Cash flow tagging: Unlocking the strategic role of treasury

By Orsolya Kozák, Treasury Specialist – Customer Success

“Strategic” is a word we hear more and more in treasury. And it’s true – treasurers are expected to do more than manage liquidity. We’re expected to advise on dividends, refinancing, working capital, and shape financial decisions.

Essentially, we are asked to look around corners. Yet, this is being done with transactional data that lacks context.

But being strategic isn’t just a mindset. It’s dependent on something very real: good data, and knowing what to do with it.

Without quality data – structured in a way that’s useful – you’re stuck in reactive mode. With it, you can move into a role where you’re supporting the CFO and leadership with clear, proactive insight.

One of the key enablers of that is what we at FinanceKey call cash flow tagging.

What is cash flow tagging?

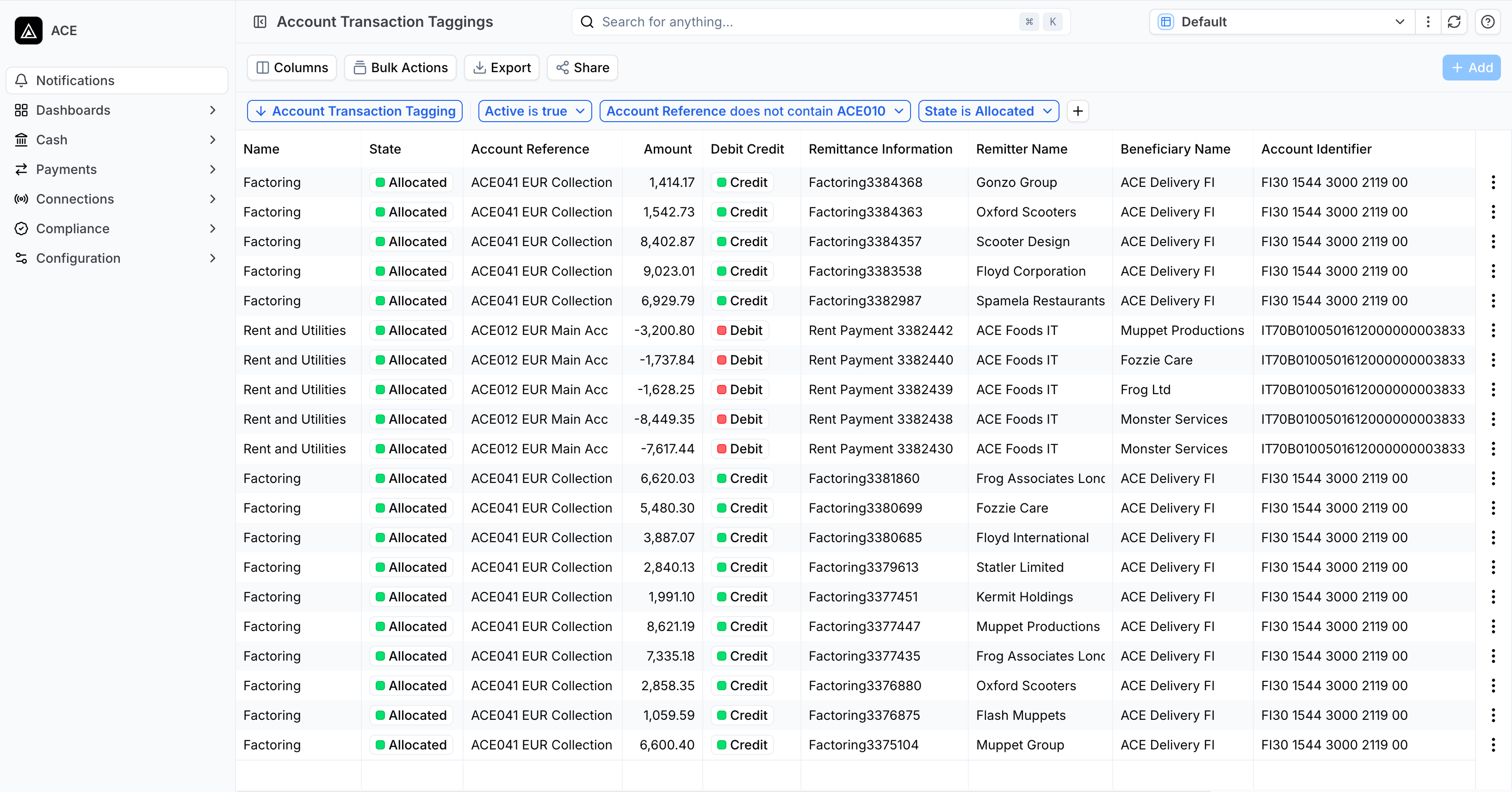

In the FinanceKey platform, tagging is about creating rules that categorise your cash transactions.

It’s not something you do manually, line by line. Instead, you define logic in the system that tells it: “If a transaction looks like this, tag it as that.”

How and when to assign tags

You can tag a transaction as payroll, tax, AR from a key customer, capex for Project X – whatever categories matter to your business.

You base these rules on what appears in the bank statement: maybe it’s a project code, a supplier name, or a text string.

The tags become a way to give context to every cash flow, and that context is what helps you explain the numbers, not just report them.

Cash flow tagging in action

For example, without tagging, you might know that you are spending €2M, but not that €200k of it is transport fees for a delayed project.

The beauty is: the more you use it, the better it gets.

You might start with 20 to 50 tagging rules. Over time, the system learns, and because it’s rule-based, not manual, the model improves without needing constant maintenance.

Some transactions will still come through unmatched – that’s expected. But those are your opportunities to iterate and improve. You create a new rule and move forward.

Within a few weeks, it is possible to reach very high coverage. And with that comes real insight.

How cash flow tagging harnesses the power of data

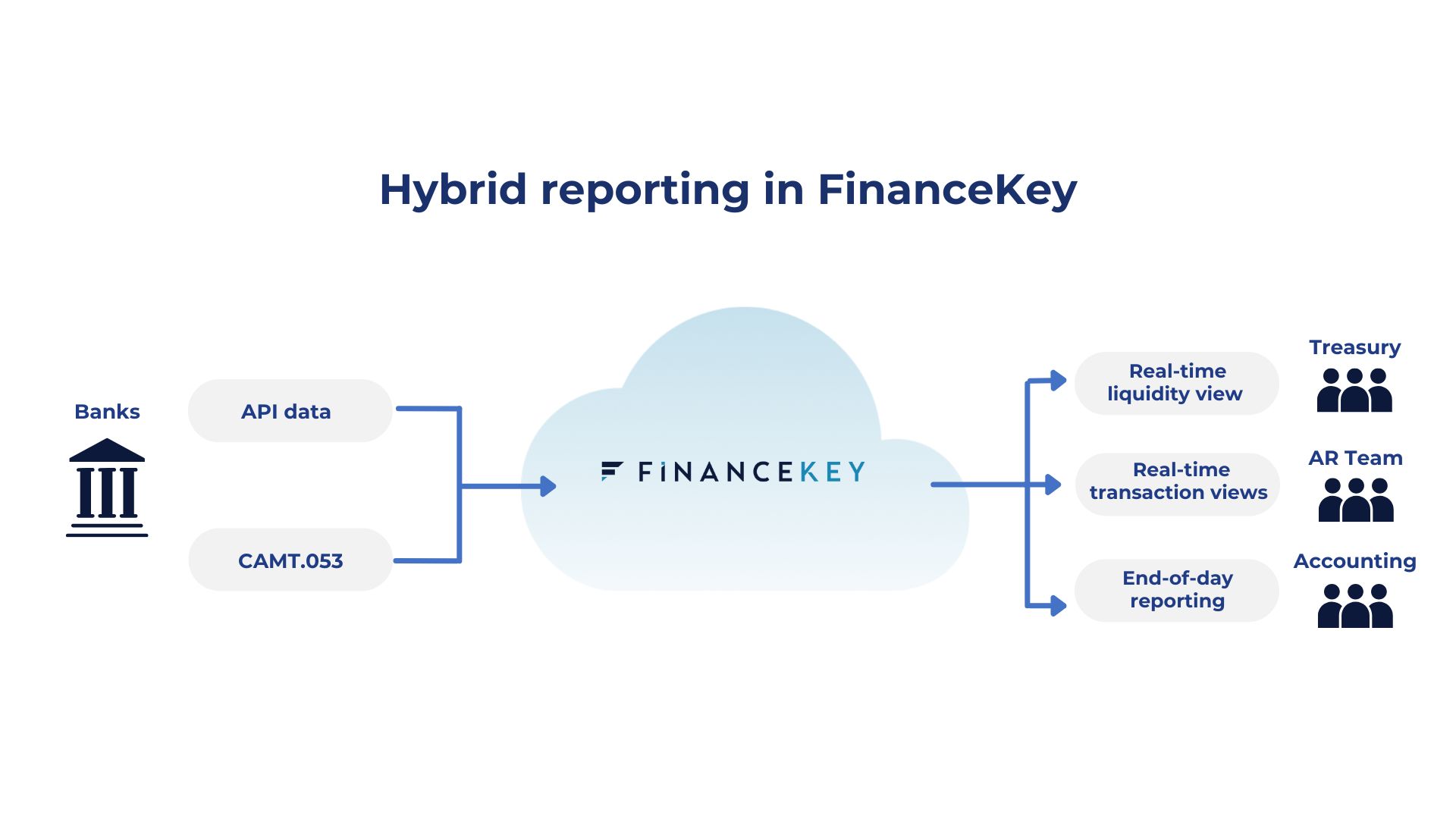

Cash flow tagging in FinanceKey feeds into dashboards that give you two very important perspectives:

- The liquidity view. This is the classic treasury view: what bank account needs to be funded, and when. For example, do I have enough of each currency in the right bank account to cover global payroll by Friday? That’s about where the cash needs to be and when.

- The category view. This is more of a financial controlling or FP&A angle: what type of cash flow is this? How much are we spending on payroll, on taxes, on suppliers? How much are we collecting from customers? This view is often done weekly and gives you a picture of what’s happening in your cash flow structure over time.

Combined, these views transform your treasury from a reporting function to a decision engine. Can you pay a dividend? Should you refinance a bond? Can you accelerate AR collections with early payment discounts to support investment?

With tags, you’re seeing patterns: maybe you’re overspending in a category, or a project is burning through budget faster than expected. You can investigate, renegotiate, adjust strategy.

Building on existing systems

Managing this kind of data manually in Excel isn’t just inefficient – it may not be possible at all at scale.

Banking platforms just give you raw statements – balances, debits, credits. You don’t get context. ERPs give you booked data, which is historical and not forecast-oriented.

FinanceKey connects those worlds. It gives you transaction-level data and lets you apply tags dynamically, making it a lot more powerful for planning.

How tagging supports different finance functions

Cash flow tagging isn’t just a treasury tool. It supports FP&A, controlling, and leadership too:

- Treasury uses tagging to forecast cash and manage liquidity at the account level.

- Controlling gets structured views of P&L categories and spending trends.

- FP&A can build more accurate rolling forecasts – updating weekly or daily based on actuals.

- Leadership gets clearer insight to support decisions on dividends, share buybacks, refinancing, and more.

And because everyone is working from the same tagged data, you avoid silos. Everyone’s speaking the same language – and looking at the same numbers.

Final thoughts

Tagging might sound operational, but for me it’s a strategic tool. It allows treasury and finance teams to go from gut feel to fact-based decisions. It creates alignment between Treasury, FP&A, and Controlling.

It takes some work to set up, yes. But most finance teams already know their businesses well enough to start building those rules. And through the process, you learn even more.

For me, cash flow tagging is the bridge between daily transactions and long-term strategy. It’s what takes a finance team from reactive to proactive – and from operational to strategic.