, and entities—so you can make informed decisions instantly.

Manage, automate

and secure

Streamline approvals, automate account funding and sweeping and gain complete visibility into your entire payment process.

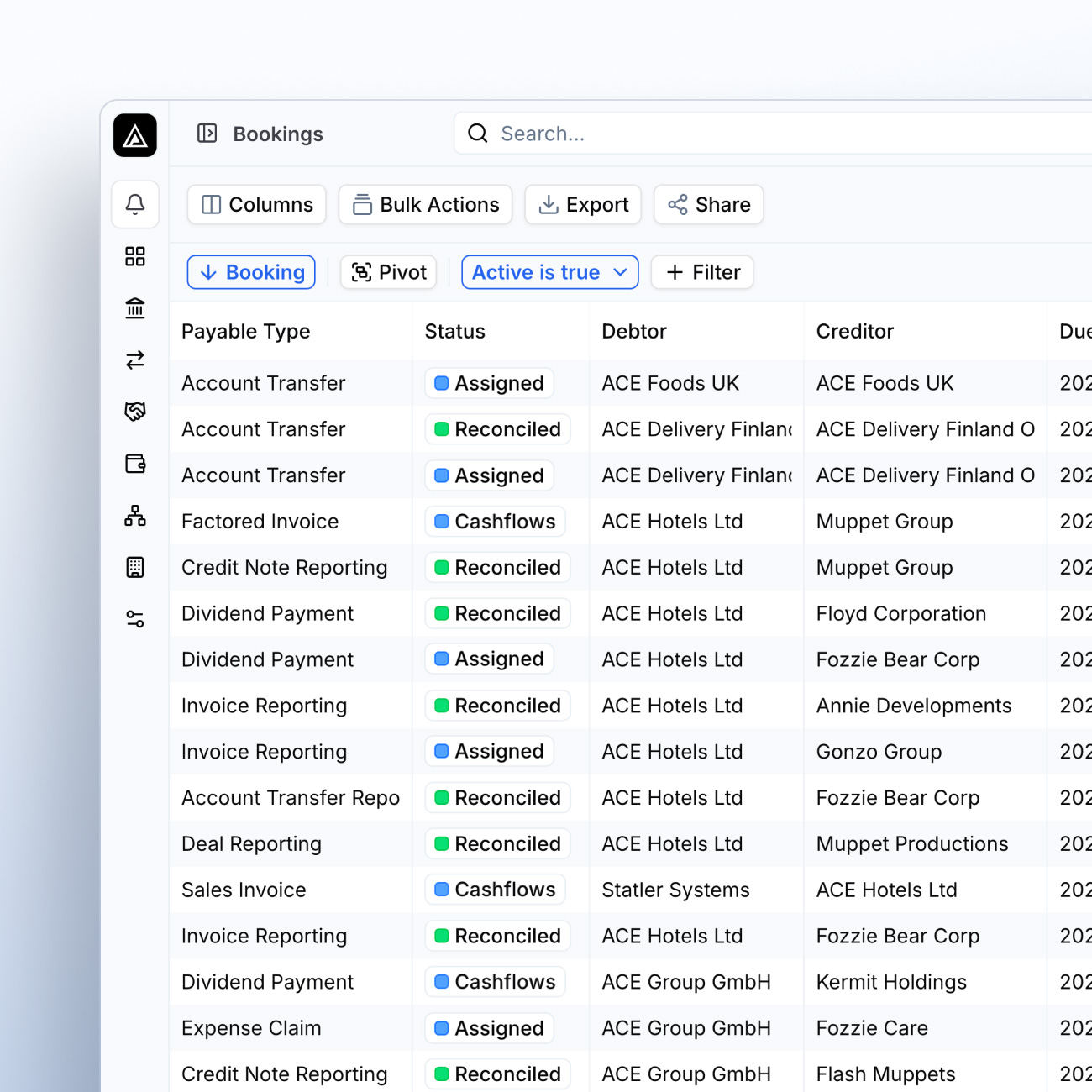

Simplify payment and finance operations with our modular, interconnected solutions

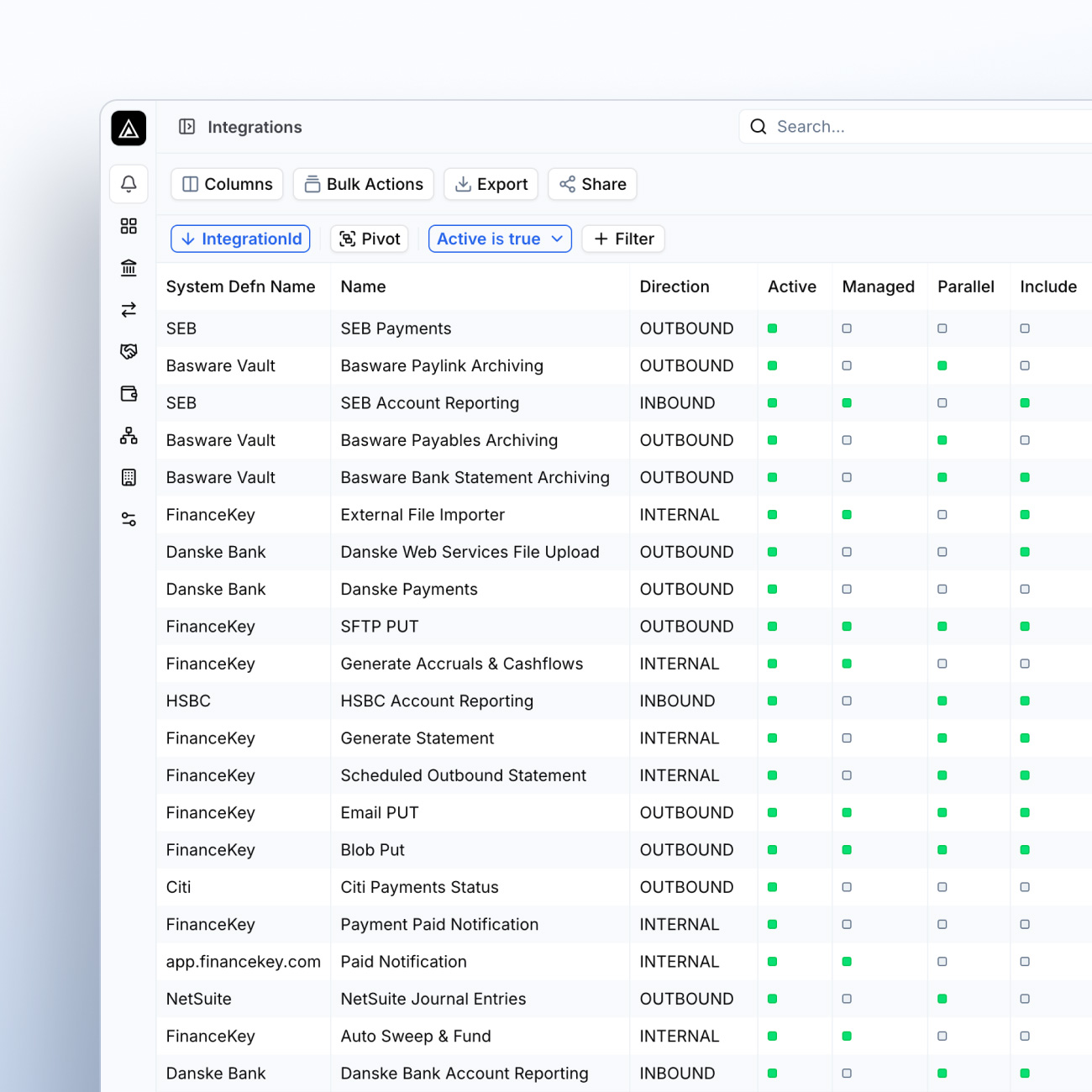

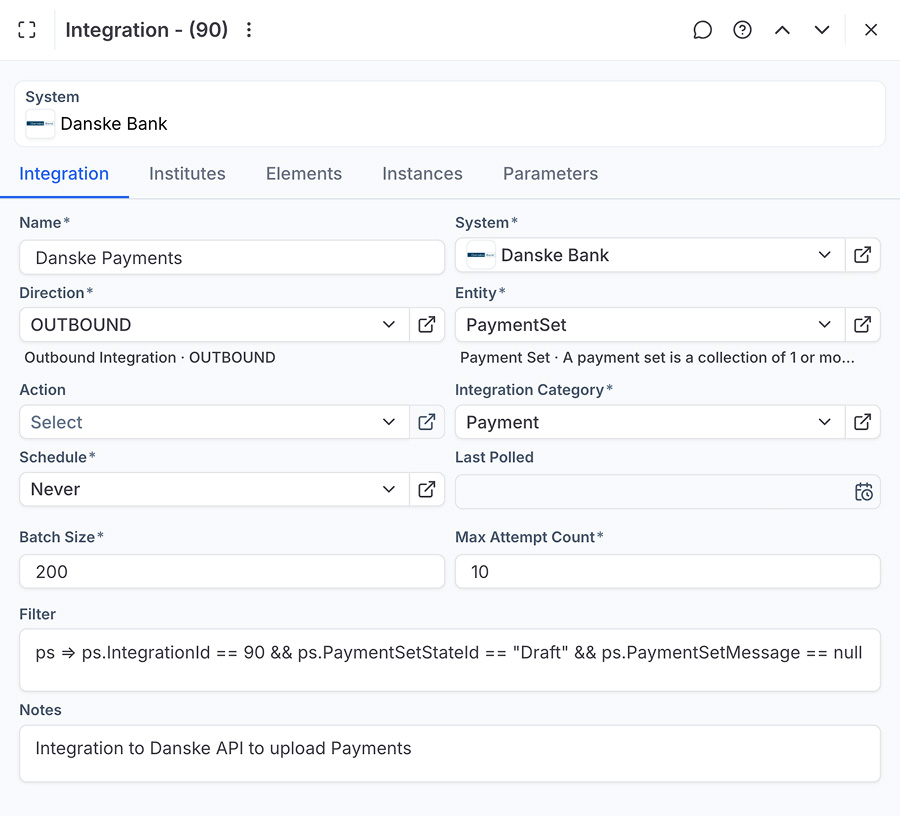

Connectivity

Simplified connectivity to banks, payment providers, ERP and TMS systems supporting APIs and file protocols.

Cash Visibility

Achieve real-time cash visibility via dashboards designed for CFOs and Treasurers – without heavy implementation projects.

Forecasting

Accurate and reliable short-term cash flow forecast updated in real-time. Improve decision making & optimise cash flows.

Payments Hub

One centralised hub to gain control over all of your payment flows. Set approval workflows and choose flexibly when to execute payments.

Liquidity

Real-time aggregation of short-term liquidity positions based on multi-bank pools per currency & blotter with FX deal requirements.

Account Validation

Verify bank account beneficiary owner name to avoid vendor bank account frauds & check the status to reduce payment returns.

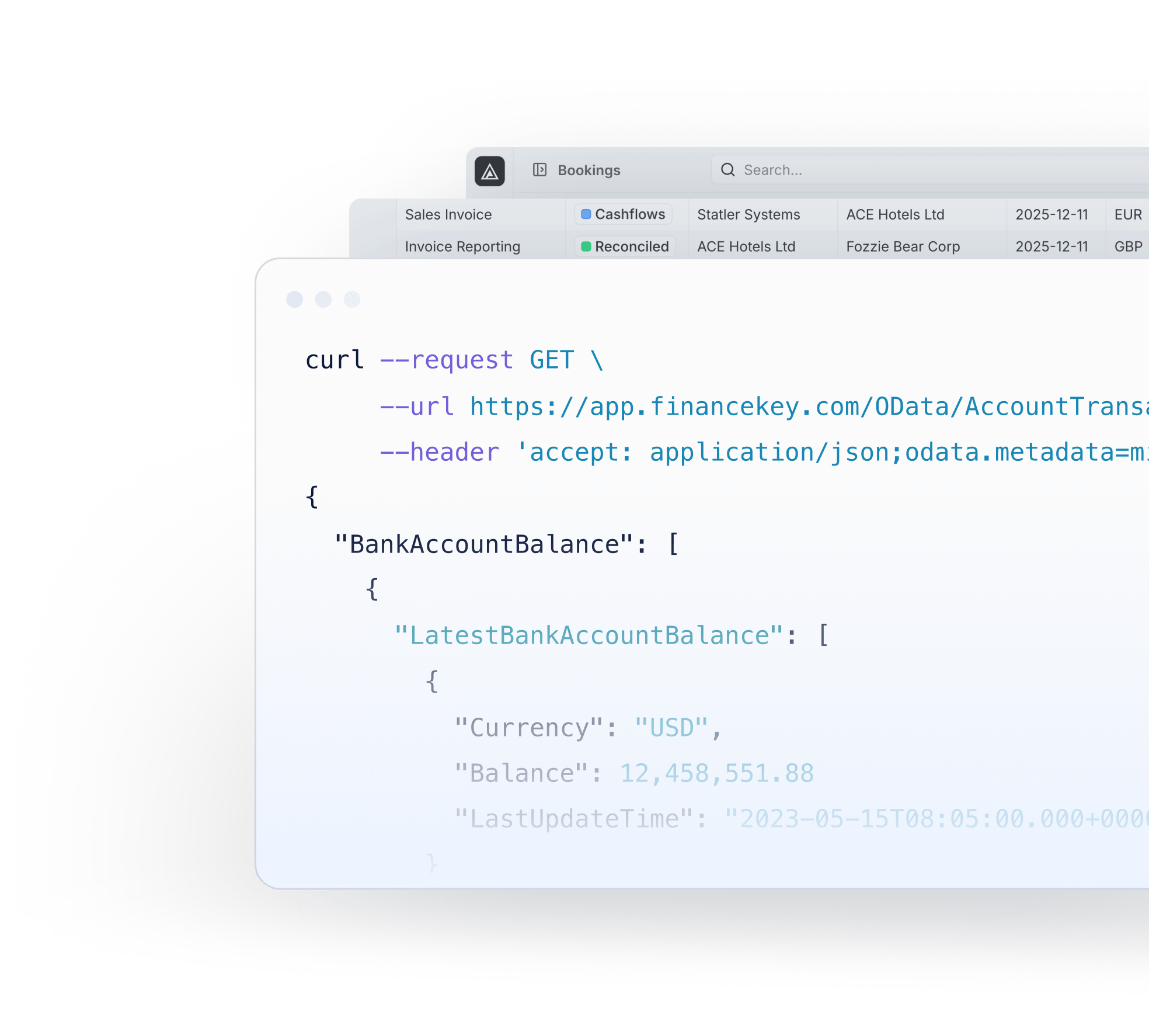

One API to connect your entire treasury

- Instantly unify financial data across banks, ERPs, and treasury systems.

- Sync real-time transactions for better cash visibility.

- Automate reconciliations & workflows with seamless API connectivity.

- Reduce IT burden with easy-to-maintain integrations.

User feedback

What our customers say

“I could not live without FinanceKey! Super easy-to-use platform and the team is always willing to listen, improving their solution to meet our demanding requests.”

“FinanceKey has truly supercharged our Treasury by providing real-time cash visibility. Speaking to other treasuries none of them have the same visibility, we are technologically way ahead!”

“FinanceKey’s intuitive dashboards are essential for any CFO in the current economic climate, and real-time cash visibility has empowered us to make better decisions and improve liquidity planning.”

How it works

Easy integrations and real-time dashboards

Experience it first hand