FinanceKey Self-Service Onboarding

FinanceKey prides itself on being a user-friendly, effortlessly implementable solution that seamlessly scales to meet the evolving demands of enterprise finance teams. In this insights post, we will dive into the simplicity of taking banking connectivity into use and the immediate advantages it delivers.

A comprehensive view of cash visibility stands as a cornerstone for both treasury and finance teams. We have prioritised making this process as straightforward as possible. Our self-service approach ensures rapid access to cash visibility, instantly unlocking numerous benefits. FinanceKey saves customers considerable time previously spent logging into multiple e-banking platforms to compile data for a holistic cash position overview.

The consolidated real-time visibility we provide, empowers our customers to react promptly, optimising their return on cash. The platform’s features include customisable notifications, allowing proactive responses to specific triggers. Additionally, FinanceKey is built to offer funding and sweeping capabilities, further enhancing financial operations’ agility and efficiency. Next, we will examine in practice how easy it is to take PSD2 bank connectivity into use in FinanceKey.

1

Login via your existing organisational account.

Support for O365, Google ID and Okta SSO and other methods using OAuth 2.0 protocols.

2

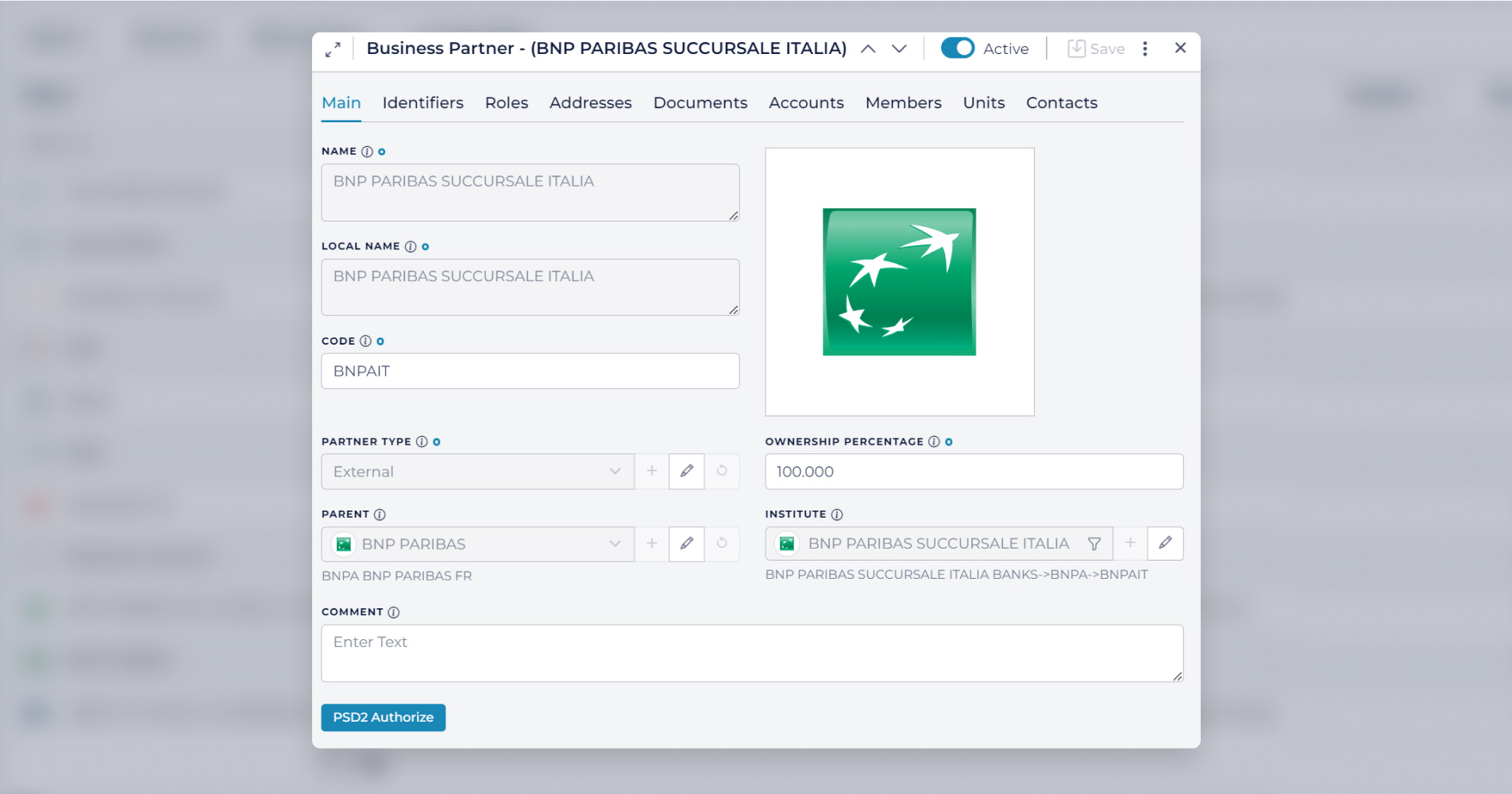

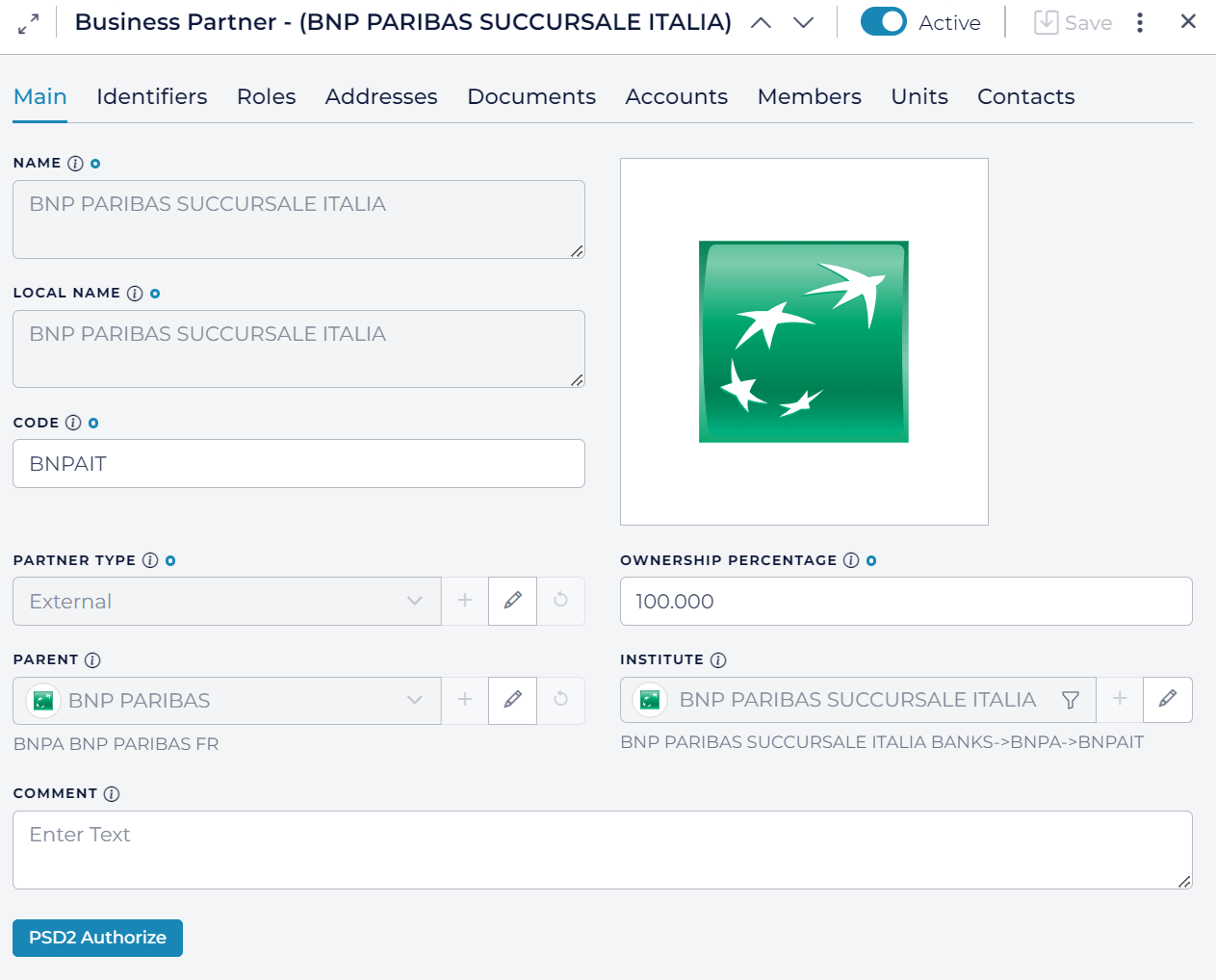

Create new “Business Partner” & authorise connectivity via the Business Partner View

New business partners & connectivity can also be enabled from the Integration Catalogue.

3

The E-banking admin can authorise connectivity

FinanceKey will direct you automatically to the banking portal where the consent is given.

4

Bank Accounts Generated Automatically

FinanceKey generates list of bank account automatically from an API response and starts retrieving data. Historical data for the last 90 days and real-time updates as per the schedule customer can set up in FinanceKey.

5

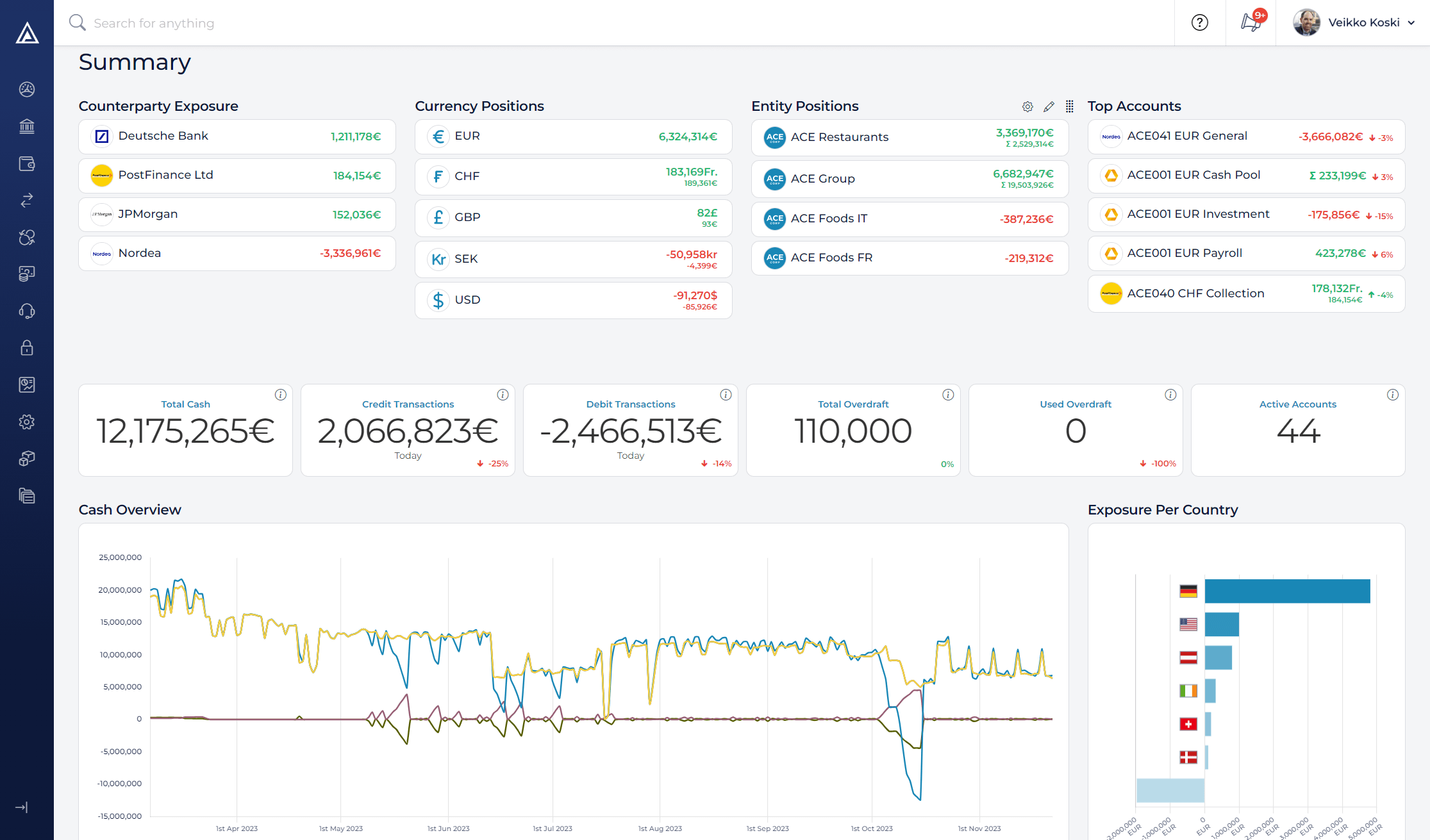

Default dashboards are available in Reporting Currency

With bank connections authorised and data flowing in, the default dashboards are generated automatically. Dashboards are dynamic and customers can create their dashboards from any underlying view inside FinanceKey.

In summary, FinanceKey’s self-service onboarding not only allows quick access to cash visibility but unlocks instant, actionable insights. By enabling quick and informed decision-making, FinanceKey transforms how businesses can manage their cash. Through the user-friendly interface and real-time capabilities, FinanceKey sets the stage for data-driven treasury, positioning enterprises for a competitive advantage.