A treasurer’s guide to bank connectivity

By Topias Vainio, Treasury Solutions Manager at FinanceKey

“If we connect to a bank via an API, is Swift still involved somewhere in the background?”

That was one of the questions I received while presenting use cases around real-time banking data at a treasury conference recently. It shows how bank connectivity is still an evolving topic for many treasury teams.

For years, treasurers have relied on well-established channels to exchange payment instructions and reporting data with their banks. Now, as expectations shift toward real-time visibility and automation, new technologies like APIs are expanding what’s possible.

In this article, I’ll break down the main ways treasurers connect with banks, how each method is evolving, and what to consider when building a connectivity setup that works now and prepares you for what’s next.

File-based H2H (host-to-host) connectivity

H2H is the most familiar form of bank connectivity – a direct link between your system and your bank, used to exchange payment instructions and reporting data.

These setups can range from simple SFTP (secure file transfer protocol) to more structured frameworks like EBICS and Web Services. All are file-based, but EBICS and Web Services add standardisation, authentication, and extra security layers on top of basic file transfer.

EBICS

EBICS (Electronic Banking Internet Communication Standard) is common in markets like Germany, France, Austria, and Switzerland. It supports multiple message types – for example, PAIN (Payment Initiation) messages for payments and CAMT (Cash Management) messages for account statements and reporting. These are both XML-based formats defined under the ISO 20022 standard. EBICS enables secure, multi-bank communication through a single, shared protocol.

Web Services

Web Services use structured messaging (most often SOAP, or Simple Object Access Protocol) to move financial data between systems. SOAP defines how messages are formatted and transmitted – think of it as a digital envelope that keeps financial data consistent and secure, regardless of which systems are talking to each other.

For treasurers, both EBICS and Web Services are dependable and well-supported – which is why they’ve lasted. The trade-off is speed: updates happen according to the bank’s schedule, not in real time.

Swift: the global network and messaging standard

Swift is the backbone of global financial messaging, connecting over 11,000 institutions. For large corporates, it remains essential – especially when working across multiple banks and regions.

Why treasurers still rely on it:

- Global reach and standardisation

- Strong security and governance

- Options for intra-day reporting (MT942)

Where it can be challenging:

- Implementation can take time and coordination

- Ongoing costs for connectivity and service bureaus

- Data still arrives in batches

But Swift is also evolving. It’s moving to the ISO 20022 messaging format, introducing richer, more structured data for payments and reporting, and expanding initiatives like Swift GPI to improve transparency and tracking for cross-border flows.

More recently, Swift has added cloud connectivity and APIs – including its API Gateway and Account Reporting API – bringing more flexibility and paving the way for real-time data exchange.

For treasuries, that means Swift is still largely batch-based today, but steadily becoming part of a broader, multi-format ecosystem that combines traditional messaging with emerging real-time capabilities.

APIs: the real-time layer

APIs (application programming interfaces) are transforming how treasuries access reporting data. They allow systems to “talk” directly, so balances and transactions update in real time. Some banks even let you request detailed historical data instantly – something that used to require an overnight batch.

There are two main types of banking APIs treasurers deal with:

- Open banking APIs – built to meet regulatory requirements for open data (the EU’s PSD2 and equivalents).

- Premium or corporate APIs – designed specifically for enterprise use, with richer data and stronger performance.

(If you want a deeper dive on this, see our article on the differences between open banking and premium APIs.)

On the payment side, banking APIs are still catching up. Not all payment types are supported, and regulatory APIs can require multiple approvals. That’s why many treasuries still prefer file-based channels for bulk or recurring payments.

But for reporting, reconciliation, and balance visibility, APIs already make a clear difference – especially when you need data that’s always current.

Making the right choice – and making it work

Modern bank connectivity is about choosing what fits your geographical footprint, systems, and goals. For example, a company aiming to reduce idle cash would benefit from near real-time visibility, allowing funds to be moved before payment cut-offs.

Large corporates often rely on Swift for global consistency, while mid-sized companies use direct file-based H2H connections. Increasingly, we see treasuries adopting a hybrid approach as a transitional phase – APIs for instant reporting and analytics, established channels for payments until API coverage matures further.

This is what our customer NORS has done: executing sweeps for excess cash with MT101 messages via Swift, triggered by real-time balance updates via APIs.

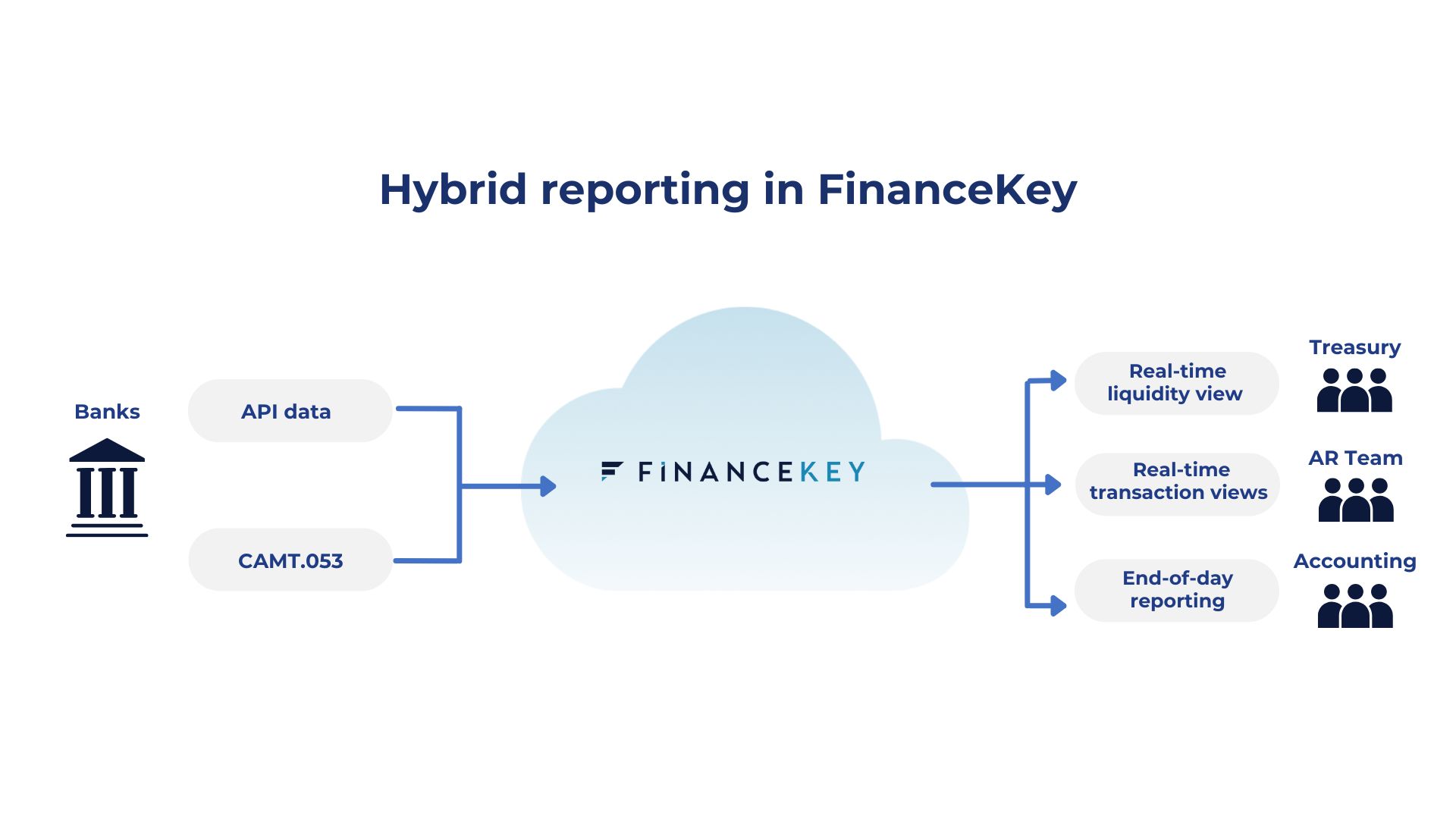

FinanceKey makes this kind of hybrid model easy to manage – orchestrating connections across banks, converting API data into traditional formats when needed, and monitoring quality behind the scenes. That includes handling exceptions automatically, reconciling mismatched data, and ensuring consistent reporting across all banks and channels.

The big picture

As bank connectivity evolves, treasuries are moving from static, file-based exchanges toward more dynamic, real-time and data-rich models.

For finance teams, that means more choice – and more control – over how and when they connect. The goal is simple: build a foundation that gives you the visibility, reliability, and agility you need today, while staying ready for what’s next.

If you’re exploring how to modernise your payment and treasury setup, or looking to start using APIs for specific use cases, contact us to find out more