SAP treasury automation: Lessons from FinanceKey customers

By Alex Cannon, FinanceKey, Head of Growth

SAP does a lot for treasury teams – cash positions, payments, reconciliations – it’s all there. But when it comes to connecting with banks or adapting during a system change, things can get manual fast.

That’s where FinanceKey has been especially useful.

Our clients use it to automate the flow of data in and out of SAP without having to rewire their systems. Whether they’re dealing with daily bank statements or migrating to S/4HANA, it’s all about making that process easier and more flexible.

Here are a few ways I’ve seen treasury teams pair FinanceKey with SAP to get more done with less effort.

Customer case 1: Automating bank statement ingestion and payment flows

SAP handles statement processing well, but staying connected to multiple banks can require a lot of custom work. Teams often end up maintaining formats, building middleware, or troubleshooting file mismatches.

Here’s how clients use FinanceKey to streamline that:

- Bank statements are pulled automatically, translated into the right format, and sent directly into SAP

- Multiple banks and formats are handled consistently, even across regions

- Outbound payment files from SAP are routed to the right banks without needing one-off integrations

It’s not about replacing SAP – it’s about removing the friction around it, so treasury teams can focus on approvals and oversight, not file handling.

Customer case 2: Making S/4HANA migrations easier with parallel system support

Migrating from an old ERP to S/4HANA almost always involves a parallel run. You need to keep both systems live, test data flows, and compare results before making the final switch. But running two environments can slow things down – especially when it comes to keeping financial data aligned.

FinanceKey helps teams move faster with less overhead:

- Routes the same bank data to both the old ERP and S/4HANA automatically

- Keeps systems in sync, so you can test real processes without duplicating work

- Simplifies the cutover, since everything is already flowing the way it should

In one case, a client used FinanceKey to send payment data to two different ERPs, Odoo and SAP during a migration. It let them validate everything upfront, fix any issues early, and flip the switch when they were ready – without disruption.

Customer case 3: Treasury automation without additional SAP development

SAP is powerful, but getting it to talk to every bank, in every format, for every workflow often means custom development. That can slow down automation projects – or make them too costly to pursue.

FinanceKey gives teams a simpler path:

- Pushes FX and interest rate data into SAP without manual uploads

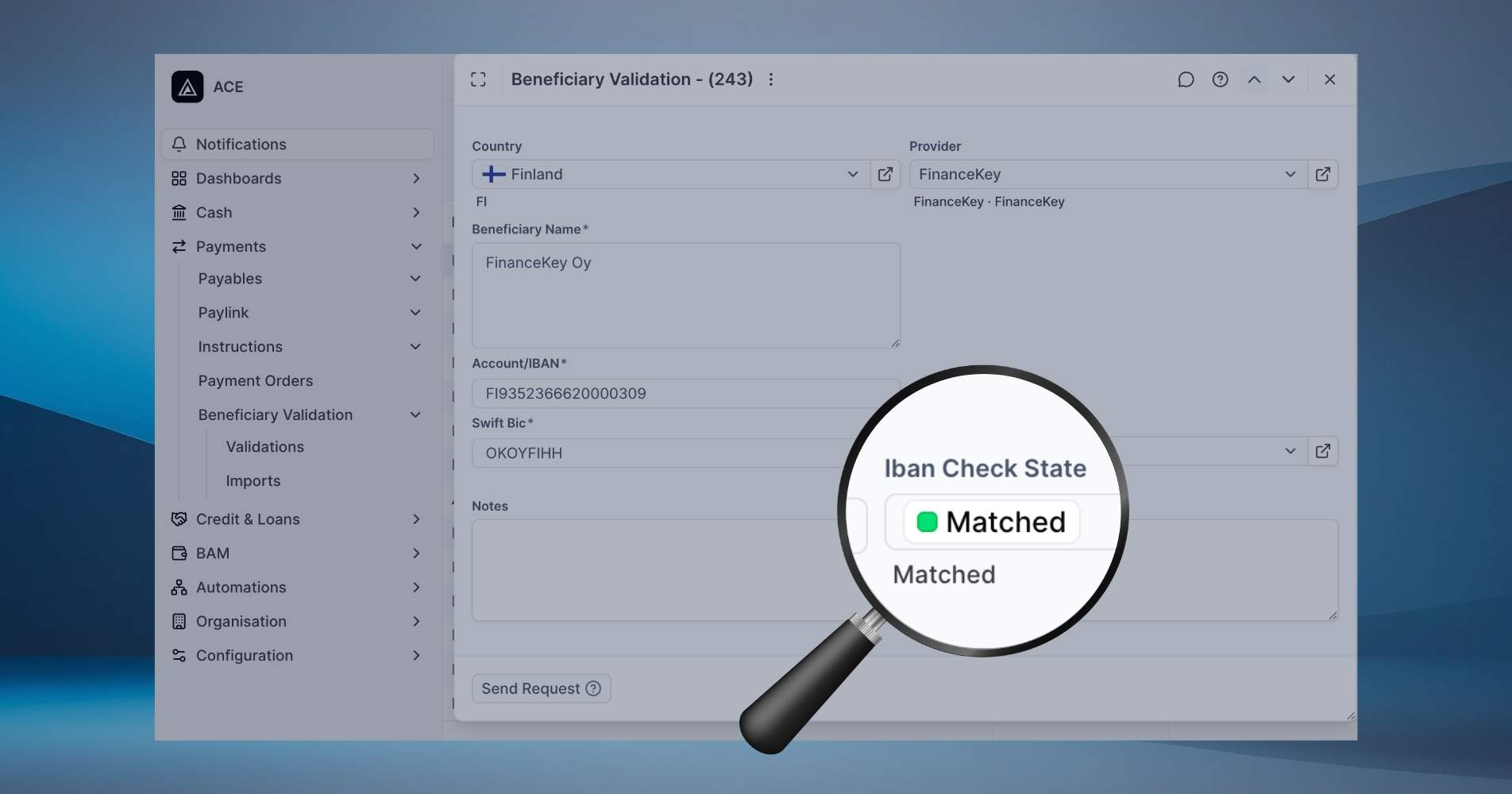

- Matches incoming payments to open receivables automatically

- Generates clearing files to support reconciliation workflows

- Supports bank account opening/closure flows (available with select banks)

These aren’t theoretical use cases – they’re things clients are doing right now. And because FinanceKey handles the banking-side complexity, SAP teams don’t have to overengineer their internal systems to get there.

Customer case 4: Centralising bank connectivity across multiple ERP instances

Many global companies run more than one ERP instance – multiple SAP environments, or a mix of SAP and other systems. That setup can be necessary, but it creates a challenge for treasury: Do you connect every bank to every ERP? Or build a web of internal transfers just to keep data flowing?

FinanceKey gives teams a cleaner option:

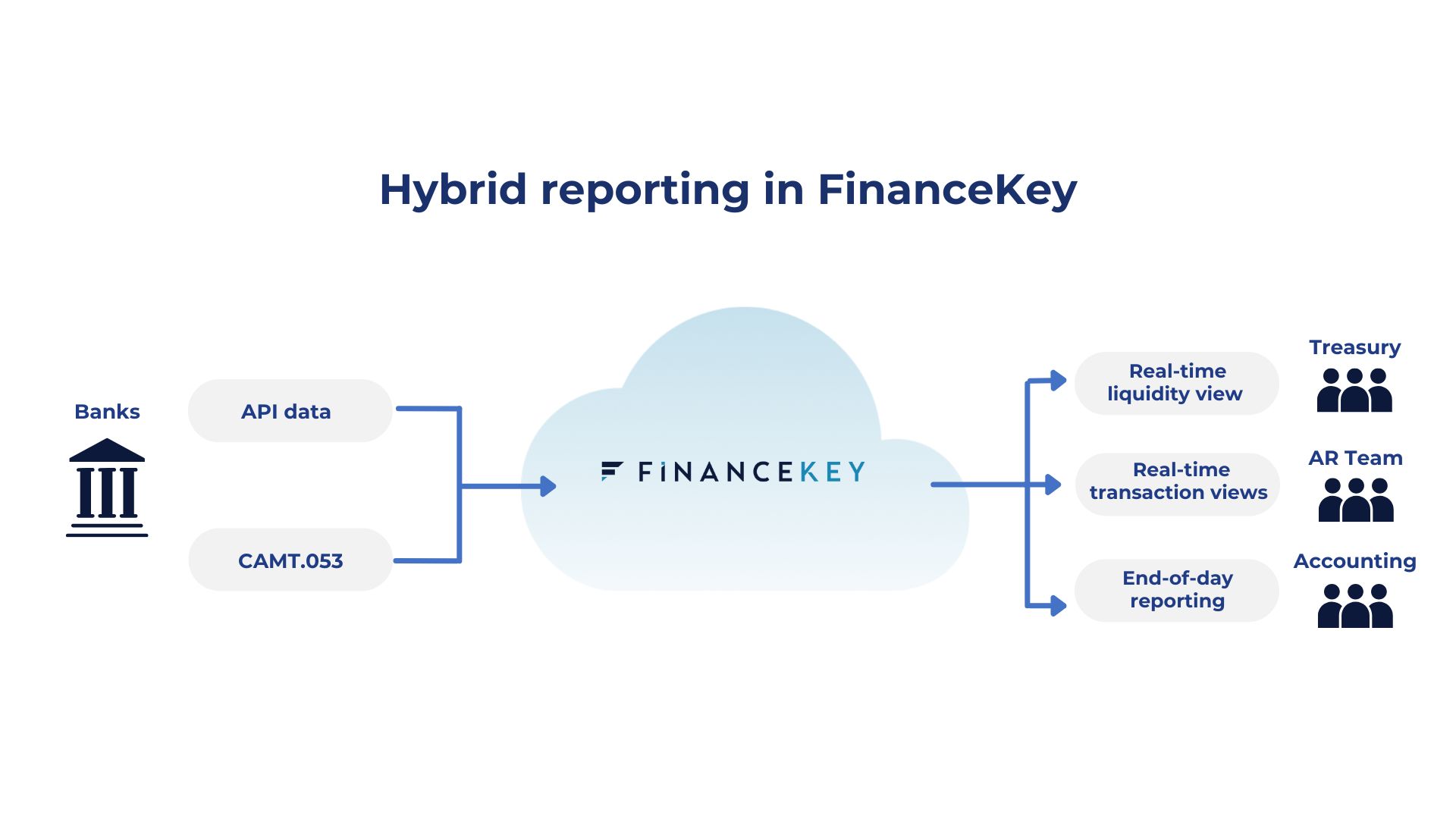

- Connects to your banks once, then routes data to the right ERP systems

- Filters and formats data so each system only receives what it needs

- Avoids redundant bank integrations and simplifies internal architecture

This setup means less duplication, fewer connection points, and more flexibility as their ERP landscape evolves. They don’t have to rethink every integration when something changes – they just update the routing logic in FinanceKey.

Wrapping up

Getting the most out of SAP isn’t just about what the system can do—it’s about how easily your team can make it work across banks, regions, and evolving processes.

Whether it’s simplifying daily statement flows, speeding up a migration, or unlocking new automations without heavy development, FinanceKey is helping treasury teams extend what SAP already does well.

We’re happy to show what’s possible – even if you’re just exploring where to start.