Five things every treasury technology business case needs

By Orsolya Kozák, Treasury Specialist – Customer Success

In my previous article, How to design a treasury technology roadmap, I explored how to assess your systems and define your priorities. The next step is to turn that roadmap into action, and that means making a business case.

But here’s the trap many treasury leaders fall into: treating the business case as a spreadsheet of cost savings. Of course, savings matter. Yet if your story ends there, you’re missing the bigger picture – and the opportunity to position treasury as a true strategic partner.

1. Savings are the starting point, not the destination

Yes, savings are important. Direct savings – like cutting underused features, reducing banking fees, or moving to a lighter TMS complemented by a specialist solution – are easy to quantify and resonate with decision makers.

But a business case that only talks about cheaper platforms or reduced fees risks being seen as tactical. Cost savings may open the door, but they shouldn’t be the whole conversation.

Capacity is the new currency

The real value lies in what the solution enables:

- Team capacity freed up: Less time spent on manual checks or platform juggling means analysts can focus on projects and continuous improvement.

- Continuous innovation: Instead of firefighting daily processes, treasury can lead new initiatives across finance.

- Resilience built in: By reducing dependence on individuals to carry out repetitive work, you strengthen the function against turnover or absence.

The headcount you “save” isn’t about reducing payroll, it’s about reinvesting talent into higher-value work.

2. The people factor: retention, engagement, growth

Business cases often underestimate the human dimension. Yet in treasury, it’s the relentless burden of manual work that quietly erodes engagement and long-term value.

According to the 2025 AFP Compensation and Benefits Survey, the two most significant challenges facing treasury employees are limited resources (39%) and the volume of work (36%). Meanwhile, a 2025 survey of finance leaders found that 79% of finance and accounting teams are “bogged down” in manual tasks.

That’s why transformation matters: it’s not about retraining your entire workforce or ripping out every system. It’s about removing repetitive manual processes, so your team has the space to thrive.

Here’s why embedding this perspective in your business case matters:

- Retention saves money: The cost – and delay – of recruiting and onboarding skilled treasury talent is steep. A transformational system that mitigates burnout and friction helps keep high performers engaged.

- Career development is a differentiator: When routine operational tasks are automated, leaders gain bandwidth to create stretch projects and growth opportunities.

- Employee wellbeing drives performance: A happier, less stressed team delivers better outcomes. This isn’t just an HR talking point – it influences metrics that actually matter to the CFO.

Treasury talent is both scarce and strategic. Losing people due to boredom or disengagement is a liability.

From my own perspective as both a corporate treasurer and a qualified coach, I know that freeing a team from repetitive tasks doesn’t just buy back hours – it restores energy, creativity, and confidence. That’s why embedding the people factor in your business case isn’t optional – it’s essential.

3. Show shared value across finance

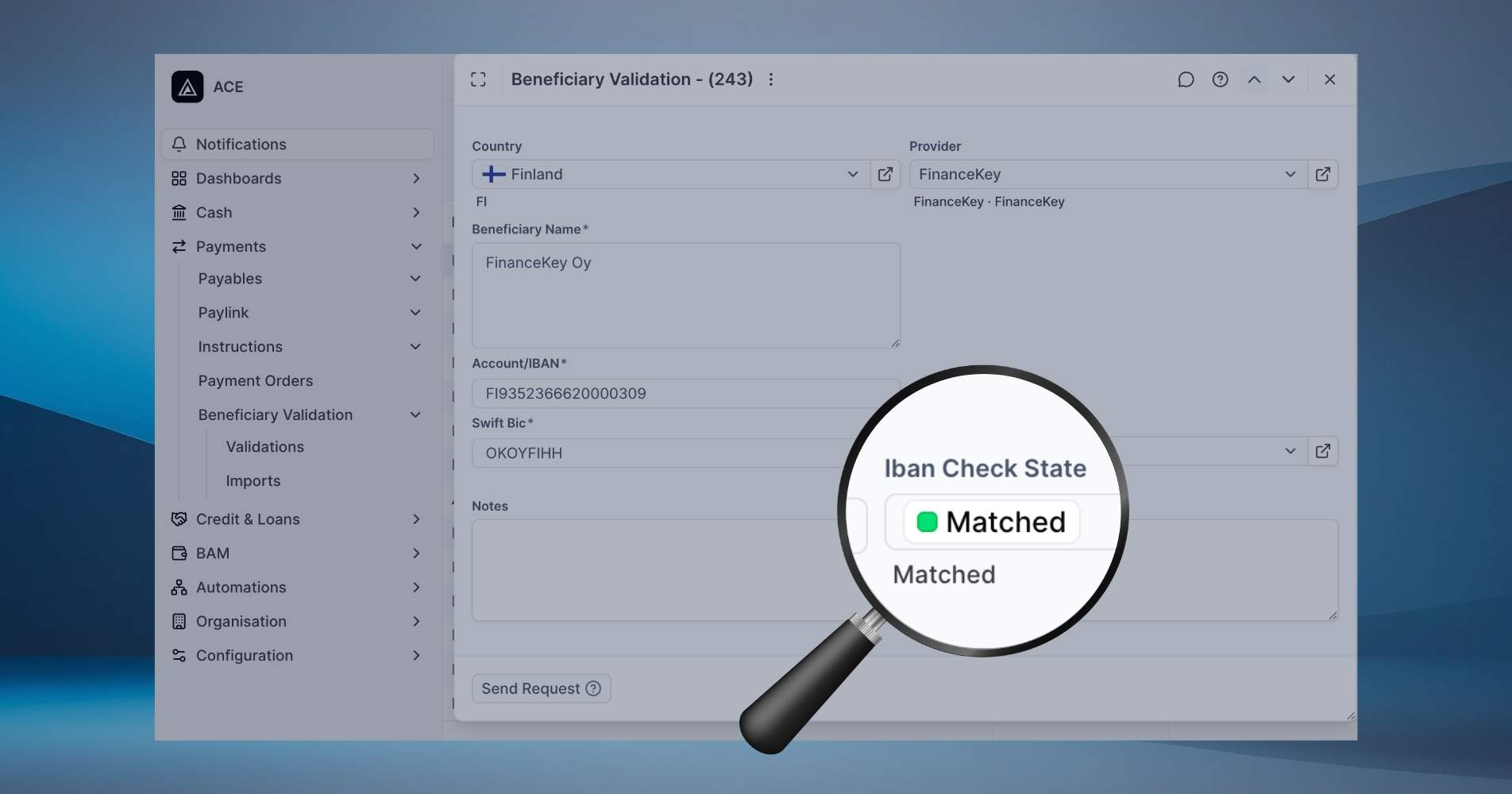

Another angle often missed: treasury is rarely the only beneficiary. A new platform provides functions that other teams rely on too:

- Shared services using payment hubs and reconciliation tools.

- Controlling leveraging reporting and planning functions.

- Local finance teams depending on country-level reporting.

By highlighting these cross-functional benefits, you can spread costs fairly and make the business case about enterprise value, not just treasury spend.

4. Empower the teams you need to succeed

Going beyond the finance team, let’s not forget your IT colleagues. Treasury transformations don’t happen in isolation, and IT is often the silent partner that makes success possible.

As my colleague Macer pointed out in a recent FinanceKey blog, IT teams need clarity, collaboration, and simplicity to play their role effectively. Too often, treasury projects become technology-heavy initiatives where IT is expected to shoulder the burden of integration and ongoing support. That’s a recipe for delay and frustration.

Instead, when you build your business case, consider the following:

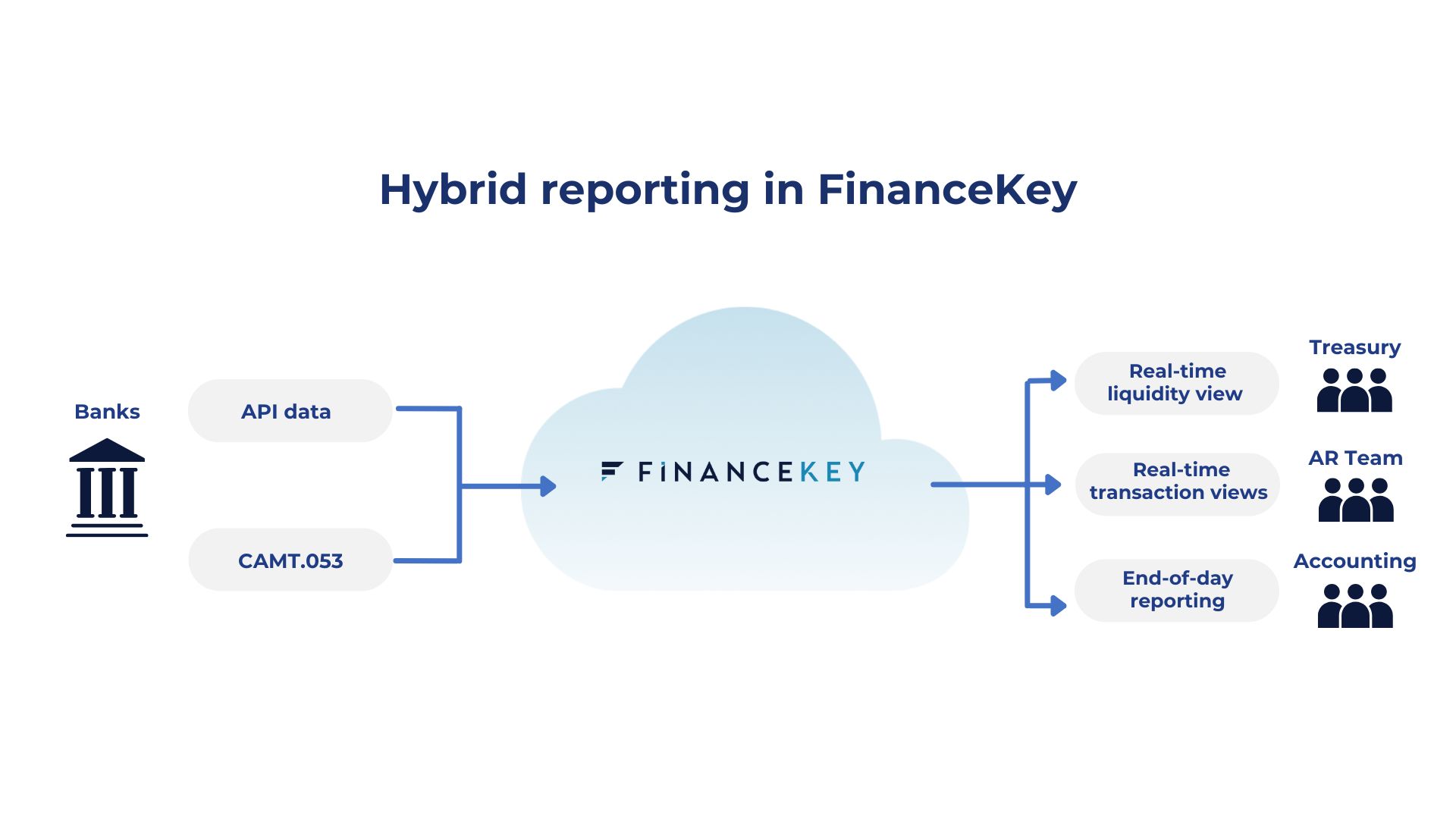

- Does your solution reduce IT dependency by being cloud-native and user-friendly?

- Can it simplify integration with clear APIs and modular design – so IT doesn’t need to custom-build connectors or spend weeks on maintenance?

- Does it foster collaboration by giving IT a transparent view of how treasury and finance teams intend to use the system?

Bringing IT into the story on aligning on scope from the start not only strengthens your case but also reassures leadership that you’ve thought about the full operating model.

When IT is empowered rather than burdened, treasury gets the agility it needs – and IT gets the control and security it requires.

5. Position treasury as a strategic partner

Finally, a strong business case should elevate treasury’s role. This isn’t about securing budget for a shiny new tool. It’s about:

- Reframing treasury as an innovator within finance.

- Demonstrating leadership in digital transformation.

- Aligning with the CFO’s strategic goals of resilience, efficiency, and insight.

This positions treasury as a proactive partner – not a back-office function asking for budget.

Conclusion: think bigger than savings

A treasury transformation business case should start with savings, but it should never stop there. By weaving in capacity gains, people benefits, and cross-functional value, you’re not just justifying spend. You’re painting a vision of a more efficient, resilient, and strategic treasury function that lifts the entire finance organisation.

That’s the kind of business case that gets noticed – and gets approved.