How Verification of Payee works in FinanceKey

By Veikko Koski, CEO and Founder, FinanceKey

As vendor master data teams work to prevent fraud and payment teams look for greater certainty before releasing funds, the Verification of Payee (VoP) initiative – launched this October – has been a welcome step forward enabling a new level of bank account validation.

At FinanceKey, we’ve been focused on making this process faster, easy to use, and scalable for different use cases.

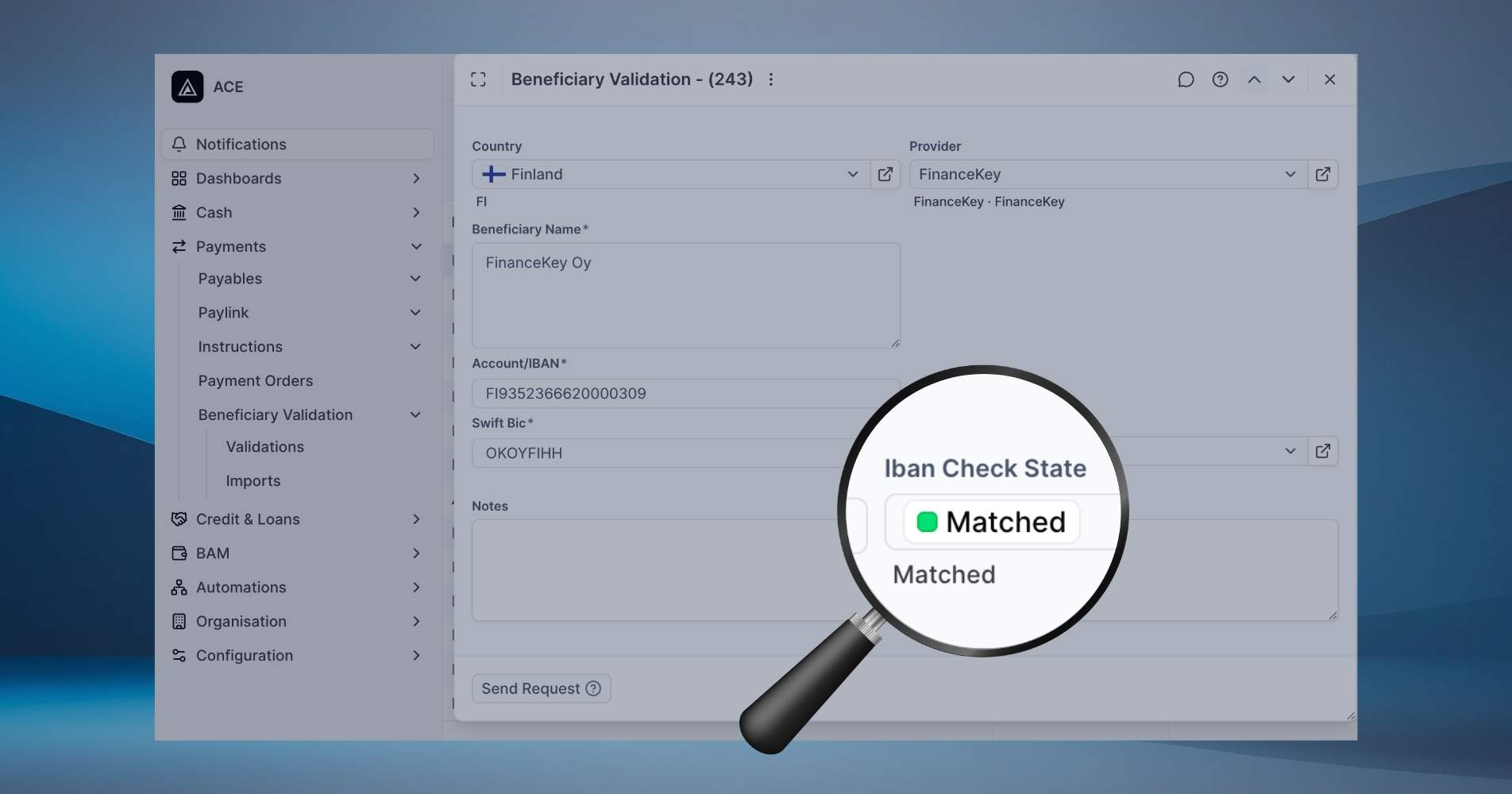

We’ve now added coverage through the Verification of Payee scheme into FinanceKey’s account validation module. This allows our users to confirm whether a bank account truly belongs to the intended beneficiary across banks in the euro area countries.

How VoP validation works in FinanceKey

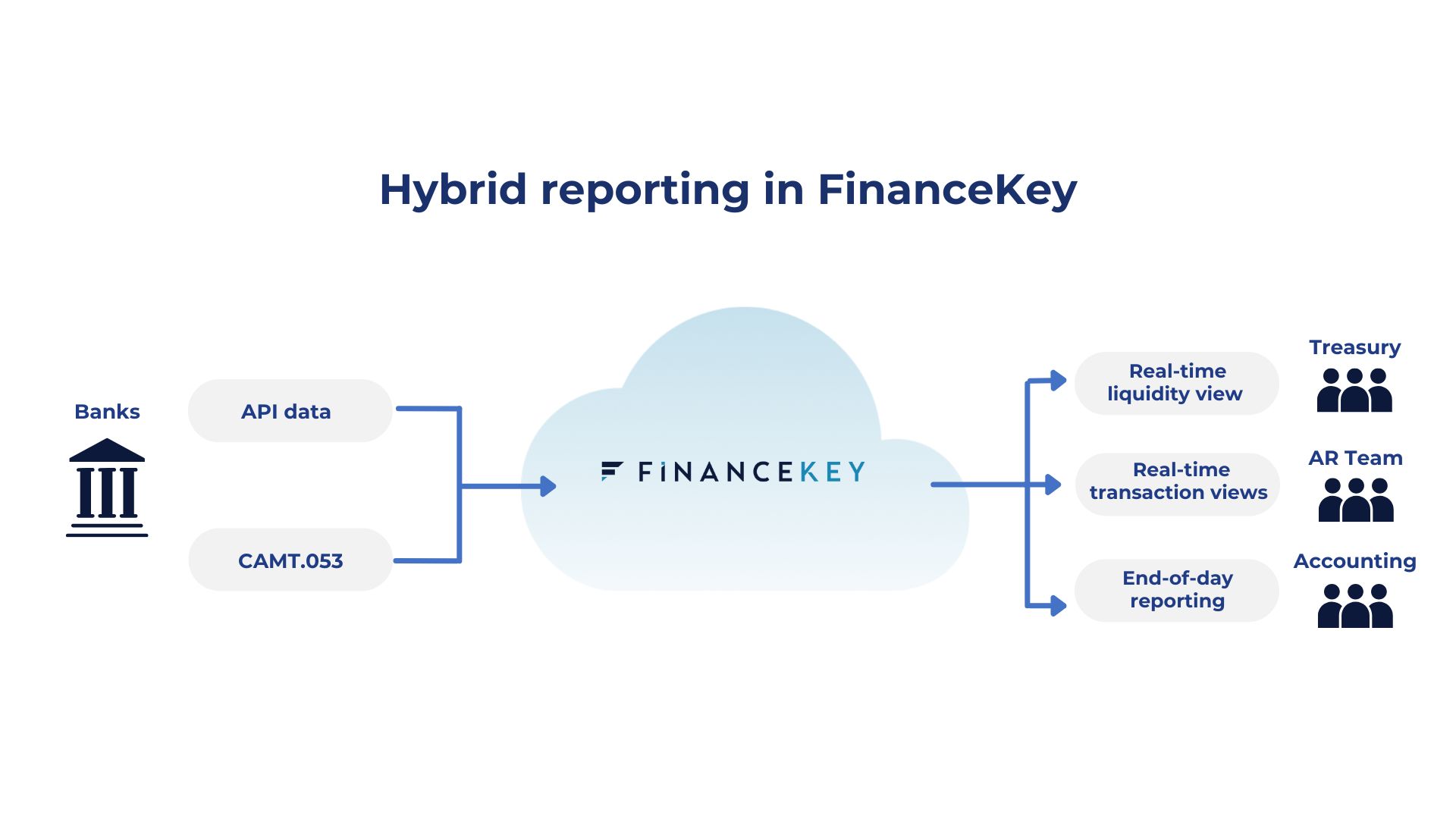

FinanceKey is connected to a Verification Mechanism that is part of the VoP scheme, enabling us to validate EUR-denominated accounts in countries participating in the euro area (non-euro countries in the EU will follow in July 2027). When a user submits a validation request, responses typically arrive within 20-40 seconds, even in cases where multiple accounts are checked in bulk.

The VoP response for owner name checks provides clear set of statuses: “match”, “partial match”, or “no match.”

One super cool feature that adds real value for finance teams is the information provided in partial matches. In cases where the submitted beneficiary name is a close match with the bank’s records, FinanceKey returns the confirmed name provided by the bank.

For example, when we tested our own account using “FinanceKey Ltd,” the validation result returned a partial match with the confirmed name “FinanceKey Oy.” That level of transparency helps users quickly resolve discrepancies with vendor master data records.

You can see this process in action in this short video:

Flexible validation options built for real workflows

Organisations might approach bank account validation differently, so FinanceKey supports multiple ways to verify account ownership:

- Ad– hoc checks for individual accounts (shown in the above video)

- Bulk validation by importing a file with many accounts

- Full automation through integration with your existing systems.

Whether you’re validating a new supplier, reviewing payroll details, or strengthening controls for payments, FinanceKey adapts to the process you already have in place.

Global validation beyond VoP

VoP coverage strengthens our capabilities in Europe, but FinanceKey’s validation doesn’t stop there. We are connected to additional providers offering global coverage. While not all countries fall under the same mechanism, we can provide detailed coverage information based on your specific needs.

If your team manages international payments or complex vendor networks, understanding what’s available in each country is key – and we’re happy to walk you through the details.