Why apply for a trial?

Act faster in critical situations

With the turbulent markets, real-time reporting & better visibility to bank exposures have more value than ever.

Improve decision making

Take decisions based on data you can trust. Avoid unnecessary 3rd party financing, minimise interest expenses & leverage available cash for investments.

Enhance operational performance

Streamline receivable reconciliation, improve cash forecasting, optimise liquidity & working capital management and drive higher return on cash.

Use cases

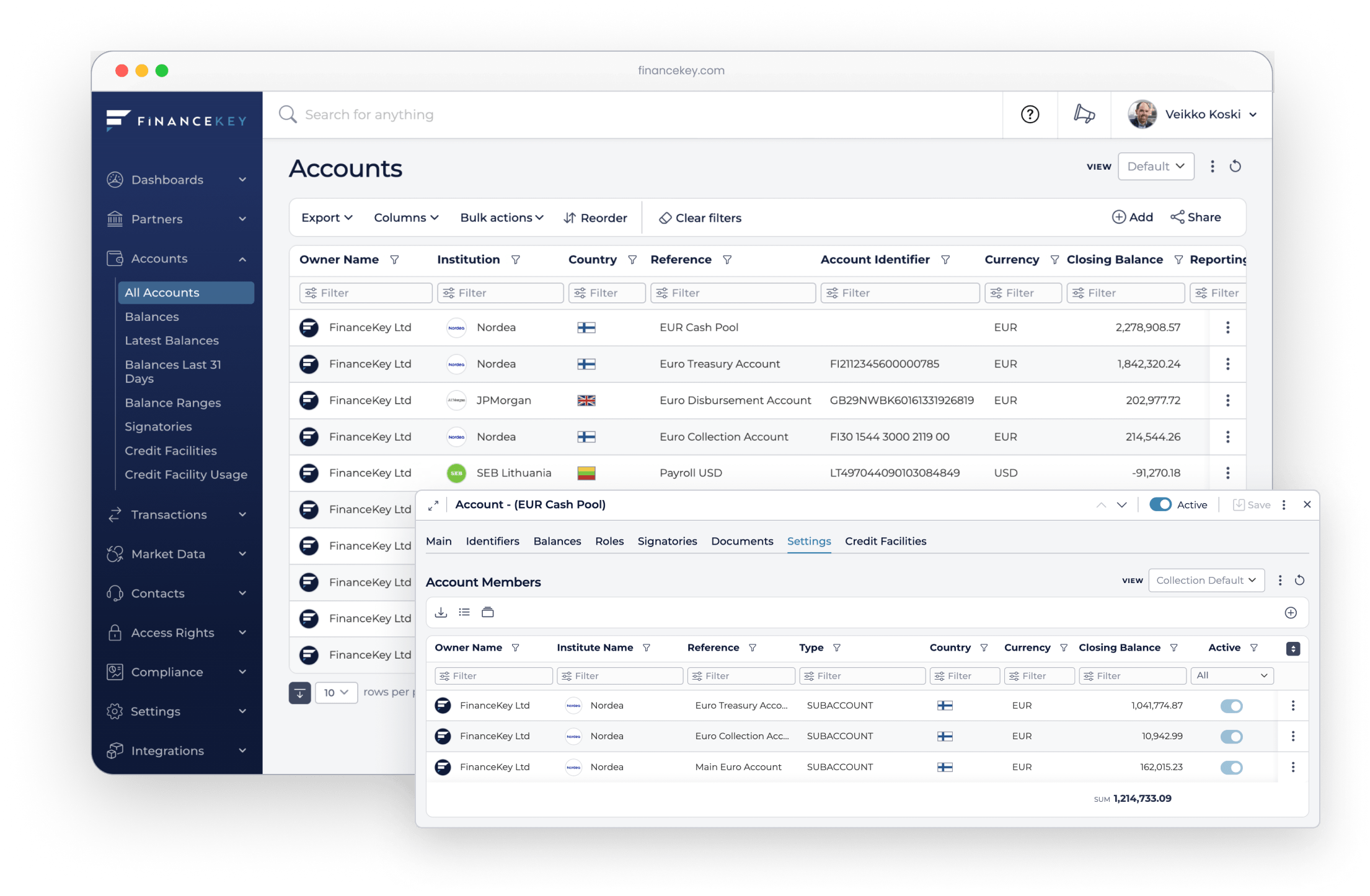

Take advantage of real-time cash and transaction visibility

Integrations

Leverage Premium Banking APIs

Manage APIs with ease, and access standardised real-time multi-bank reporting in one easy-to-use platform.

+ more

Experience it first hand

Contact Us

FAQs

API connectivity and real-time access to 2 core cash management banks balances and transactions via FinanceKey user interface.

FinanceKey charges a reasonable monthly fee from the trial depending on the scope (to agree per customer). Some banks might charge for their premium API connectivity.

FinanceKey takes care of the system setup with minimum resource needs by the customer. You will help us to connect with your bank relationship person, taking care of API agreements and joining weekly feedback sessions.

FinanceKey takes care of the integrations in the background & handles the security keys and credentials on behalf of the customer. With direct corporate banking APIs, the customer signs API agreements per bank. Regulatory PSD2 and UK Open Banking APIs can be taken into use as a self-service.

Customers gain real-time visibility in a single source without the need to log in to multiple e-banking portals, multiple times a day for multiple purposes. You can act faster, drive higher return on cash, improve forecasting and working capital cycle. The trial offers an easy way to explore APIs and quantify real-time reporting benefits across your treasury and the wider finance organisation.

* Trial scope: connectivity to 2 core cash management banks. No limitations on users and API calls. Separate contracts to agree per cash management bank for the usage of premium / direct APIs (unless regulatory API consumed).