Treasurers, here’s what your IT team needs to succeed

By Macer Skeels, CTO and Co-Founder, FinanceKey

When people talk about innovation in corporate treasury, the conversation often centres around the CFO or treasury team – the main actors and end users.

But true innovation begins much earlier: with the IT teams responsible for building and maintaining the systems they rely on. In most organisations, these are the unsung heroes of treasury innovation.

The challenges facing treasury IT teams

A major challenge IT teams face is managing the massive amounts of data that transit through treasury platforms. In many organisations, especially those with legacy systems or fragmented data sources, gathering, formatting and transferring data between systems can take months.

From my experience in IT and process engineering, I’ve learned how important it is to reduce the operational burden on these teams.

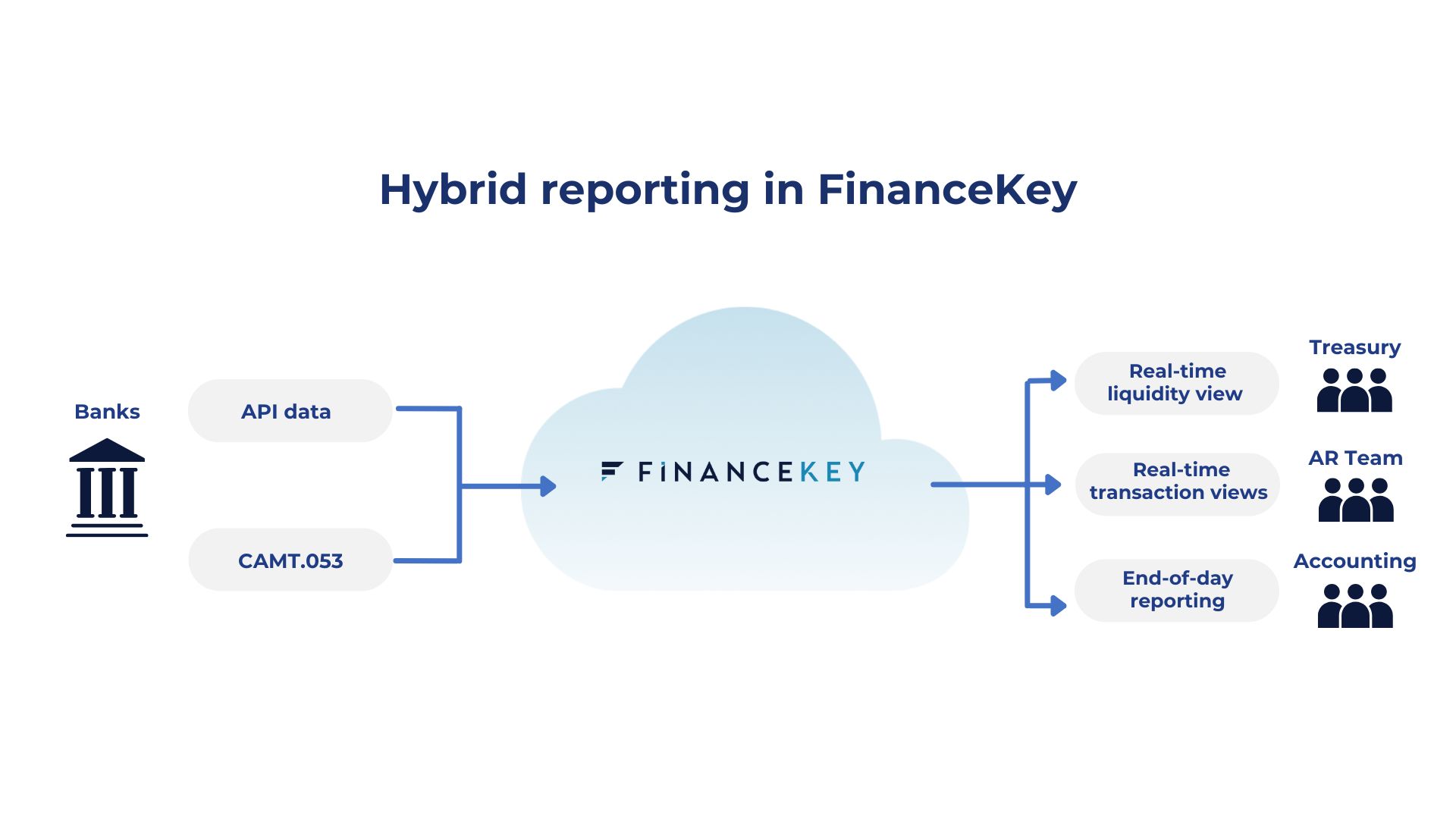

That’s one of the reasons why we designed FinanceKey, a platform that not only offers functionality for Corporate Treasury and Finance, but also standardises data and simplifies the connectivity between banks and internal systems.

We wanted IT teams to avoid situations where they say, “We’d love to implement this initiative, but it’ll take months to get the right data.”

We built a solution that doesn’t just connect to banks, but also to internal systems.

We see significant benefits in using REST API connections, and will use those where possible but are open to using other technologies, such as SOAP, SFTP or file based integrations when required.

Shifting left: Proactively empowering IT teams

The concept of “shifting left” is something I’ve always believed in when it comes to IT systems.

In traditional IT processes, testing and validation often happen late in the process – the right-hand end of a project timeline. By the time issues are discovered, they’re harder and more costly to fix.

The shift-left philosophy encourages addressing potential issues earlier in the workflow rather than waiting until everything is in place to start identifying problems. This ensures systems are validated and optimised long before they reach the end user.

The likelihood of system failures or disruptions is reduced, and the system is much more reliable.

An early warning system that works

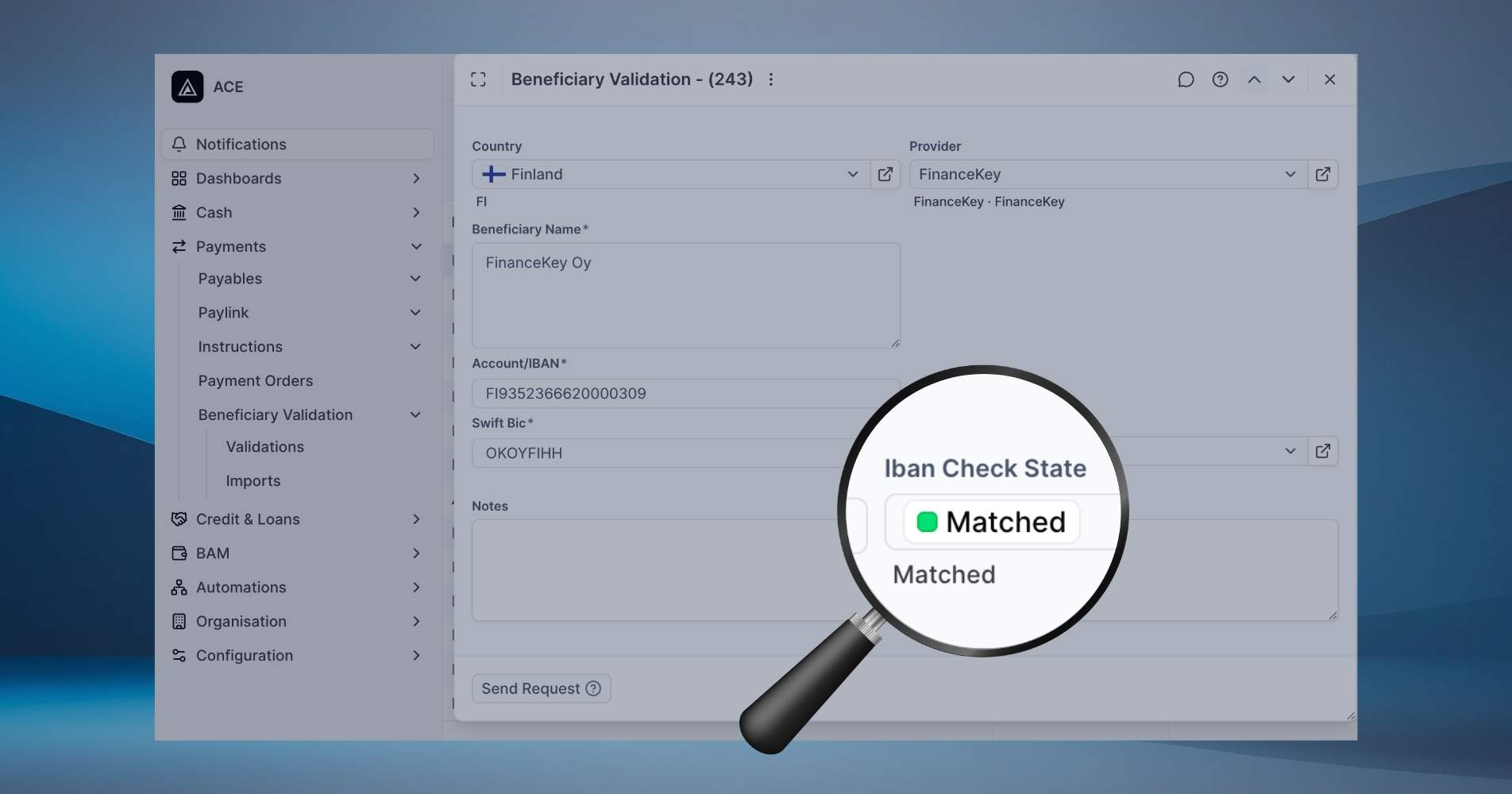

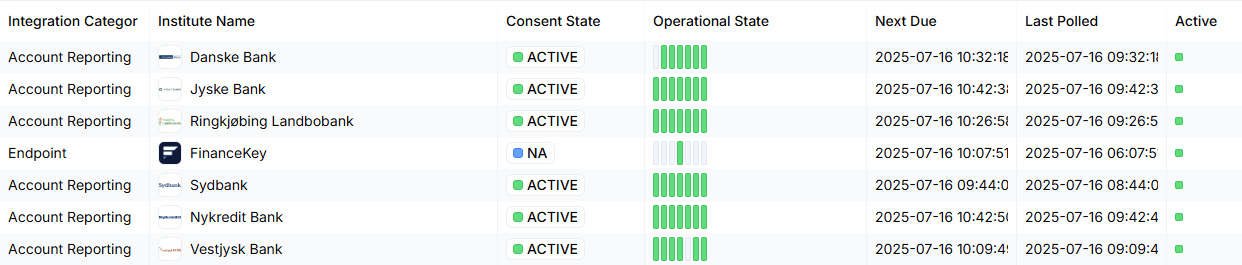

An example of “shift left” in action is our system for flagging connectivity issues.

In many systems, the end users are the first to flag a problem, and by then, it’s often too late to resolve the issue quickly.

To solve this, we introduced real-time visibility via a simple traffic light system: green lights for everything functioning, orange for partial success, red for errors, and grey for inactivity.

This gives IT teams visibility into the status of connections and lets them dive into logs to troubleshoot issues quickly.

IT can therefore take action before users even notice a problem, containing it and therefore significantly reducing downtime and disruption.

Lessons from the factory floor

Coming from a background in process engineering, I’ve always viewed IT system design through the lens of optimisation.

In manufacturing, we use principles like Lean and Just-In-Time (JIT) to improve efficiency and reduce waste. These same concepts are just as applicable to IT systems.

JIT is about getting the right materials, in the right quantities, at the right time.

In IT terms, this translates into ensuring data is available when needed, in the right format, and without delays caused by system inefficiencies. In FinanceKey, we have achieved this by using continuous API triggered pulls. We enrich and convert the data to a common format, and continually monitor all steps of the process.

Like a well-run factory floor, a well-optimised IT system should keep data flowing smoothly, without bottlenecks that slow things down.

From internal fixes to ecosystem thinking

This approach reminds me of Toyota’s implementation of Lean principles on their factory floor. They didn’t just focus on improving their own operations, they extended that improvement to their suppliers.

By working with their partners to improve processes, they were able to boost efficiency across the entire manufacturing operations. In the same way, treasury IT must work with ERP vendors, banks and data providers to drive system-wide efficiency.

If IT teams only focus on their internal operations, they’re missing out on the bigger picture. You need to look at the entire ecosystem and collaborate with external systems and partners to create a truly efficient, seamless experience.

It’s one of the reasons we are always happy to partner with banks to help them co-design their APIs.

The role of data scientists

Here’s another example of this ecosystem approach. While IT teams are central to innovation, we can’t overlook the data scientists who rely on clean, standardised data.

These teams need data that’s ready to use, without spending time manually cleaning and formatting it. When data is inconsistent or not standardised, it can significantly slow down their analysis and decision-making.

FinanceKey addresses this by automatically standardising data on the fly. For example, if we receive a bank transaction description instead of a code, we will replace that with an ISO code. Our system supports a wide range of data formats: MT101, BAI, CAMT and custom APIs, and maps them into a consistent structure, ready for immediate use.

This process eliminates the need for time consuming data formatting which can sometimes take weeks, and helps both IT teams and data scientists work more efficiently and collaboratively.

Ultimately, innovation should ensure that everyone involved is set up for success, creating a win*5 scenario.

As treasury systems grow more complex, success increasingly depends on empowering IT and data teams who make innovation possible. By adopting proven optimisation principles and collaborating across the ecosystem, we can reduce friction, improve performance, and accelerate results.