How to design a treasury technology roadmap

By Orsolya Kozák, Treasury Specialist – Customer Success

Over the years, I’ve worked on a range of treasury innovation projects as a corporate treasurer. Some have been triggered by internal process improvements, others by external market factors.

But one thing I’ve learned is that building a treasury technology roadmap is not the same thing as launching a full-blown transformation project.

A technology roadmap is narrower in scope. It’s about understanding what technology you need, why you need it, and how to go about getting it.

A transformation project, on the other hand, usually includes changes to people, processes, and structure – not just systems.

If you’re a treasury team just starting to think about modernising your tech stack, here’s how I’d recommend approaching it.

Start with what you have (and what you don’t)

Before you go shopping for new systems, you need to know what you’re working with.

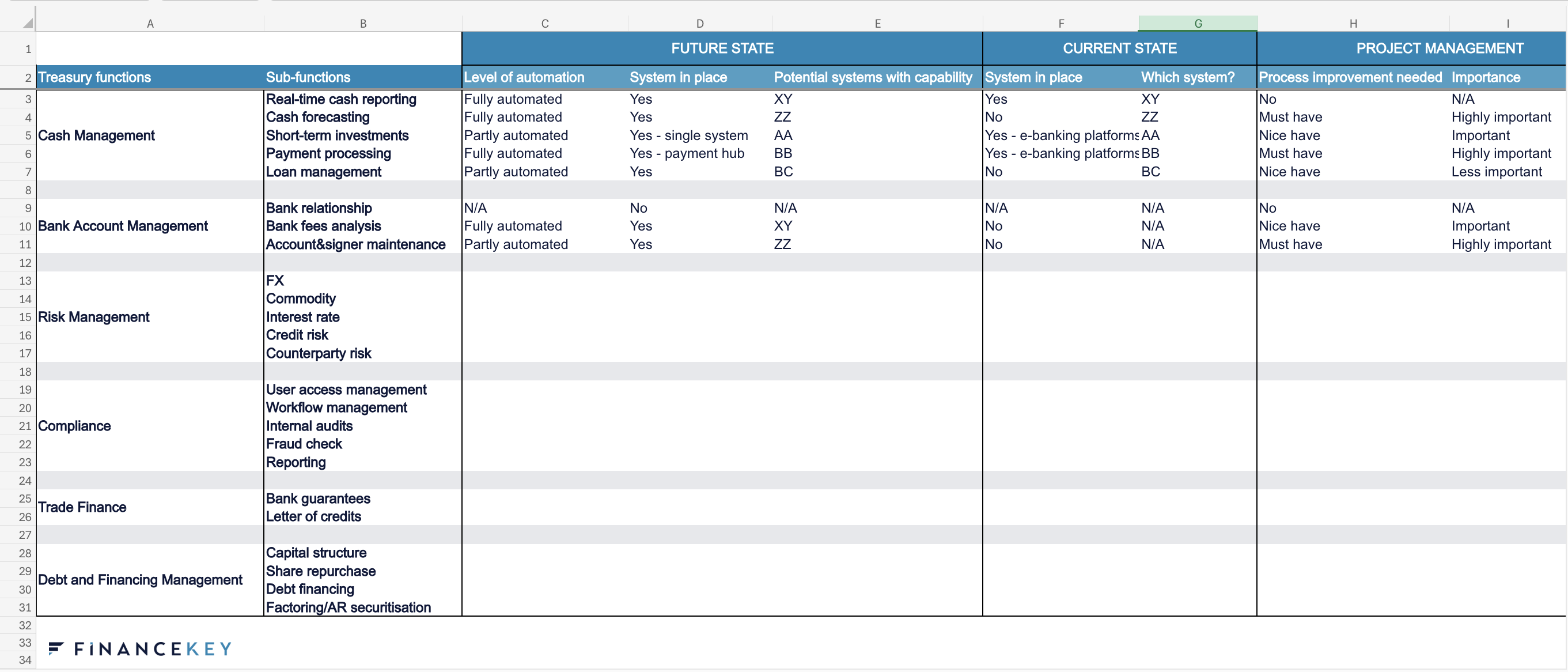

It’s worth looking into these 4 basic topics around your current state:

- What are your core treasury functions (cash management, FX hedging, bank account management, user access controls, etc)

- Which systems you currently use for each function, if any

- Where the gaps are – and which of those gaps are “must-haves,” “nice-to-haves,” or “improvement areas”

- Any tools or providers you are locked into with long-term contracts.

A map like this gives you a practical view of your current landscape. You’ll see where you’re exposed, where you’re duplicating effort, and where consolidation might create cost or efficiency wins.

For instance, you may already have a tool for bank fee analysis – but you know you won’t renew that contract in a year. That’s an opportunity to look for a better-integrated solution.

Similarly, there may be functions where you’re doing everything manually in Excel – but the team is starting to struggle under the load. That’s a sign the gap is becoming critical.

Grab your free template

To help you get started, I’ve created a simple Excel matrix you can use to map your treasury functions, systems, and gaps. Just fill in the form at the bottom of this page to download it.

Map your processes while you scan the market

There might be a general misconception that you have to finish a full internal process review before speaking to technology providers. My view is different.

In my experience, the best approach is parallel: start exploring systems while reviewing your processes. One informs the other.

Talking to suppliers often opens your eyes to new ways of working – it challenges you to ask, “Why are we doing things this way?”

For example, in one project, the treasury team had been using a six-eyes approval process for payments for years. No one questioned it – it was just how things had always been done.

But during the system exploration phase, we dug into the rationale and discovered there was no regulatory requirement behind it. For SOX compliance, a four-eyes principle was sufficient.

Making changes like these frees up capacity, reduces bottlenecks, and makes the process much more manageable – especially for smaller treasury teams.

Know the limitations

That said, not everything is within your control – and that’s important to recognise early.

For example, your ERP system might be used across the entire company, meaning treasury has little influence over whether or how it’s changed.

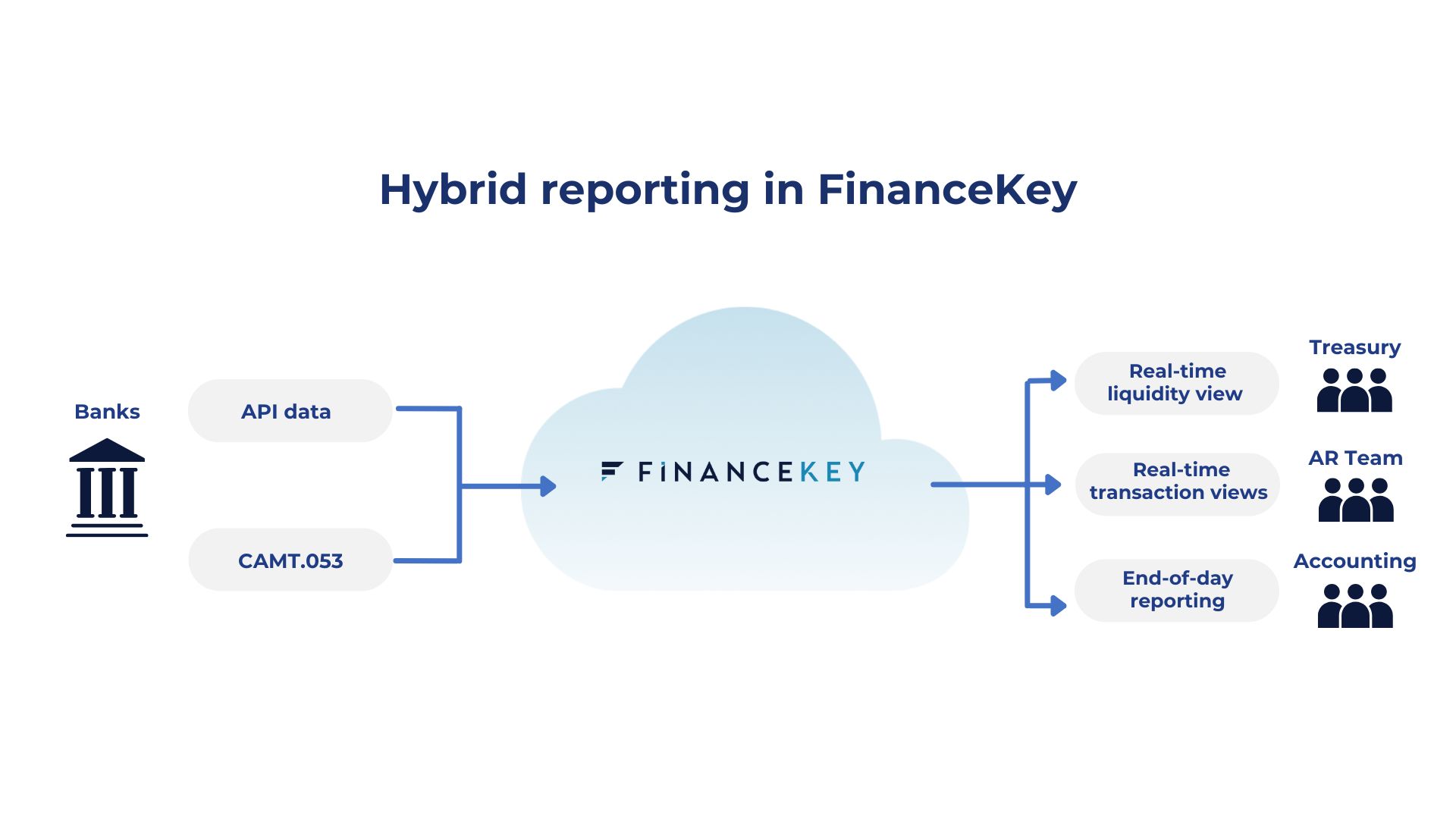

In these situations, the smart approach is to look for solutions that work alongside your ERP rather than trying to replace it.

That’s exactly where a platform like FinanceKey fits in – it acts as an automation layer, giving you the controls and efficiency treasury needs, without having to rip out or overhaul your core ERP systems.

The key is to approach the market with a clear view of what can change and what can’t, and to involve solution providers in the discussion as you shape your future state.

Don’t ignore features that come bundled “for free”

Sometimes the most valuable benefits are not the ones you set out to find.

For example, let’s say your primary focus is to find a solution for cash management activities, but the solution provider offers a nice bank fee analysis function as well – something which is not a current pain point, but still worth noting.

You now have your business case, as that one “bonus” feature may help fund the rest of the solution – a nice surprise, and a reminder that you should track everything, even if it’s not a current priority.

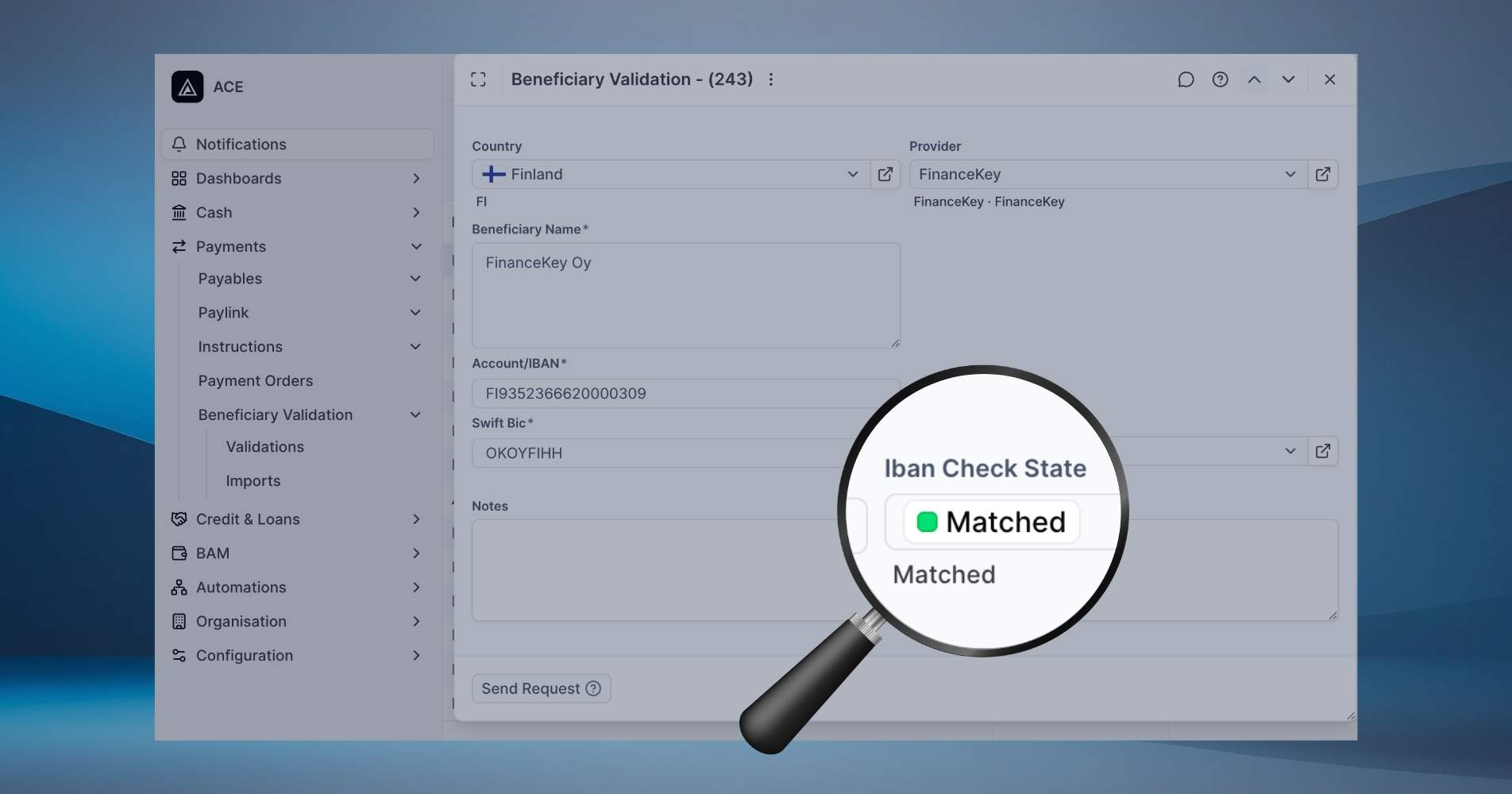

Reassess your approach to access and user management

One area treasury teams often underestimate is the administrative burden of e-banking platform accesses. If you’re operating across 10 platforms, and each person needs access to each one, that’s 10 logins per user – plus all the governance, audits, and maintenance that go with it.

But if you use a central payment hub, you grant access in one place – and reduce overhead massively.

It improves security, reduces direct and indirect costs (bank fees per user and workload need), and streamlines onboarding and offboarding.

It’s operationally better, and I can assure you auditors will love it.

In addition to this topic, some important questions to ask about any potential access management solution:

- Can it handle approval workflows?

- Can it reconcile accesses across platforms for SOX compliance?

- Does it provide you with detailed audit trails, without manual effort?

These questions will help you to understand if it’s a good match for your process requirements.

Get to a handshake before you commit to changes

Once you start moving forward with a provider, there needs to be mutual commitment – a handshake of sorts. Not a full contract, but a letter of intent, or even just an agreement in principle.

That’s because making internal changes to fit a system takes time and effort. If the provider gives you an offer with a one-month expiry while you’re still doing that work, it’s not realistic.

Make sure there’s a mutual understanding that you’re adapting with the intent to implement. That trust is essential.

Change usually starts when something breaks

Treasury teams rarely launch these initiatives out of boredom. There’s always a trigger:

- An audit gap

- A new regulatory requirement

- A volatile market environment (Brexit, sanctions, new hedging needs)

- An internal mandate from Finance or Risk.

You try to solve it manually – with Excel, or process patches – and eventually realise that it won’t scale. That’s when it’s time to start building the roadmap.

What comes next?

The roadmap is your foundation. Once that’s in place, you’ll need to make a business case that clearly shows the value and efficiency gains for not just treasury but the whole finance team (and beyond).

But if you’re just getting started, my advice is:

- Map your functions

- Document your systems, gaps, and contracts

- Talk to suppliers early

- Be open to tweaking your processes

- Track “must-haves” and “nice-to-haves”

- Look for features that offset cost elsewhere.

Excel workbook

Download the treasury technology roadmap template

Thanks for sending your message. Here’s your file to download: