Five real-time treasury myths (and what we’re really seeing)

FinanceKey’s CEO breaks down five real-time treasury myths and shows how finance teams are getting results without replacing existing tools.

Webinar: Building better treasury APIs together

Inside Danske Bank and FinanceKey’s collaboration on piloting a real-time account and balance API.

Lunar Bank chooses FinanceKey to power real-time, API-driven liquidity management at scale

Lunar, one of the largest digital banks in the Nordics with more than one million customers, has chosen FinanceKey to support the next stage of its growth journey.

Open banking vs premium APIs: what treasurers need to know

Learn how to choose between PSD2 and premium banking APIs for your treasury setup. Understand the differences, real-world use cases, and how to integrate APIs into your existing systems.

Danske Bank and FinanceKey deliver real-time treasury for enterprise customers

Danske Bank today announced a collaboration with FinanceKey to deliver real-time access to liquidity data, enabling CFOs and treasury teams to operate with greater speed, accuracy, and foresight.

FinanceKey secures €3M to eliminate manual work in corporate finance teams

Finnish fintech company FinanceKey announces a new €3 million seed funding round to scale its client base, expand into new markets, and accelerate the shift to fully automated enterprise treasury systems.

FinanceKey recognised as one of Finland’s 10 hottest startups

We’re excited to share that FinanceKey has been named one of Finland’s 10 hottest startups by Talouselämä! This recognition highlights our commitment to revolutionising treasury management with a modern, API-first and AI-powered solution.

FinanceKey Interview at ATEL Tech Day 2024

At the ATEL Tech Day on November 7th, the FinanceKey team, including CTO Macer Skeels and Business Development Manager Topias Vainio, presented FinanceKey’s innovative, API-first, AI-powered treasury solutions to enterprise treasurers in Luxembourg. In his interview at the event, Topias highlights how FinanceKey is transforming treasury management by enabling real-time multi-banking, cash management, payments, account validation, and short-term cash forecasting—all through a modern, user-friendly interface.

FinanceKey’s Recap: An Action-Packed Slush Week

Discover how FinanceKey navigated a busy week at Slush, organizing a CFO Lunch and House Party, while also engaging in productive customer meetings and participating in key events at Slush.

EuroFinance Insights with FinanceKey CTO Macer Skeels

At EuroFinance 2024, FinanceKey's CTO, Macer Skeels, shared insights on FinanceKey and the company’s vision for the future of treasury management, emphasising the transformative role of AI in treasury operations.

Next-Level Cash Management: FinanceKey & Raiffeisen Bank International Whitepaper

We are excited to release our joint whitepaper with Raiffeisen Bank International AG, exploring how innovative solutions and strategic partnerships are transforming treasury management in a digitized and AI-driven world.

FinanceKey receives funding under the European Union’s EURA program

FinanceKey receives funding under the EU’s regional and structural policy (cohesion policy) for the 2021–2027 programme period. The funding received under the EU's EURA program provides a significant boost to FinanceKey's growth trajectory, enabling us to scale operations and keep investing in innovative solutions. This support not only strengthens our capacity to deliver impactful results but also positions us as a leader in our industry.

FinanceKey Migrates to Azure SQL Elastic Pools to Enhance Database Performance and Scalability

FinanceKey, a leading innovator in treasury technology, is excited to announce the migration of its hosted solutions to Azure SQL Elastic Pools. This transition represents a significant upgrade in FinanceKey’s database performance and scalability, guaranteeing our users an enhanced level of service and efficiency.

“Cash is king, but we have the whole royal family”

In an environment characterised by irregular financial flows, cash is undeniably crucial. However, it's not just about cash being king; the entire "royal family" of financial controls must be in place to ensure everything runs smoothly, says Jacob Koch during his presentation at Treasury 360° Nordic 2024.

Clever API solution put the full account overview at his fingertips

For years, Jacob Koch, Head of Treasury at Danish renewable energy developer Better Energy, dreamt of consolidated overview across his several banks and hundreds of accounts. Starting with a chance meeting at Treasury 360° Nordic 2023, this has now turned into reality.

Building a Flexible Friend: FinanceKey on Listening, Learning and Delivering

Tom Alford (TMI) is joined by Macer Skeels to discuss what sets FinanceKey’s solution apart in the treasury landscape as a TMI-Award winner. Macer offers an in-depth examination of FinanceKey’s functionalities, highlighting its strengths in simplifying bank connectivity, defining its intended target audience, and outlining exciting future development plans.

FinanceKey receives globally recognised ISO/IEC 27001:2022 certification

FinanceKey, a leading innovator in treasury technology, proudly announces that it has received the ISO/IEC 27001:2022 certificate, signifying compliance with the globally recognised standard for Information Security Management Systems (ISMS), further strengthening FinanceKey’s position as a trusted business partner.

FinanceKey Wins Best Innovation Lab Solution Award at TMI Technology & Innovation Awards

FinanceKey, a leading innovator in treasury technology, has been awarded the Best Innovation Lab Solution at the TMI Technology & Innovation Awards 2023. This recognition is a testament to FinanceKey's commitment to provide innovative, real-time and modern technology solutions and signifies FinanceKey's success in delivering these sought-after solutions that many finance & IT professionals have been waiting for.

FinanceKey Unveils Cutting-Edge Generative AI Feature in Treasury and Management Solution

FinanceKey is thrilled to announce the introduction of a revolutionary generative AI feature in its flagship Treasury and Management Solution.

FinanceKey Enhances it’s Treasury Software with C# .NET Core 8 Upgrade

FinanceKey upgrades their application to use C# .NET Core 8

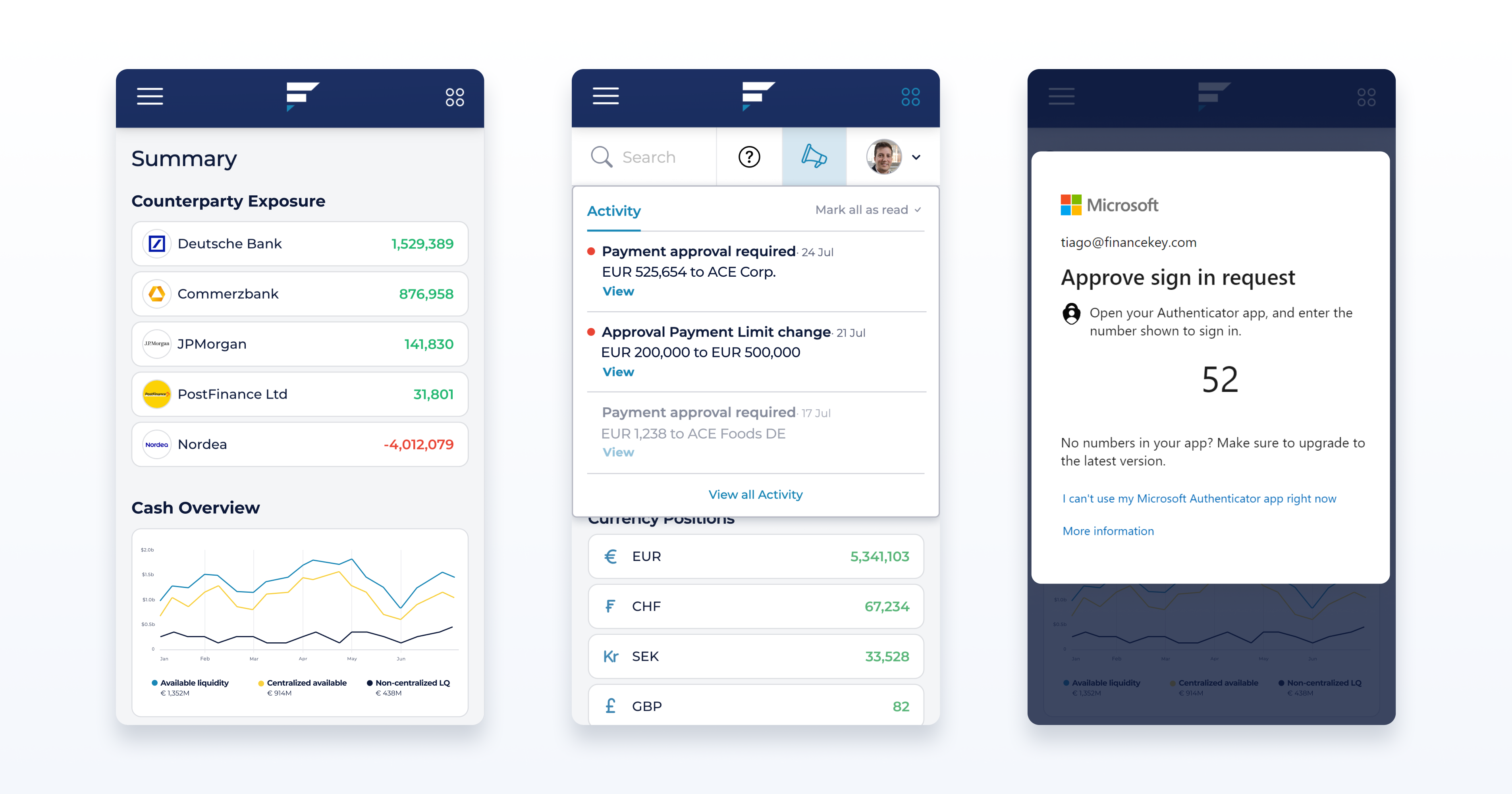

FinanceKey is now on Mobile!

FinanceKey unveiled its Mobile Version during the EuroFinance International Treasury Management conference in Barcelona. It was fantastic to see so much excitement about our Mobile Version – many treasurers and CFOs are eager to manage their treasury while on the go!

Agile Technology Supporting Customers’ Payment and Treasury Needs Today and in the Future

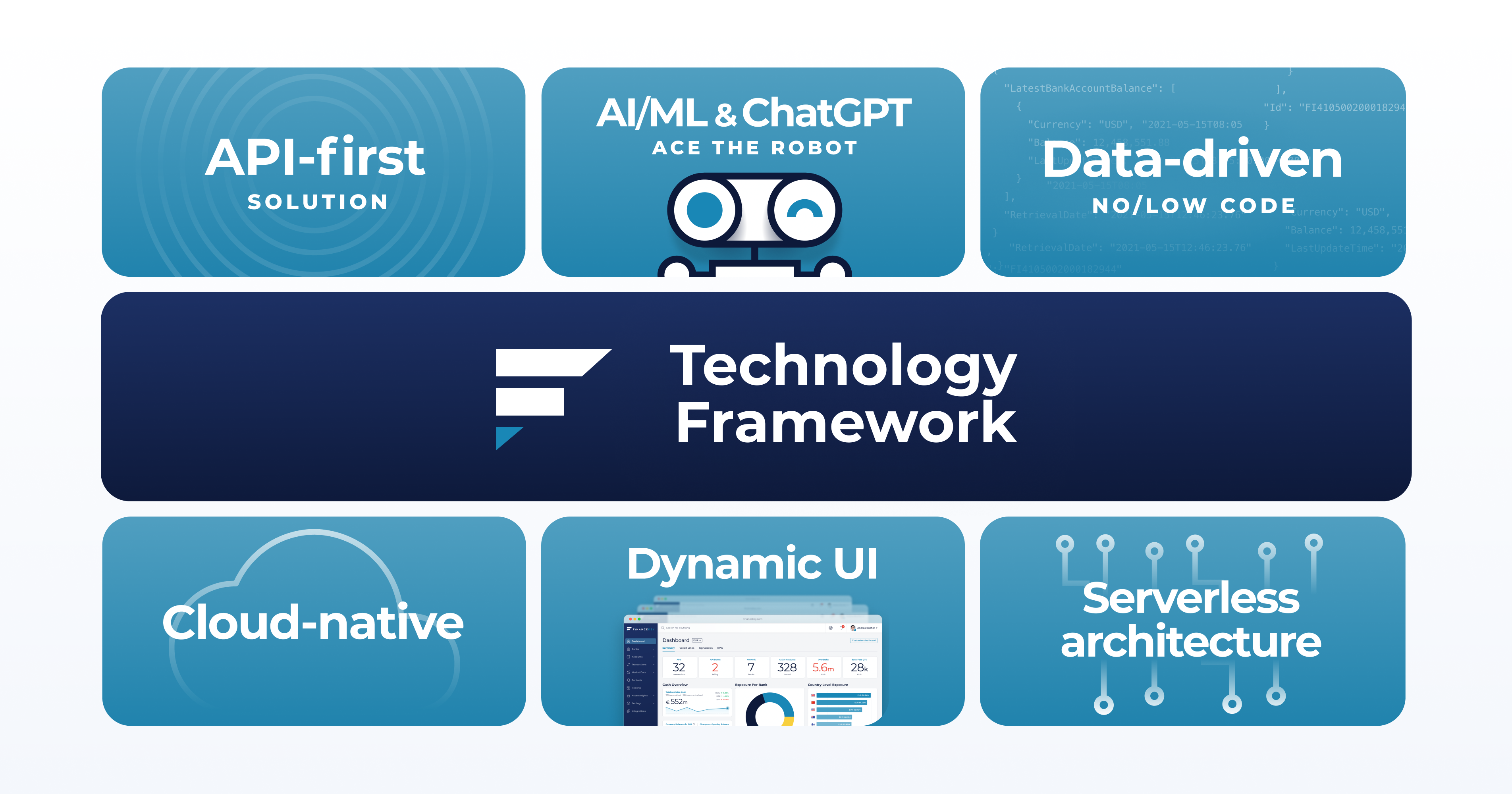

FinanceKey is a Next Gen platform allowing seamless integrations via modern APIs, real-time cash management and a centralised payment hub. As a modern solution, FinanceKey is AI-powered, offering intelligence for forecasting and fraud protection. The core of FinanceKey is an open, modular and scalable technology that offers flexibility to meet the customer demands of today and the future, and developing quickly new functionalities.

FinanceKey Goes Live with Raiffeisen Bank International Cash Management Open APIs

FinanceKey becomes an official third-party provider for Raiffeisen Bank International (RBI) Cash Management Open APIs and is live with RBI’s Account Statement API providing access to real-time balances and transactions.

FinanceKey and Enable Banking Partner to Deliver Real-Time Financial Visibility for Businesses

Finnish fintech companies deliver instant cash visibility across multiple banks, empowering businesses to navigate economic uncertainty and streamlining finance processes, powered by a seamless Open Banking experience.

How to build a modern treasury infrastructure?

The requirements for finance and treasury solutions are changing as the complexity of system landscapes, payment operations and data are growing. Dealing with multiple systems, banks and other external providers is a challenge that keeps IT consultants busy.

FinanceKey has been accepted to join the Common Global Implementation initiative simplifying corporate-to-bank implementations

FinanceKey is pleased to announce being a member of the Common Global Implementation - Market Practice (CGI-MP) initiative. FinanceKey CTO Macer Skeels joins CGI-MP working groups bringing a wealth of treasury & technology knowledge to the committees and valuable insights into multi-bank connectivity from corporate, bank and software vendor perspectives.

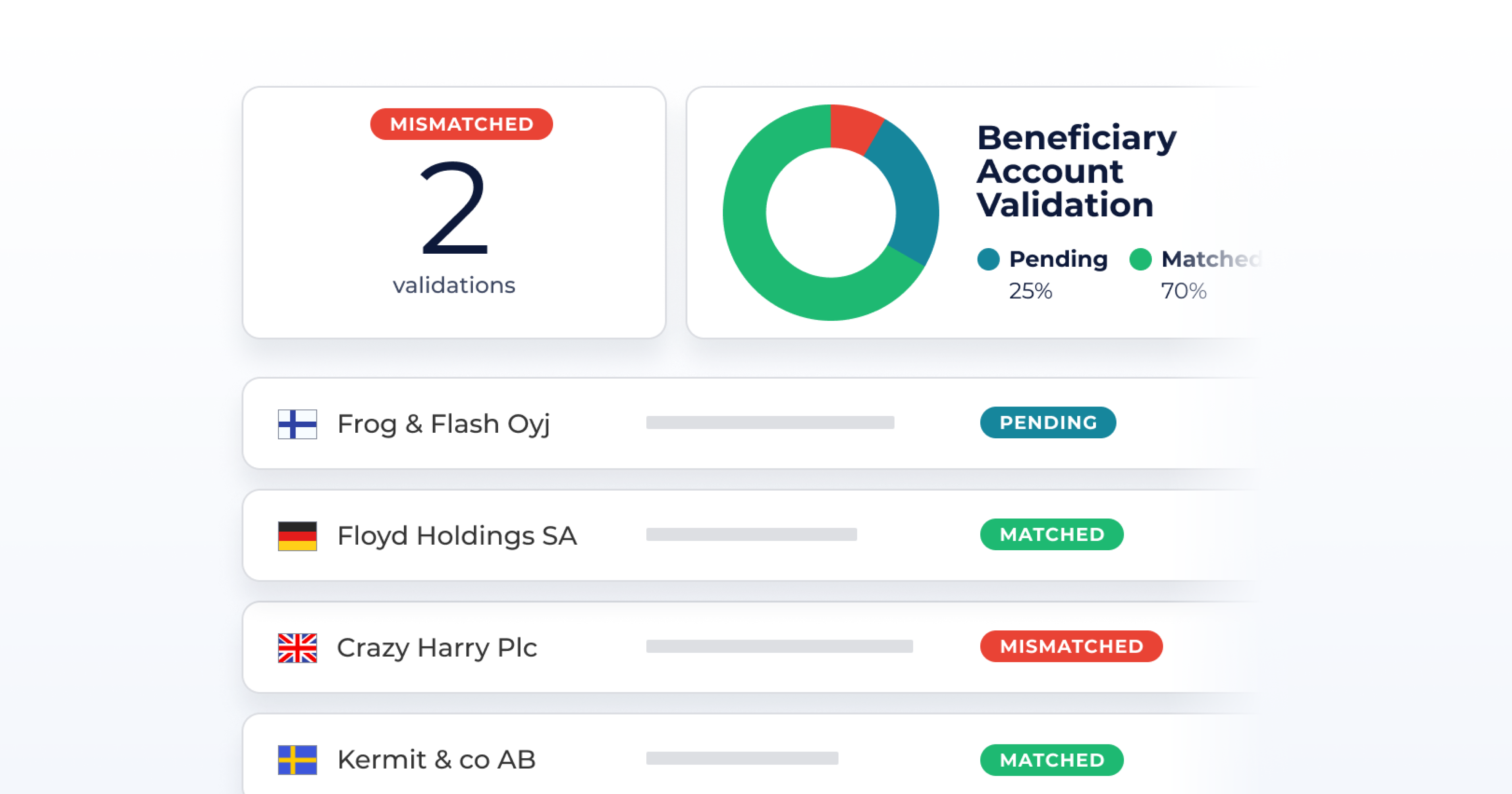

How to protect against fraudulent bank account change requests?

Payment frauds are getting more sophisticated and complex to spot as fraudsters attack day-to-day business processes. One common fraud is hacking into the supplier’s email, changing the bank details on the invoice and sending it for payment. Change requests coming from a credible source, including valid documentation, are hard to spot unless one has a prudent protection mechanism built for vendor frauds.

One platform supporting treasury automation, dashboards and integrations

Treasury teams work in the intersection of multiple systems and external partners, creating a very fragmented landscape from tooling, data and workflow perspective. To solve the complexity treasuries are facing, FinanceKey has invested early on in building scalable technology, that can support any payment and treasury use case.

FinanceKey joins Mastercard Lighthouse program for Fintech start-ups

FinanceKey has been selected as one of 15 fintech companies from the Nordics and Baltics to participate in Mastercard's Lighthouse FINITIV program. Initiative focus on building partnerships with Mastercard, AWS and leading banks in the region.

FinanceKey becomes an official Account Information Service Provider under EU’s PSD2 regulation

FinanceKey has been awarded Account Information Service Provider (AISP) status by the Finnish Financial Supervisory Authority (FSA). AISP registration provides us with the ability to help customers access their bank account data via the regulated Payment Services Directive 2 (PSD2) Application Programming Interfaces (APIs) within the European Union (EU).

Welcome to the team, KP!

Experienced finance leader, and currently advisor, coach and board professional, Kristian Pullola joins FinanceKey as Chair of the Board. Kristian brings a wealth of strategic and hands-on experience to the founding team having worked in several top finance and treasury roles during his career, including positions as Executive Vice President, CFO and Vice President, Head of Treasury and Investor Relations at Nokia Corporation.

Meet the FinanceKey founding team

We are thrilled to announce the FinanceKey founding team. Together, we aim to build intuitive tech for finance professionals eager to leverage API banking. We have ourselves faced the pain points many finance and IT professionals encounter every day — and are looking forward to help solve these for others while driving the use of real-time finance operations.

Tomorrow’s treasury – A strategic business partner with real-time insights based on API banking

The waves of open banking innovation reach the corporate sector as banks look into providing better service for their biggest clients. Banks hold a lot of data that helps automate treasury operations. For banks, APIs offer the potential of monetizing the data and innovative ways of providing banking services. Businesses benefit from API banking with new and unprecedented opportunities to digitize finance operations end-to-end and become real-time.