Five real-time treasury myths (and what we’re really seeing)

By Veikko Koski, CEO and Founder, FinanceKey

Real-time treasury. Everyone nods when they hear it, but ask three people what it means, and you’ll get three different answers.

Some hear it and start thinking: “Which processes could we automate?” while some might be afraid of more work (and pressure). Some question the added value, and others still get nightmares from previous implementation projects.

At FinanceKey, we spend a lot of time listening to treasurers, controllers, CFOs and back-office teams. I’ve been in their shoes too – having spent years working in both corporate and bank treasuries, dealing with accounting, managing risk, liquidity, large investment portfolios and FX positions. These conversations feel familiar because I’ve lived many of the same frustrations.

Here are five myths we still hear often, and what the reality looks like for the teams we work with.

Myth 1: Real-time means working round the clock

This one comes up a lot, especially from teams that are already stretched (treasury teams are often very lean).

There’s this idea that “real-time” means always-on, always-checking, never-off. As a former corporate treasurer, I’ve been in that seat. Long days. Too many systems. Fragmented data and workflows, many manual processes. And always something urgent, with new ad-hoc requests coming in.

But in reality, the right real-time setup can give you back time, not take it away.

One of our corporate treasurer customers used to spend two hours every day manually collecting data from multiple bank portals for hundreds of bank accounts. Now, that data is pulled automatically into a single dashboard and fed by API into internal systems for forecasting and reconciliation.

Another team was leaving extra buffers in their accounts, lacking the time to transfer excess cash manually between banks. Today, they’ve set up automated triggers to execute automated cash sweeps right before the payment cut-offs.

What used to take hours now takes minutes, and they’re earning more money from interest thanks to smart deployment of funds.

Real-time doesn’t mean you’re working longer hours. It means your tools are finally pulling their weight.

Myth 2: It means changing your systems

Treasury teams know their existing systems – such as ERPs and TMS, for processing banking data and payments – are deeply embedded across the business. Changing these isn’t something they can decide or do alone.

And they shouldn’t have to.

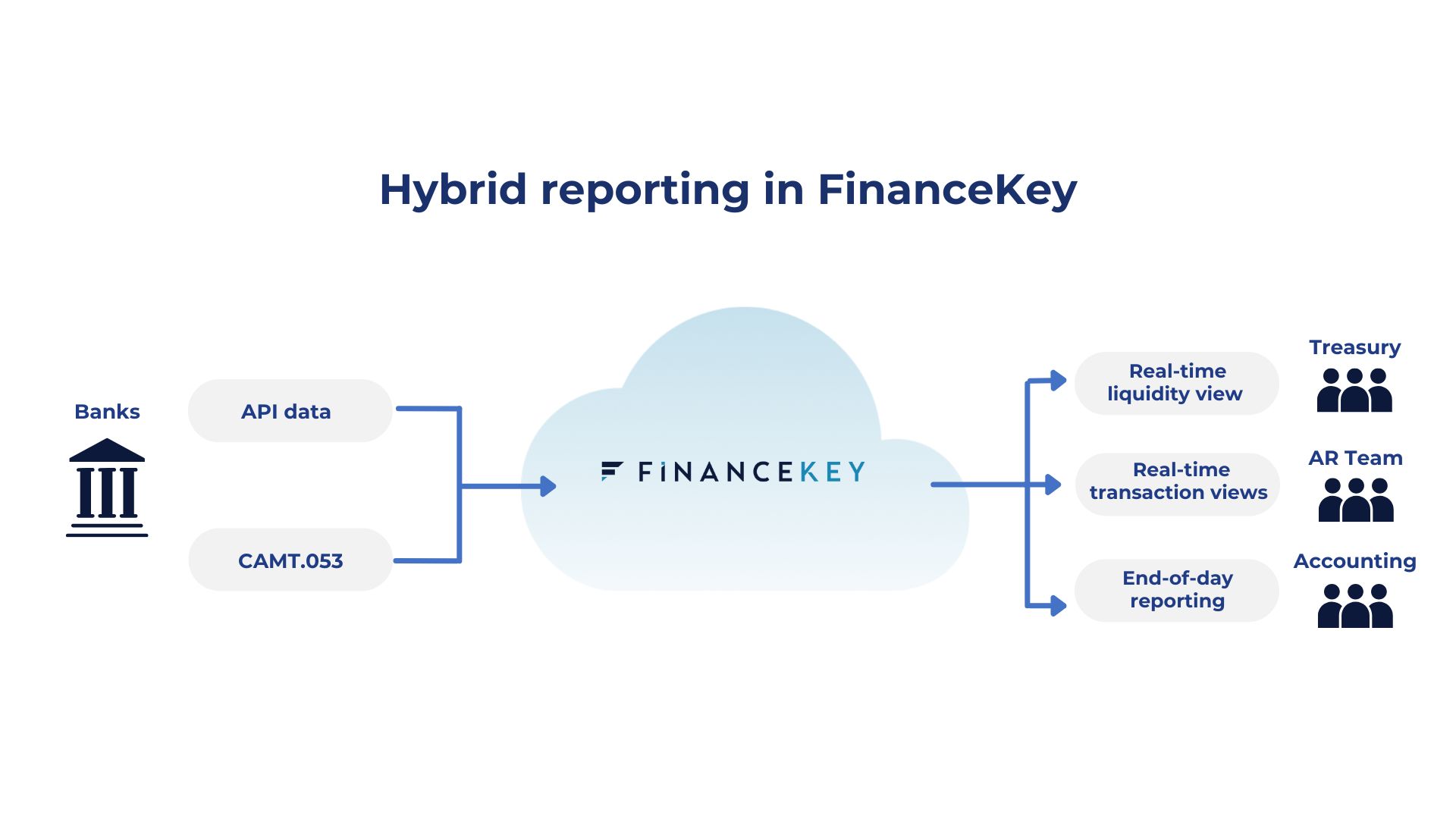

At FinanceKey, we are big believers in flexibility. FinanceKey is built to adapt to a range of treasury setups, either as a complete platform or as a service that integrates with your existing systems.

In many cases, teams use it to complement their ERP or TMS by layering in automation – like structured, real-time multi-bank data delivered through a single API into the tools they already rely on.

Our integration with SAP is one example. Our clients use FinanceKey to automate the flow of data and payment files in and out of SAP and other ERPs with simple configurations. Whether they’re looking for intra-day bank statements or migrating from ECC6 to S/4HANA, it’s all about making that process easier and more flexible.

That’s the future of real-time treasury: flexible solutions that respect the architecture you’ve already invested in.

Myth 3: It’s just about cash visibility

Improving cash visibility is a great place to start, but it’s just the beginning.

One client came to us because they couldn’t get a full view across all their banks. They were wasting hours every week logging into e-banking portals, copy-pasting data into spreadsheets, sharing them via email, and reconciling transactions manually.

Once they got real-time data flowing into a single view, something clicked.

Suddenly, they weren’t just seeing balances. They were spotting opportunities beyond treasury in the shared service organisation to accelerate and automate receivables reconciliation.

Next, they were setting alerts to avoid late payment fees and moving money to local bank accounts in time for tax and other statutory payments. Those first steps led to freeing up time across the board and building better processes.

The true impact of real-time treasury comes from the actions that cash visibility allows, especially when those actions are powered by intelligent automation.

Communicating in real-time

Real-time notifications are also very powerful. These can be connected to incoming transactions, outgoing payments, or account balances, for example.

One of our customers who uses FinanceKey for payment processing triggers Slack messages at the moment expense reimbursements are paid. It sounds small, but for a fast-moving company, it’s a big win. No more “has it been paid?” messages, and employees know exactly when their money is on the way.

Improved communication and collaboration cannot be overvalued.

Myth 4: It’s about fintechs versus banks

There’s a common narrative that fintechs and banks are in a constant race – and in some corners of finance, that’s true.

But when it comes to treasury, the reality is more collaborative than competitive.

We’ve seen firsthand how well-designed APIs can modernise a bank’s offerings without displacing core systems, allowing banks to better serve their existing customers.

And we’ve also seen how clients benefit when fintechs and banks design together, not against each other. Our collaboration with Danske Bank is one example of this approach in action.

That’s the spirit of our ecosystem model, and it’s core to how we work with banks, ERPs, and internal IT teams alike.

Myth 5: It’s about ditching Excel and starting over

Let’s be honest – Excel spreadsheets aren’t going anywhere.

And that’s fine. We still use it ourselves. Who knows of a more flexible, versatile tool?

But the reality is, many teams across the business – not just treasury – need access to up-to-date balance or transaction data. And too often, they’re still stitching it together manually.

Treasury managers, accountants, FP&A, auditors, finance ops… they all rely on spreadsheets. But they shouldn’t have to rely on email threads, daily exports, or copy-paste routines to get the data they need.

That’s why we built OData support into FinanceKey.

OData gives teams a secure way to stream real-time data from FinanceKey into Excel, Power BI or Tableau, without touching the core systems or asking for help from IT.

It’s as simple as copy-pasting a link, one time – and then it just works.

One client set up an Excel-based cash report that pulls fresh balances from FinanceKey every 15 minutes. Now stakeholders are getting the data they need, when they need it – without panicked calls to the treasury team last-thing on a Friday.

From noise to clarity

My journey has taken me from treasury accounting to the dealing desk, from front-office roles to driving digital transformation, and eventually to founding FinanceKey. One thing has stayed the same throughout: treasury teams don’t need more noise. They need clarity, control, and tools that work with them, not against them.

If you’re thinking about real-time and wondering what’s possible without turning your world upside down, we’re always happy to share what we’ve seen work. You can also see what our customers have to say.