1M+ transactions auto-tagged and counted

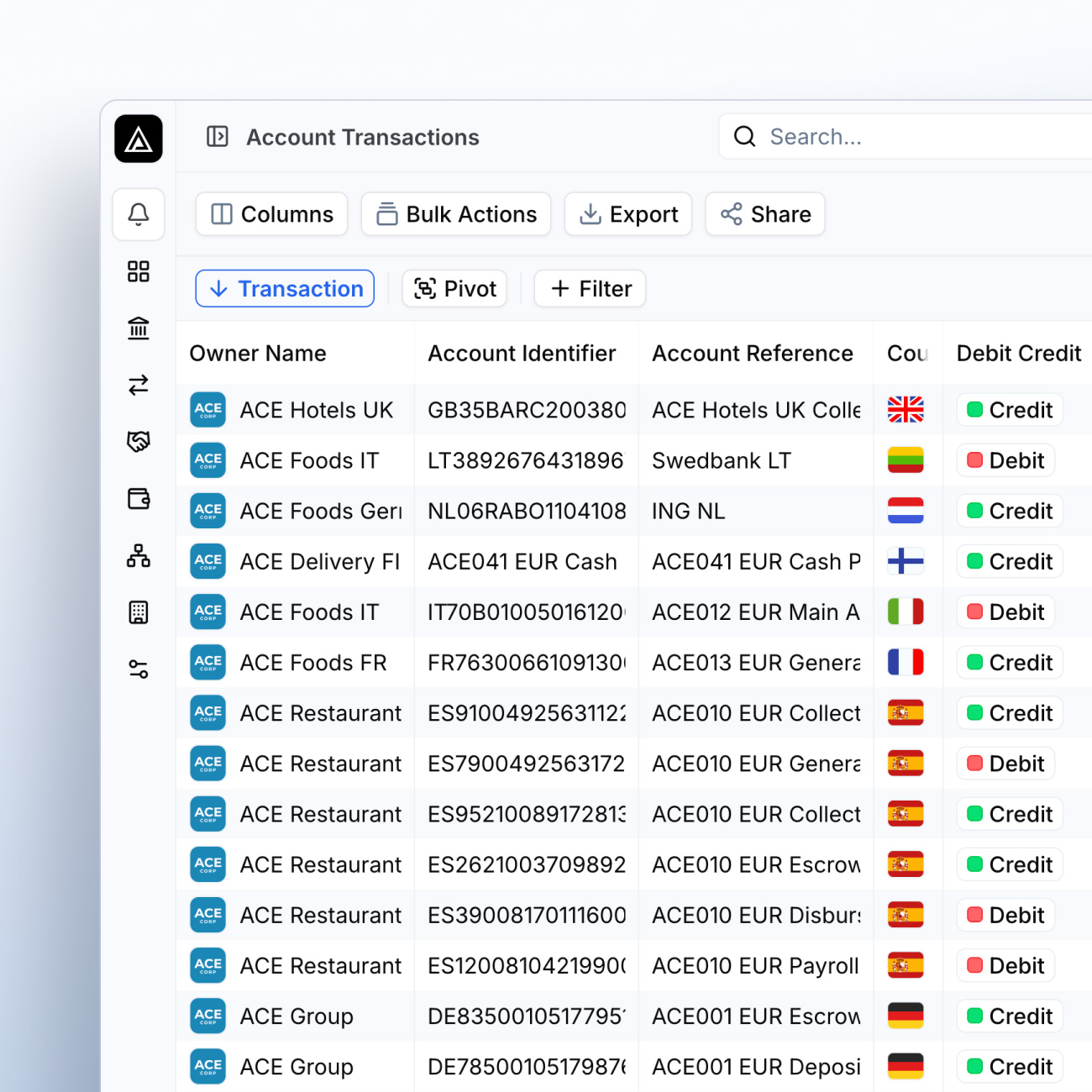

Automatically categorise your cash flows for instant clarity

Get a real-time view of where your money is coming from and where it’s going — with every transaction tagged by type, direction and purpose.

Automate transaction tagging

Turn every transaction into a cash insight.

Automatically apply smart tagging rules to classify cash flows — so you stay on top of your money without relying on spreadsheets or manual effort.

Smart, adaptive tagging

Sync with over 2,000 banks and view balances across all your accounts, updated live, in one place.

Drill down,

instantly.

Zoom into any bank, account, or entity to understand exactly where your cash sits. No spreadsheets required.

Track cash pools

with ease

Group accounts by entity, region, or purpose to monitor liquidity across your cash pools in real time.

Built

for scale

Multi-entity support, currency breakdowns, and enterprise-grade security.

Cash flow data that

drives real decisions

When your inflows and outflows are automatically tagged and structured, you unlock a new layer of financial visibility — one that helps you spot trends, reconcile cash flows, automate GL postings and respond faster to what’s happening in your business.

Automated tagging. Actionable insights.

With hundreds of transactions moving through dozens of accounts each day, manually categorising cash flows was slow, error-prone and reactive. The finance team needed a faster, more reliable way to understand where money was coming from — and where it was going.

“We used to rely on spreadsheets and instinct to explain cash flow variances. Now we can tag every transaction by category, region or business unit — and spot anomalies before they escalate.”

Transform your treasury