Making real-time bank data work for treasury and accounting

Banking APIs offer the real-time cash visibility modern treasury teams need – knowing which legal entity holds the cash, how much is available, and in which currency. The challenge is that API data is not standardised across banks.

The structure, level of detail, and consistency of data delivered via APIs can vary significantly, even when describing the same type of transaction.

This makes it difficult to treat API data as a universal replacement for end-of-day reporting – particularly for accounting and ERP processes that rely on consistent, well-defined data structures.

At FinanceKey, we’ve designed a practical solution to scenarios like this: a hybrid approach to bank account reporting that supports real-time visibility while preserving the processes treasury and accounting teams depend on.

Why “API-only” treasury breaks down in practice

In theory, bank APIs and end-of-day statements describe the same cash movements. In practice, the data can look very different depending on when and how it is delivered.

Some bank APIs provide the same level of detail as traditional file-based bank statements. In these cases, the familiar XML statement is delivered via an API – often wrapped in JSON, which acts as the digital container for transporting the data – rather than as a separate file.

From a finance perspective, this mirrors the formats ERP and accounting systems are already designed to consume.

In other cases, however, API-reported data can be less complete.

Common examples finance teams encounter include:

- Aggregation vs. Detail: Intraday API data may show a single aggregated debit, while the end-of-day CAMT.053 breaks that amount into multiple underlying transactions required for reconciliation.

- Missing attributes intraday: Details such as transaction codes, beneficiary information, or full remittance data may only be present in the CAMT.053, depending on the bank.

- Different identifiers and timing: Transaction references and statuses can change between intraday updates and the final end-of-day statement.

These differences are a normal consequence of mixing real-time data with accounting processes designed around final, booked statements.

The risk appears when intraday API data is treated as a direct replacement for statement data. Even small differences can ripple through reconciliation, reporting, and controls – and break processes finance teams can’t afford to disrupt.

A hybrid reporting model – by design

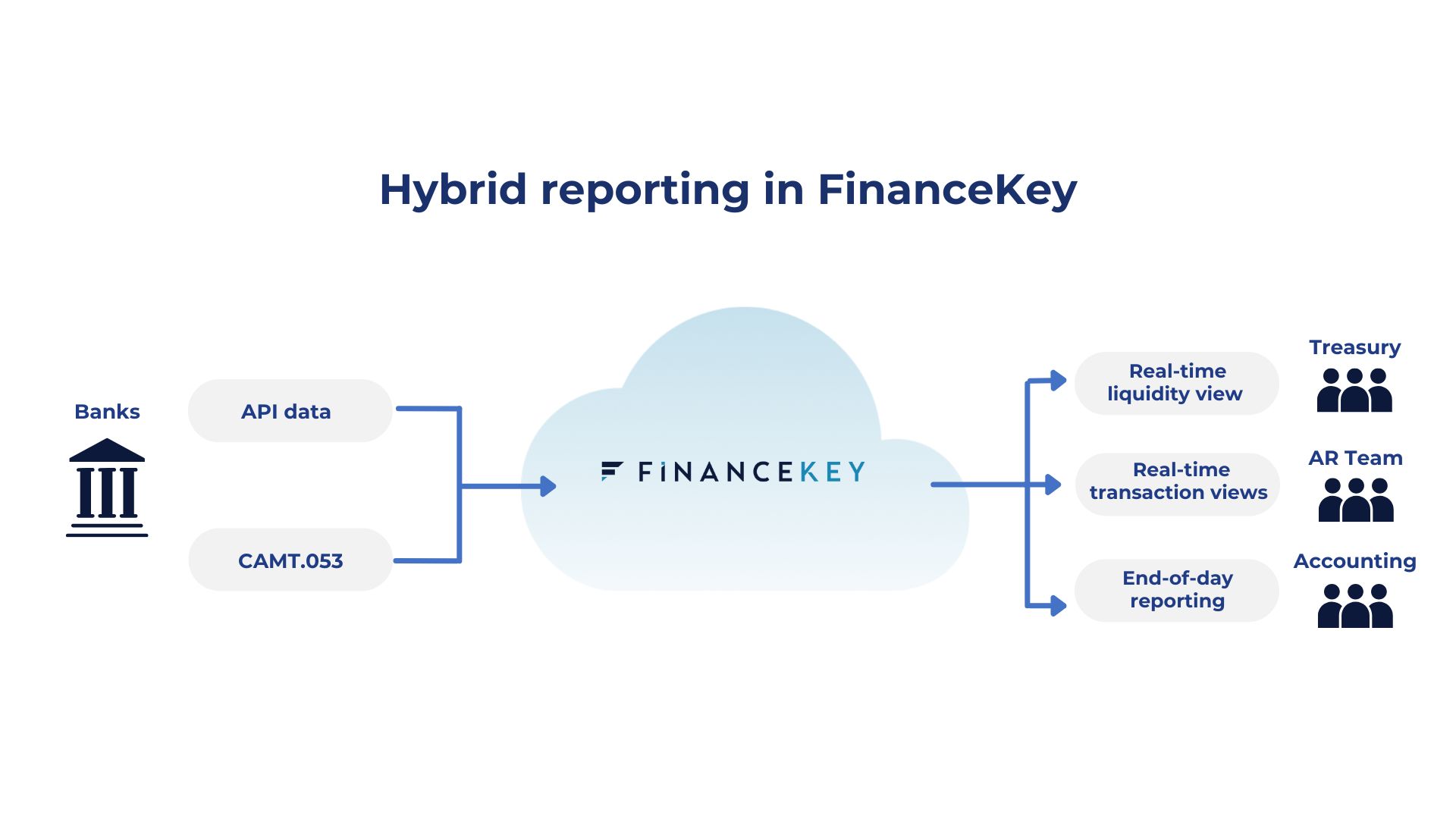

To meet the needs of both treasury and accounting, FinanceKey is built on a hybrid reporting model.

With FinanceKey:

- Intraday API data delivers real-time visibility for treasury and operational teams

- End-of-day CAMT.053 statements remain the trusted source for accounting, reconciliation, and audit

You can choose to connect via APIs, receive end-of-day statements, or use both – with all data synchronised seamlessly in one platform.

This allows organisations to move toward real-time treasury step by step, without forcing premature changes to ERP or accounting logic.

From APIs and CAMT.053 to dashboards and insight

The real advantage of FinanceKey’s hybrid approach is what happens after the data is ingested.

Both intraday API data and end-of-day CAMT.053 statements feed directly into FinanceKey’s reporting and analytics layer, enabling:

Intraday decisions powered by APIs

- Treasury teams manage liquidity more efficiently, centralise cash where possible, and optimise credit facility usage

- Accounts payable teams release payments once sufficient account coverage is confirmed

- Accounts receivable teams reconcile incoming cash as credits are booked, accelerating the working capital cycle

- Management accesses always up-to-date liquidity dashboards across banks, entities, business units, and currencies

Accounting-grade accuracy from end-of-day statements

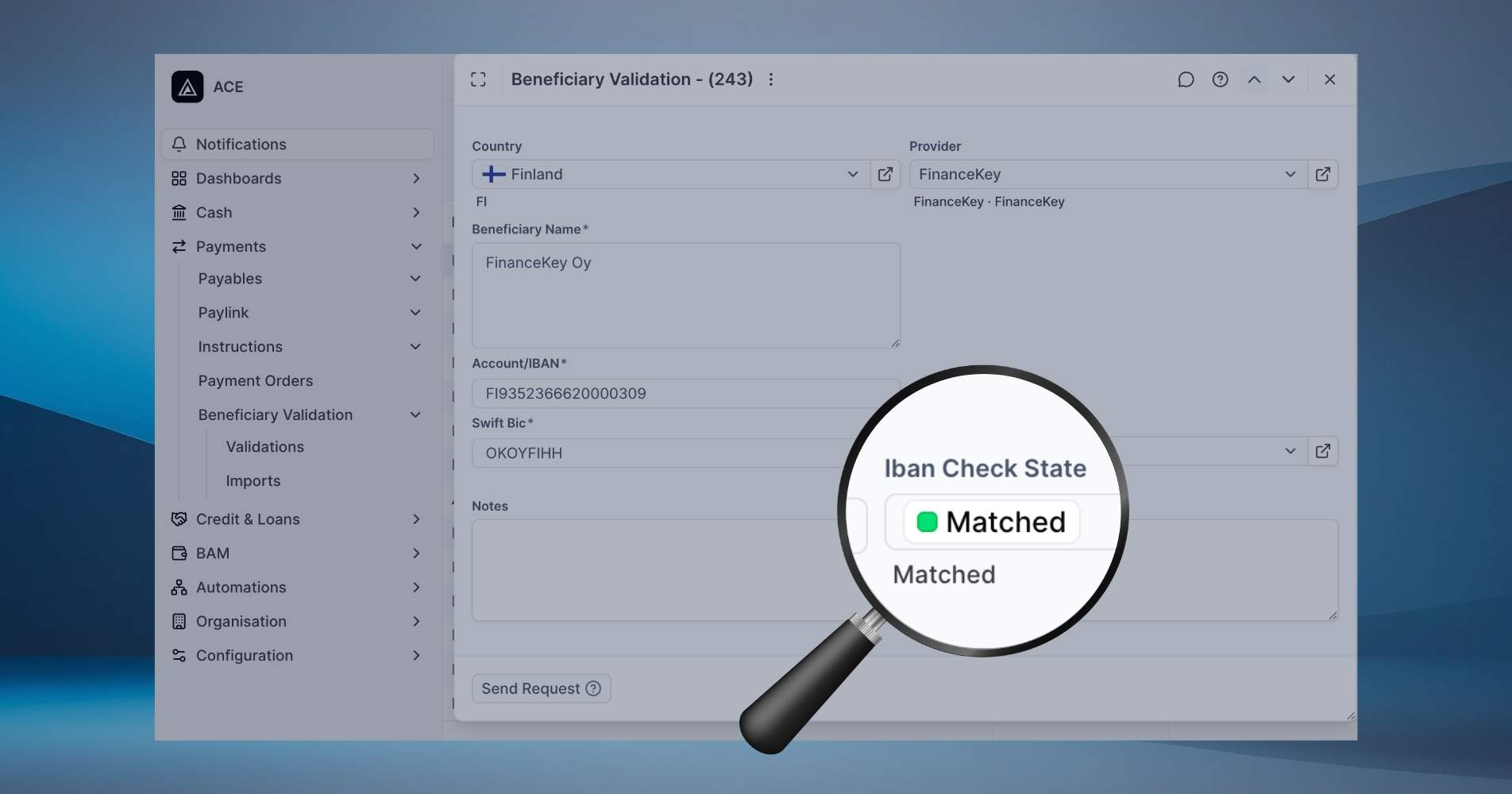

- Automated reconciliation of outgoing payments with full transaction detail

- Breakdown of consolidated debits, including visibility into bank fees

- Reliable statement-based data for posting, audit, and control

One consistent data foundation

- A single set of structured, normalised data – whether sourced from APIs or files

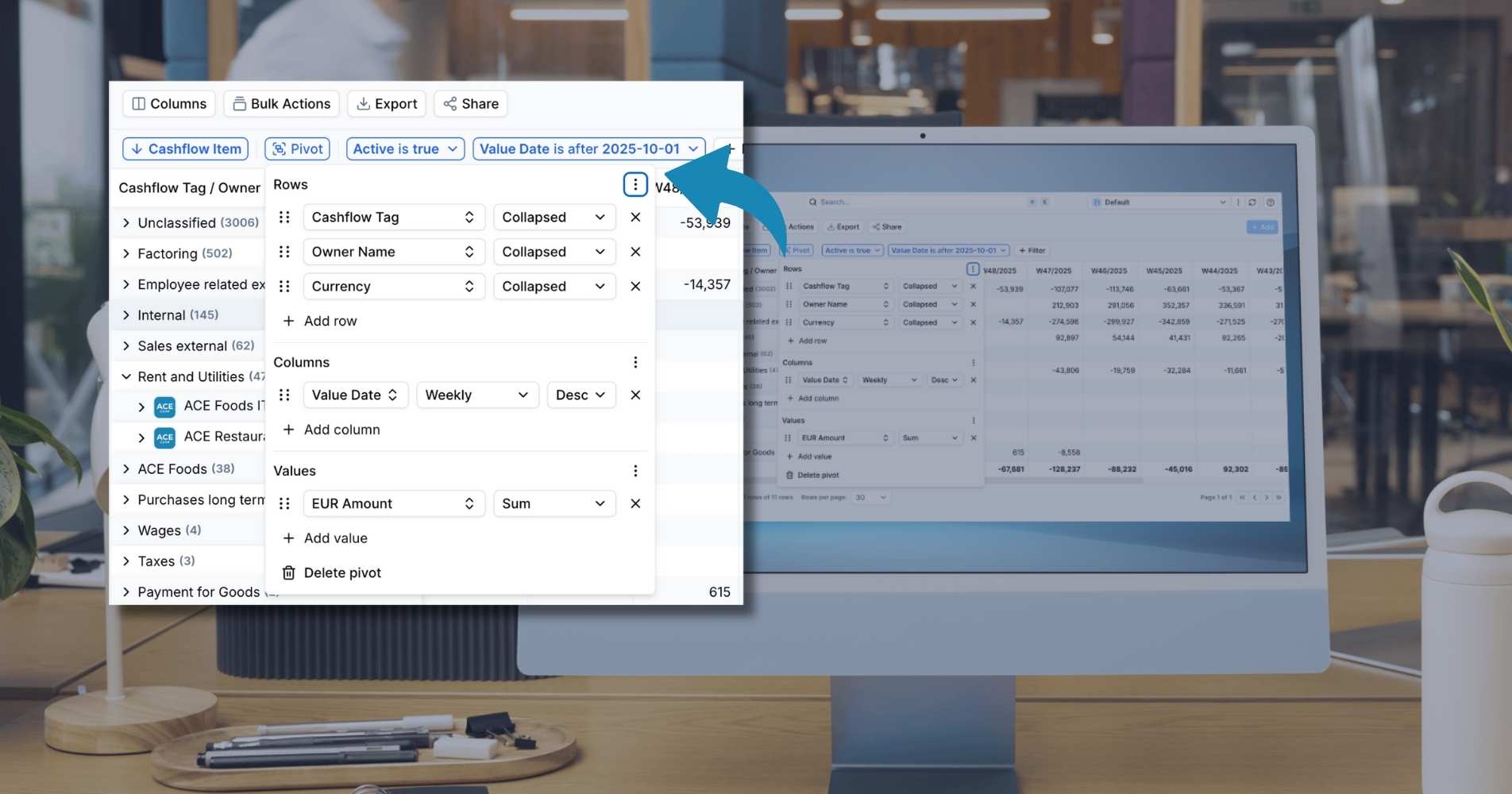

- Consistent downstream analysis in FinanceKey, Excel, or BI tools

- Enriched transaction and balance data available for pivoting, tagging, and reporting

Want to see FinanceKey in action? Get in touch to book a demo today.